The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

ZTL Payment Solution

Oslo, Norway

A

11-50 Employees

2018

Key takeaway

ZTL offers modular APIs that enable the creation of comprehensive payment solutions, allowing access to all banks through a single integration. With features like FX functionality, ZTL's payment gateway API is designed to enhance payment reliability and cover all payment scenarios.

Reference

Core business

Payment Gateway API | ZTL Payment Solution

Unlock the power of ZTL's modular API to construct robust payment solutions for any scenario. Enhance your payment product!

Payee AS

Skien, Norway

A

1-10 Employees

2022

Key takeaway

Shopify Payee Gateway offers secure and daily payouts, making payment processing simpler regardless of your bank connection. Their solutions are easy to integrate through an API or plugins.

Reference

Core business

Payee.no - We make payments easier

MeaWallet

Bærum, Norway

A

51-100 Employees

2013

Key takeaway

MeaWallet is a prominent provider of advanced payment solutions, focusing on simplifying payments and enhancing security for businesses. With a strong presence in over 50 countries, MeaWallet empowers businesses to deliver exceptional customer experiences through innovative payment methods.

Reference

Product

Mea Token Platform for Issuer Pay | MeaWallet

[vc_row row_height_percent=

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Dintero

Oslo, Norway

A

11-50 Employees

2017

Key takeaway

Dintero is dedicated to simplifying the payment journey, aiming to provide frictionless payment solutions through their innovative Digital Terminal. Their focus on advanced features and customer satisfaction positions them as a valuable player in the payment gateway space.

Reference

Service

Digital Terminal

Okay AS

Oslo, Norway

A

1-10 Employees

2005

Key takeaway

The company emphasizes its unique security software that ensures secure identification and authentication of users and transactions, which is crucial for payment gateways. With compliance to SOC2 and offering Strong Customer Authentication (SCA) methods, they provide solutions that help clients, including e-wallet providers and remittance services, manage regulatory requirements related to secure payment processes.

Reference

Product

Product | Okay

Buypass

Oslo, Norway

A

51-100 Employees

2001

Key takeaway

Buypass offers a comprehensive range of secure and user-friendly payment solutions, making it easier for merchants to integrate their services. With a strong focus on digital ID and payment systems, Buypass ensures a safer and more efficient experience for both individuals and businesses.

Reference

Product

Allow your customers to use Buypass ID and payment solutions | Buypass.com

Become part of our merchant network. 2.3 million Norwegians already have Buypass ID and can use it with your digital services.

Speedy Checkout Line

Oslo, Norway

A

1-10 Employees

-

Key takeaway

Speedy Checkout Line specializes in mobile checkout technology solutions that enhance the shopping experience by integrating seamlessly with existing systems. Their platform offers features such as real-time transaction viewing and order fulfillment, making it a versatile option for retailers looking to improve payment processes both in-person and online.

Reference

Product

Features - Speedy Checkkout Line

eCommerce, In-Person FutureProof Retail's platform brings the best of online shopping into the store, with line free checkout, order ahead, personalized deals and much more: Additional Formats The platform's capabilities can be configured to meet the needs of most stores in a wide variety of formats, including:

Spense

Oslo, Norway

A

11-50 Employees

2020

Key takeaway

Spense offers a comprehensive payment solution that accepts all debit and credit cards, enhancing customer experience through convenience and mobility integrations. Their services are tailored to meet business needs, ensuring reliability and scalability for growth.

Reference

Core business

Streamline all your dealership payments

Faster pay-outs, automatic reconciliation and transaction transparency across departments.

Aera Payment & Identification

Oslo, Norway

A

11-50 Employees

2016

Key takeaway

Aera Payment & Identification, a company owned by Coop and NorgesGruppen, focuses on keeping payment costs low in the retail value chain and developing new payment solutions that enhance customer experiences. Their platform supports various payment methods, including card, NFC, QR, and mobile, allowing for easy integration into e-commerce solutions without the need for additional certification.

Reference

Product

Aera Plattform - Aera

Netthandel, in-store eller omni-kanal. Identifikasjon og sikker autentisering av kunden er avgjørende for å lykkes med å utvikle nye kundereiser på tvers av kanaler.

Fygi Technologies

Mysen, Norway

A

11-50 Employees

2019

Key takeaway

Fygi provides a mobile-based self-service solution for retail, including a secure Scan Pay Go payment system that allows customers to scan and purchase products directly using their phones. This innovative approach enhances the customer experience and ensures retailers are always operational.

Reference

Core business

The secure solution for Scan Pay Go - Fygi English

Fygi offers a mobile Scan Pay Go solution. Customers scan and purchase the products they want using the phone.

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

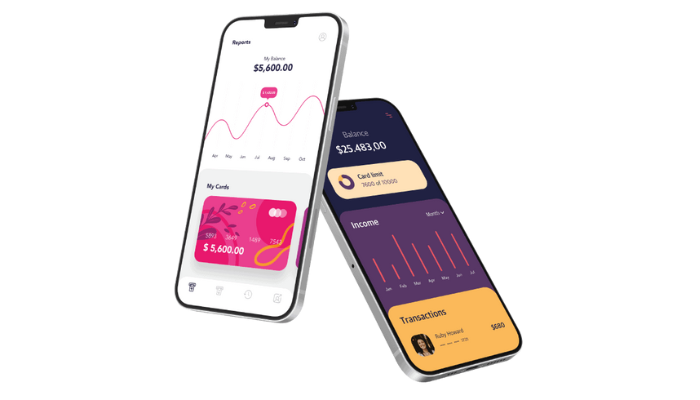

Service

Finance App Development Services

Go to product

In Norway, the payment gateway industry is influenced by several key considerations that prospective entrants should evaluate. Regulatory compliance is paramount, as businesses must adhere to the regulations set forth by the Norwegian Financial Supervisory Authority, which oversees electronic payment services. Understanding the implications of the EU's PSD2 directive is also essential, as it enhances consumer protection and fosters competition by enabling third-party providers access to bank data, which can impact payment gateways. Challenges include navigating the competitive landscape dominated by established players, as well as adapting to rapidly evolving consumer preferences for seamless and secure payment experiences. Opportunities arise from the increasing acceptance of digital payments, driven by a tech-savvy population and the Norwegian government's push towards becoming a cashless society. Environmental concerns are gaining traction, with a growing emphasis on sustainable practices, which can influence consumer choices and business operations in the industry. Furthermore, the global market relevance of Norwegian payment gateways is significant, as they can expand their services beyond local borders, tapping into the broader European market. Collaborating with fintech innovators can provide additional leverage in developing advanced solutions that cater to diverse customer needs. Overall, thorough research into these factors will empower potential stakeholders to make informed decisions in Norway's dynamic payment gateway sector.

Some interesting numbers and facts about your company results for Payment Gateway

| Country with most fitting companies | Norway |

| Amount of fitting manufacturers | 17 |

| Amount of suitable service providers | 13 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 2001 |

| Youngest suiting company | 2022 |

Some interesting questions that has been asked about the results you have just received for Payment Gateway

What are related technologies to Payment Gateway?

Based on our calculations related technologies to Payment Gateway are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Who are Start-Ups in the field of Payment Gateway?

Start-Ups who are working in Payment Gateway are Payee AS

Which industries are mostly working on Payment Gateway?

The most represented industries which are working in Payment Gateway are IT, Software and Services, Finance and Insurance, Other, Oil, Energy and Gas

How does ensun find these Payment Gateway Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.