The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

PayGate

Durban, South Africa

C

11-50 Employees

1999

Key takeaway

DPO Group is a leading African payment service provider that enables businesses and individuals to accept payments online through various methods, including major cards and mobile money.

Reference

Core business

PayPal-Gateway - PayGate

Power eCommerce

Alpharetta, United States

B

1-10 Employees

2002

Key takeaway

Power eCommerce, Inc. emphasizes the importance of automating the ecommerce experience to enhance customer satisfaction and reduce costs. They specifically mention offering payment gateways as part of their Power eCommerce™ platform, which is designed to streamline online transactions for merchants.

Reference

Product

Payment Gateways for Power-eCommerce

Oceanpayment

Yushan, China

D

11-50 Employees

2014

Key takeaway

Oceanpayment positions itself as a leading provider of digital payment processing and gateway solutions, designed to meet the diverse needs of ecommerce merchants. With a focus on data security and user-friendly experiences, the company offers access to over 500 payment methods across 200 countries, facilitating seamless international transactions.

Reference

Product

Best Online Payment Gateway Provider for International Transactions – Oceanpayment

Solutions for global payment gateways processors can be found at Oceanpayment. We can help to develop gateways for 500+ types of payment in 200+ countries.

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

QPay India Pvt Ltd

Chennai, India

D

11-50 Employees

2013

Key takeaway

QPay India Private Limited offers a secure and reliable online payment gateway that is PCI-DSS 3.2 certified, ensuring fast and safe transactions for e-commerce merchants. With a focus on providing flexible payment solutions, QPay is positioned as an economical option for businesses looking to accept payments online.

Reference

Core business

Payment Gateway India|Online Payment Solutions|Mobile POS|mPOS Machine

Viamage

Cork, Ireland

A

1-10 Employees

2017

Key takeaway

Viamage Limited offers a universal e-commerce framework for PHP7, which likely includes payment gateway solutions, enhancing their capability to develop real-time applications and complex web portals. Their expertise in creating custom portals and mobile applications positions them as a valuable partner for businesses looking to implement efficient payment processing systems.

Reference

Product

Payment Gateway | Viamage

Universal e-commerce framework for PHP7

WebEquator Ltd

Maidenhead, United Kingdom

A

11-50 Employees

2012

Key takeaway

WebEquator specializes in custom software development and system integrations, including payment gateways, offering end-to-end solutions that encompass consulting, integration, and development. Their expertise in delivering bespoke software solutions positions them as a valuable partner for organizations seeking to implement effective payment processing systems.

Reference

Service

Payment Gateways | Consulting, Integration, Development

SecurePay

Melbourne, Australia

A

101-250 Employees

1999

Key takeaway

SecurePay, an online payment service provider, was awarded "Best Payments Gateway" in 2022, highlighting its ease of integration, flexibility, and security, making it a trusted choice for over 90,000 Australian businesses. The platform also supports Apple Pay, offering a simple and secure payment solution.

Reference

Core business

SecurePay | Online Payment Gateway Service Provider Australia

Trusted Australian online payment provider. Online payment gateway, online payment services, online payment platform and internet merchant accounts.

IPGPAY

Hong Kong Island, China

D

11-50 Employees

2012

Key takeaway

IPGPAY Limited offers a comprehensive payment gateway solution that is easy to integrate and customizable, making it suitable for various online payment types. Their system is designed with bank-grade security and includes features for fraud detection and risk management, ensuring a reliable experience for merchants.

Reference

Product

Merchant Payment Gateway Features - IPGPAY.com

Corepay

Winter Park, United States

B

1-10 Employees

-

Key takeaway

Corepay is a specialized Payment Service Provider that offers tailored payment solutions for high-risk e-commerce merchants, ensuring transparent pricing and a quick approval process. They emphasize the importance of a reliable payment gateway, which is essential for authorizing and processing online payments between customers and merchants.

Reference

Product

Payment Gateways | Corepay

A payment gateway is a service that authorizes and processes payments in e-commerce websites between customers and merchants.

Grezpay

Faridabad, India

D

11-50 Employees

2019

Key takeaway

Grezpay is a leading payment gateway solution in India, enabling businesses to seamlessly accept and process payments through a variety of methods, including credit and debit cards, net banking, UPI, and popular wallets. With user-friendly integration options like SDKs and APIs, Grezpay supports businesses of all sizes, ensuring 24/7 customer support and access to multiple payment processors on a single platform.

Reference

Core business

Grezpay Payment Gateway

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

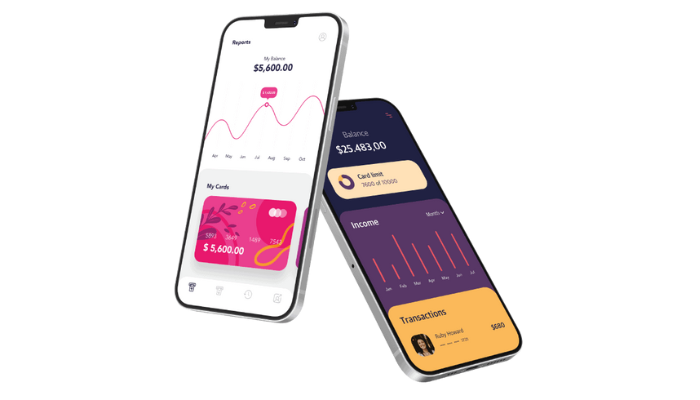

Service

Finance App Development Services

Go to product

A payment gateway is a technology that facilitates online transactions by securely processing credit card and electronic payments between customers and merchants. It acts as an intermediary that encrypts sensitive information, such as credit card details, to ensure security during the transaction process. By integrating with various payment methods, a payment gateway allows businesses to accept payments through their websites or mobile applications, providing a seamless experience for users. In addition to processing payments, payment gateways often include features such as fraud detection, transaction analytics, and customer support. This technology is essential for e-commerce businesses looking to enhance their online presence and provide customers with safe, efficient payment options.

A payment gateway acts as a bridge between a customer and a merchant, facilitating online transactions. When a customer makes a purchase, the payment gateway encrypts sensitive information like credit card details and securely transmits it to the payment processor. Once the transaction is initiated, the payment processor communicates with the customer's bank to verify the funds and ensure the transaction is legitimate. If approved, the funds are transferred to the merchant’s account, completing the process. This technology not only enhances security through encryption but also streamlines the payment experience for both customers and merchants.

1. Secure Transactions

Utilizing a payment gateway enhances security by encrypting sensitive data, such as credit card information, during transactions. This reduces the risk of fraud and data breaches, instilling trust in both businesses and customers.

2. Convenience

Payment gateways streamline the payment process, allowing customers to complete transactions quickly and easily. They support various payment methods, including credit cards and digital wallets, catering to diverse customer preferences and improving overall user experience.

3. Global Reach

These gateways enable businesses to accept payments from customers around the world. With support for multiple currencies, companies can expand their market reach and engage a broader audience without geographical limitations.

4. Integration with E-commerce Platforms

Many payment gateways seamlessly integrate with popular e-commerce platforms. This compatibility simplifies the setup process and enhances functionality, allowing businesses to manage transactions efficiently within their existing systems.

5. Recurring Payments

For subscription-based services, payment gateways facilitate automatic billing. This feature ensures timely payments and improves cash flow, making it easier for businesses to manage subscription models.

A reliable payment gateway must incorporate a range of robust security features to protect sensitive financial data.

1. Encryption

This feature ensures that all data transmitted between the customer and the payment processor is securely encrypted, making it unreadable to unauthorized parties.

2. Fraud Detection Tools

Advanced fraud detection tools analyze transactions in real-time to identify and prevent suspicious activities, helping to minimize the risk of chargebacks and fraudulent transactions.

3. Compliance with PCI DSS

Adherence to the Payment Card Industry Data Security Standard (PCI DSS) is crucial. This set of security standards helps organizations that handle credit card information maintain a secure environment.

4. Tokenization

Tokenization replaces sensitive card details with a unique identifier or token, ensuring that actual card information is not stored on the merchant's server, thus enhancing security.

5. 3D Secure

This additional layer of authentication adds a verification step during the payment process, requiring customers to provide a password or a one-time code, which helps to confirm their identity.

Implementing these security features can significantly enhance the protection of transactions and customer data within the payment gateway system.

Fees for payment gateways can differ significantly based on various factors such as transaction volume, business type, and geographical location. Transaction Fees Typically, payment gateways charge a percentage of each transaction, which can range from 1.5% to 3.5%. Some may also impose a fixed fee per transaction, which can vary depending on the gateway. Monthly Fees Additionally, some providers may charge a monthly subscription fee or maintenance fees, while others operate on a pay-as-you-go model without recurring costs. Understanding these fee structures is crucial for businesses to choose the right payment gateway that aligns with their financial strategy.

Some interesting numbers and facts about your company results for Payment Gateway

| Country with most fitting companies | United States |

| Amount of fitting manufacturers | 7150 |

| Amount of suitable service providers | 6871 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 1999 |

| Youngest suiting company | 2019 |

20%

40%

60%

80%

Some interesting questions that has been asked about the results you have just received for Payment Gateway

What are related technologies to Payment Gateway?

Based on our calculations related technologies to Payment Gateway are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Payment Gateway?

The most represented industries which are working in Payment Gateway are IT, Software and Services, Finance and Insurance, Other, Marketing Services, Logistics, Supply Chain and Transportation

How does ensun find these Payment Gateway Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.