The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Loan in Click

Tel-Aviv, Israel

B

11-50 Employees

2017

Key takeaway

Loan In Click provides an innovative platform that enables customers to submit loan requests in just 5 minutes, making the process efficient and accessible from anywhere. With a secure loan administration panel and support for digital signatures, Loan In Click streamlines the entire loan management process.

Reference

Core business

Home | Loan In Click | Loans Platform

Loan in click offers a flexible & secure loan administration panel to manage the whole process in the digital loans platform. Verification - Offering - Signing

ZZFinancing.com

Jerusalem, Israel

B

1-10 Employees

-

Key takeaway

The company specializes in providing international financing solutions, offering fast, low fixed-interest loans of up to $1 billion USD without the need for personal guarantees, credit checks, or income verification. Their services cater to high net-worth individuals and business entities, focusing on liquidity for various personal and business needs.

Reference

Core business

ZZFinancing.com - International Financing Solutions. We solve problems. We provide solutions. FAST LOW FIXED-INTEREST LOANS UP TO $1+ BILLION USD. Quick Liquidity / Fast Funding available in 1-3 weeks. Contact us today.

Rhino Eco

Tel-Aviv, Israel

B

1-10 Employees

2021

Key takeaway

The company offers a streamlined, AI-powered point-of-sale platform that provides tailored solar financing options, allowing clients to receive personalized digital financing offers in under 60 seconds. This innovative approach simplifies the financing process for sales representatives and enhances the overall customer experience.

Reference

Core business

Rhino Eco - Solar Financing Made Easy

Rhino-eco is providing solar dealers with a simple point-of-sale financing platform offering flexible & tailored financing for homeowners wishing to go solar.

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

AZ Smartlend Ltd.

Tel-Aviv, Israel

B

- Employees

2015

Key takeaway

Smartlend is a fintech startup that automates the loan and decision-making process for financial institutions and lenders, optimizing creditworthiness determination and risk assessment. Their use of proprietary technology and big data algorithms enables comprehensive credit decisions for prospective borrowers, potentially enhancing the auto loan application experience.

Reference

Core business

Smartlend

iCapital Ltd.

Tel-Aviv, Israel

B

1-10 Employees

2016

Key takeaway

The company offers comprehensive automated solutions for financial vendors, including banks and insurance companies, to enhance the distribution and management of their financial products. Their iPro platform specifically automates relationships with brokers, improving efficiency in pricing, promotions, and distribution.

Reference

Product

iPro – iCapital

iPro is our solution for financial vendors - automating their relationship with the brokers in terms of pricing, promotions and distribution of the financial products. iPro is aimed at investment firms, insurance companies and other financial vendors that create financial products and distribute them through distribution channels. By using iPro financial vendors increase the efficiency of their

WaBo FinTech

Mate Asher Regional Council, Israel

B

1-10 Employees

2015

Key takeaway

WaBo FinTech is a peer-to-peer microloans platform focused on providing innovative financial solutions for the unbanked, utilizing advanced risk management tools and behavioral gaming algorithms to assess borrowers' repayment potential. Their approach includes quick and cost-effective loan transactions through cryptocurrency, enhancing accessibility for those in need of auto loans.

Reference

Core business

Home | WaBo FinTech

Innovative Assessments

Tel-Aviv, Israel

B

1-10 Employees

2015

Key takeaway

Worthy Credit focuses on financial inclusion by using character-based credit scoring solutions and advanced psychometrics to provide better access to credit for underserved consumers and micro-businesses.

Reference

Core business

Innovative Assessments

Character-based credit scoring solutions for financial inclusion. IA uses advanced psychometrics to augment traditional credit models and help better service underbanked consumers and micro-businesses.

Open-Finance.ai

Nes Ziona, Israel

B

11-50 Employees

2021

Key takeaway

Open-Finance.ai leverages open banking technology and AI to enhance financial decision-making, particularly in areas like credit and insurance. Their partnership with FICO aims to transform how financial institutions access and utilize customer financial data, ultimately improving the auto loan process through better insights and faster decisions.

Reference

Core business

Open Finance - Open Banking for everyone

Connect with open banking with ease.

Xioma Automotive

Hod HaSharon, Israel

B

11-50 Employees

2015

Key takeaway

Xioma Automotive specializes in providing advanced software solutions for the automotive retail market, offering integrated functionalities that enhance operational efficiency for dealerships and importers. Their focus on digital transformation through the Automotive Cloud positions them as a key player in the industry's evolution.

Reference

Core business

Automotive Cloud | Automotive & Machinery DMS | Xioma Automotive

Rich knowledge of the automotive industry with functionality that’s fully integrated with SAP Business One.

Autofleet

Tel-Aviv, Israel

B

11-50 Employees

2018

Key takeaway

The company, Autofleet, is focused on optimizing transport services and enhancing fleet performance, which could be relevant for auto loan considerations related to vehicle management and operational efficiency.

Reference

Core business

Autofleet | About

Powering leading operators worldwide, we optimize millions of monthly rides, allowing fleets to maximize performance and revenues in multiple verticals.

Technologies which have been searched by others and may be interesting for you:

When exploring the auto loan industry in Israel, several key considerations emerge. The regulatory landscape plays a crucial role, as the Bank of Israel oversees financial institutions, ensuring compliance with lending standards and consumer protection laws. Understanding interest rates, which can fluctuate based on economic conditions and central bank policies, is essential for potential borrowers. Additionally, the competitive landscape is marked by traditional banks, credit unions, and fintech companies, each offering diverse financing options. This competition can lead to more favorable terms for consumers, such as lower interest rates or flexible repayment plans. Challenges in the market include economic fluctuations and rising inflation, which can impact borrowers' ability to repay loans and lead to increased default rates. However, opportunities exist in the growing demand for electric vehicles and the shift towards sustainable transportation, prompting lenders to consider green financing options. Environmental concerns are becoming increasingly significant, with policies encouraging the adoption of eco-friendly vehicles. Finally, the global market relevance of Israel's auto loan sector is influenced by advancements in technology and digital banking solutions, which can streamline the loan application process and enhance customer experience. Understanding these factors will equip potential investors and consumers with the knowledge needed to navigate the auto loan landscape effectively.

Some interesting numbers and facts about your company results for Auto Loan

| Country with most fitting companies | Israel |

| Amount of fitting manufacturers | 15 |

| Amount of suitable service providers | 10 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 2015 |

| Youngest suiting company | 2021 |

Some interesting questions that has been asked about the results you have just received for Auto Loan

What are related technologies to Auto Loan?

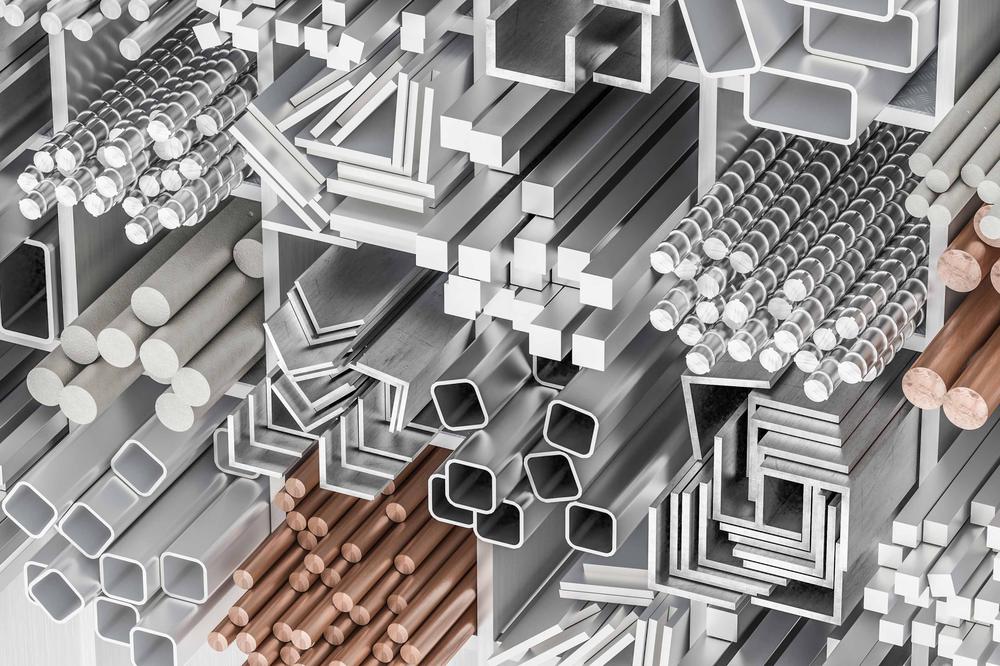

Based on our calculations related technologies to Auto Loan are Glass, Superconductors, High-Performance Materials, Raw Materials, Phase Change Materials

Who are Start-Ups in the field of Auto Loan?

Start-Ups who are working in Auto Loan are Rhino Eco, Open-Finance.ai

Which industries are mostly working on Auto Loan?

The most represented industries which are working in Auto Loan are Finance and Insurance, IT, Software and Services, Automotive, Other, Consulting

How does ensun find these Auto Loan Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.