The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

Contract Intelligence with Gen AI

Go to product

When exploring the mortgage industry in South Korea, several key considerations come into play. Regulatory frameworks are critical since the government imposes strict guidelines on lending practices and interest rates to ensure stability in the housing market. Understanding these regulations, including the loan-to-value ratio and debt-to-income ratio, is essential for assessing lending options. Additionally, the competitive landscape in South Korea is dominated by both traditional banks and emerging fintech companies, creating a dynamic market environment. It's important to evaluate the strengths and weaknesses of various institutions, including their technological capabilities and customer service quality. Challenges in this sector include rising household debt and fluctuations in property prices, which can impact borrowers' ability to repay loans. Conversely, opportunities exist amid a growing demand for housing, particularly in urban areas, and advancements in digital banking that enhance customer accessibility and service efficiency. Environmental concerns also play a role, with increasing awareness around sustainable building practices influencing consumer preferences and regulatory standards. Lastly, the global market relevance of South Korea's mortgage industry is heightened by its integration into international finance, making it crucial for stakeholders to stay informed on global economic trends that could affect local conditions.

Some interesting questions that has been asked about the results you have just received for Mortgage

What are related technologies to Mortgage?

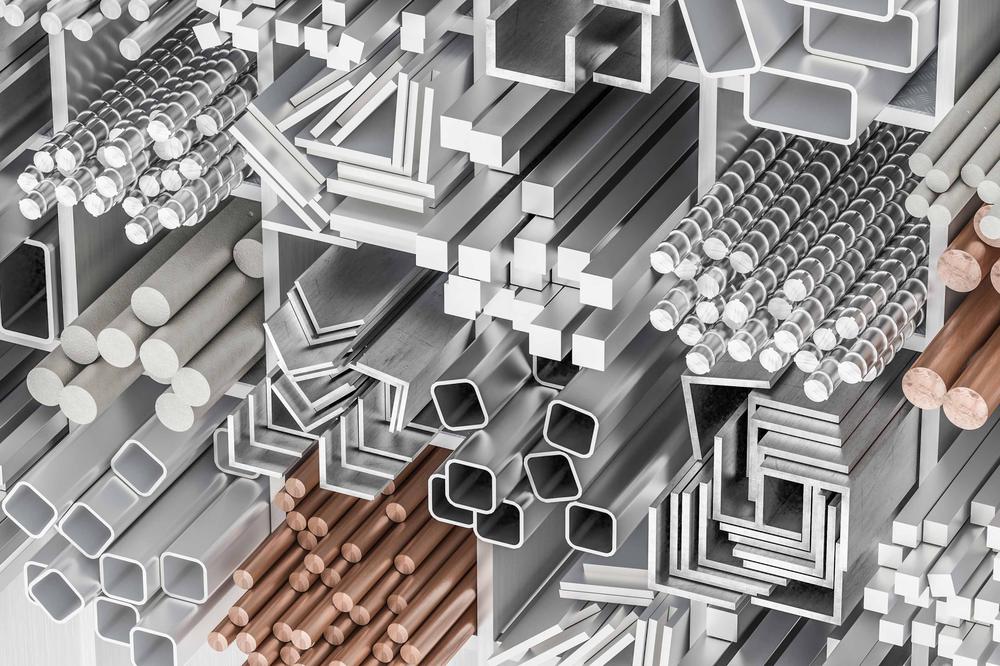

Based on our calculations related technologies to Mortgage are Glass, Superconductors, High-Performance Materials, Raw Materials, Phase Change Materials

How does ensun find these Mortgage Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.