The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Bitt

Barbados

51-100 Employees

2013

Key takeaway

Bitt is a leading expert in digital currency, offering central bank digital currency (CBDC) and stablecoin solutions that facilitate instant settlements. Their Digital Currency Management System (DCMS) is designed to support the development and implementation of digital fiat currency, ensuring compliance with regulatory requirements for central banks and financial institutions.

Reference

Product

Digital Currency Solutions for Financial Institutions | Bitt

Cryptografic

Tallinn, Estonia

A

1-10 Employees

2019

Key takeaway

Cryptografic® is a global cryptocurrency payment provider that enables merchants and enterprise clients to accept various digital currencies, including Bitcoin, Ether, and Ripple's XRP. Their secure and scalable solutions, along with competitive pricing and no transaction fees, position them as a leading option for businesses looking to integrate cryptocurrency payments.

Reference

Core business

Cryptografic – Crypto exchanges

Digital Cash GmbH

Frankfurt, Germany

A

1-10 Employees

2020

Key takeaway

Digital Cash GmbH specializes in issuing physically backed tokens for the crypto-ecosystem, aiming to provide a stable digital currency solution that mitigates the volatility of traditional digital assets. By leveraging blockchain technology and partnering with leading service providers, they offer a 100% physically-backed Euro token on the Ethereum blockchain, facilitating global payments and asset tokenization.

Reference

Core business

Home - Digital Cash GmbH

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

BlockChainBox

London, United Kingdom

A

1-10 Employees

2017

Key takeaway

The company specializes in providing solutions for the Blockchain and Cryptocurrency industry.

Reference

Core business

Supplier of Blockhain and Crypto Currency Solutions

Pure Currencies Ltd

United Kingdom

A

1-10 Employees

-

Key takeaway

Pure Currencies offers payment and foreign currency exchange services through its partners, ensuring a reliable platform for digital currency transactions. With Equals Connect Limited authorized by the Financial Conduct Authority, customers can trust in secure payment services.

Reference

Core business

Pure Currencies

Circle

Boston, United States

B

101-250 Employees

2013

Key takeaway

The company provides solutions for accessing, storing, and managing USDC and Euro Coin, highlighting the importance of stablecoin digital payments for global transactions. Their suite of Web3 developer tools aims to simplify building on blockchain, which is essential for evolving the financial system through innovative digital currency solutions.

Reference

Product

Circle | Solutions for Venture Capital

Learn how USDC, Euro Coin and digital currency solutions from Circle are helping VC fund startups in increasingly global, fast-moving markets.

CryptoChill

Switzerland

A

1-10 Employees

2018

Key takeaway

CryptoChill is a customizable cryptocurrency payment gateway that emphasizes security, privacy, and scalability, making it an ideal solution for integrating digital currency payments. With features like multi-user access, automatic conversions, and a private gateway for high volume clients, CryptoChill supports businesses looking to adopt cryptocurrency transactions efficiently.

Reference

Core business

CryptoChill – Highly customizable Cryptocurrency and Lightning Network payment gateway

WorldGilt

Cape Town, South Africa

C

11-50 Employees

2013

Key takeaway

WorldGilt is focused on Bitcoin and altcoins, highlighting its involvement in the digital currency sector.

Reference

Core business

WorldGilt - Bitcoin & Altcoin Enterprise

Bitcoin & Altcoin Enterprise

Blockchain Financial

Taipei, Taiwan

1-10 Employees

2018

Key takeaway

The company is a group of cryptocurrency enthusiasts dedicated to providing web-based services that integrate digital currencies for both personal and commercial use. They continually research the cryptocurrency ecosystem to offer unique functionalities, positioning themselves as a valuable resource for those interested in a cryptocurrency-centric platform.

Reference

Core business

Blockchain Financial

Cryptocurrency based services for personal and enterprise businesses.

CyberMoney

Oak Brook, United States

B

1-10 Employees

-

Key takeaway

CyberMoney is revolutionizing digital payments by offering a cost-effective and secure platform for merchants and consumers alike. Their technology ensures seamless payment experiences across various sales channels, making it a valuable alternative in the evolving landscape of digital currency.

Reference

Core business

CyberMoney

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Service

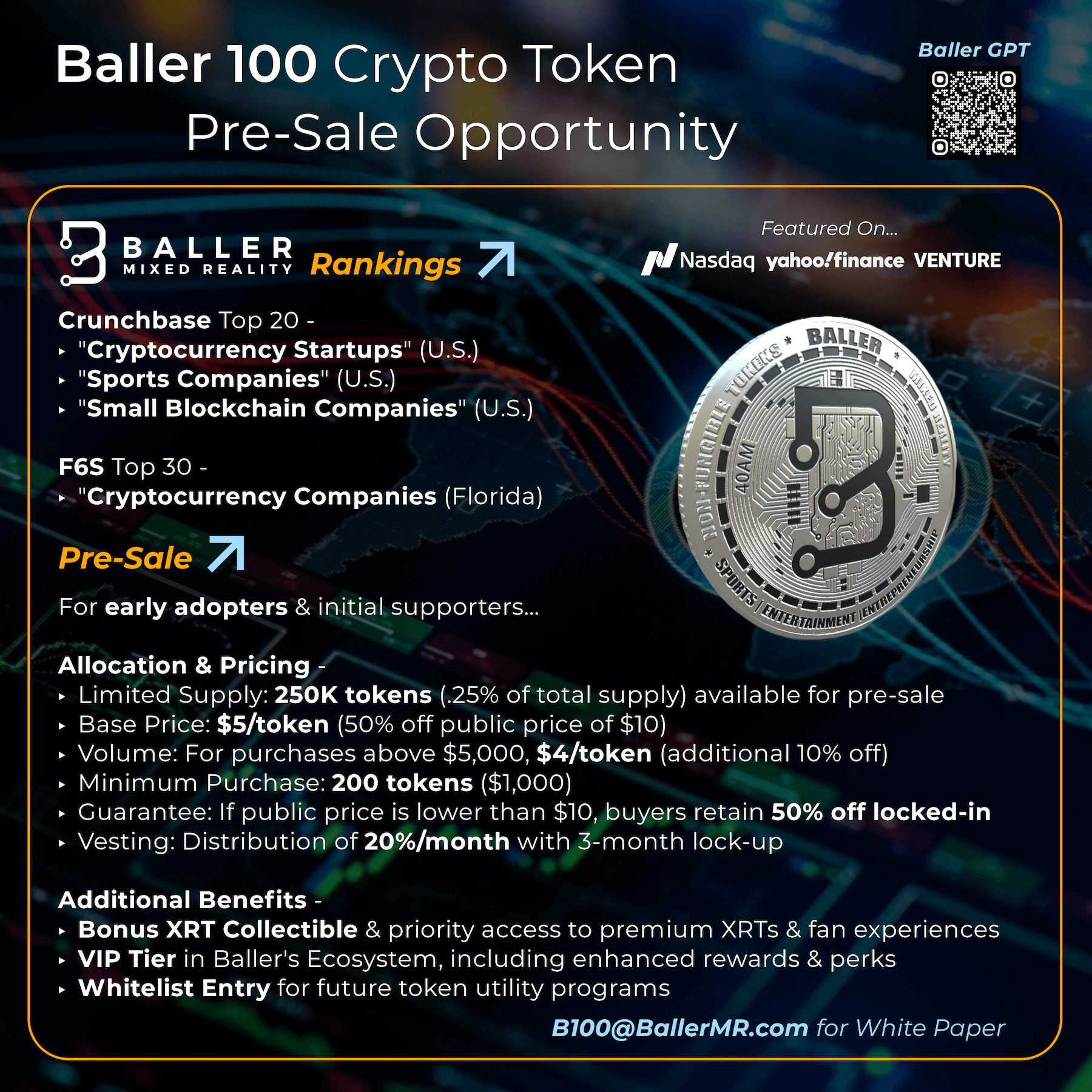

Baller 100 Crypto Token

Go to product

Digital currency refers to a form of currency that is available exclusively in digital form, lacking a physical counterpart like coins or banknotes. It operates on secure technologies, often utilizing blockchain, which ensures transparency and reduces the risk of fraud. Digital currencies can be centralized, managed by a single entity such as a bank, or decentralized, like cryptocurrencies, where control is distributed across a network. These currencies facilitate online transactions, allowing users to transfer value quickly and efficiently without the need for traditional banking systems. The rise of digital currency providers has transformed financial ecosystems, enabling new forms of investment, payment processing, and money management that cater to the evolving needs of consumers and businesses alike.

Digital currency operates through a decentralized network that utilizes blockchain technology, which is a distributed ledger system. Transactions are recorded on this ledger, ensuring transparency and security. Each transaction is verified by network participants, or nodes, through cryptographic algorithms, making it nearly impossible to alter the recorded information. Users engage with digital currency via digital wallets, which store their currency and facilitate transactions. When a transaction occurs, it is broadcast to the network, where it undergoes validation. Once verified, it is added to the blockchain, and the transaction is complete. This process allows for peer-to-peer transactions without the need for intermediaries, such as banks, enabling faster and often cheaper transfers.

1. Lower Transaction Costs

Using digital currency often reduces transaction fees compared to traditional banking methods. This is particularly beneficial for international transactions, where exchange rates and bank fees can accumulate significantly.

2. Increased Accessibility

Digital currency provides users with easier access to financial services. Individuals without bank accounts can participate in the economy through their smartphones, enabling a broader range of people to engage in commerce.

3. Enhanced Security

Transactions made with digital currency typically use advanced cryptography, which adds layers of security. This reduces the risk of fraud and identity theft, providing users with more confidence in their transactions.

4. Faster Transactions

Digital currencies can facilitate quicker transactions, especially across borders. Unlike conventional banking systems, which may take days to process, digital transactions can be completed in real-time or within a few minutes.

5. Greater Transparency

Most digital currencies operate on decentralized networks, allowing for transparent transaction records visible to all users. This transparency can help build trust among participants and reduce the likelihood of corruption.

Digital currency carries several risks that users should be aware of. One significant risk is the volatility in the value of digital currencies, which can result in substantial financial losses. Prices can fluctuate dramatically in short periods, influenced by market sentiment, regulatory news, and technological changes. Another important risk involves security concerns. Digital currencies are often targeted by hackers, making wallets and exchanges vulnerable to breaches. If a user loses access to their digital wallet or if it is compromised, they may lose their funds permanently, as transactions are irreversible. Additionally, the lack of regulation in many regions can lead to scams or fraudulent schemes, further increasing the risk for investors and users in the digital currency space.

Digital currency regulation varies significantly across jurisdictions. In many countries, regulatory bodies are working to create frameworks that ensure consumer protection, prevent fraud, and address money laundering risks. Some governments classify digital currencies as securities, requiring providers to register with financial authorities. Other regions may treat them as commodities or currencies, leading to different compliance requirements. Regulatory measures often include Know Your Customer (KYC) and Anti-Money Laundering (AML) policies, which mandate that digital currency providers verify the identity of their users. Additionally, taxation rules on transactions can also affect how digital currency providers operate. Overall, the landscape of digital currency regulation is continually evolving, with ongoing discussions about establishing a cohesive global framework.

Some interesting numbers and facts about your company results for Digital Currency

| Country with most fitting companies | United Kingdom |

| Amount of fitting manufacturers | 6961 |

| Amount of suitable service providers | 6757 |

| Average amount of employees | 1-10 |

| Oldest suiting company | 2013 |

| Youngest suiting company | 2020 |

20%

40%

60%

80%

Some interesting questions that has been asked about the results you have just received for Digital Currency

What are related technologies to Digital Currency?

Based on our calculations related technologies to Digital Currency are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Digital Currency?

The most represented industries which are working in Digital Currency are IT, Software and Services, Finance and Insurance, Other, Marketing Services, Consulting

How does ensun find these Digital Currency Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.