The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

WHOLECAP ADMINISTRATION PTY LTD

Sydney, Australia

A

1-10 Employees

2017

Key takeaway

WholeCap is a specialized provider of credit and equity investments, focusing on mid-market lending and non-traditional financing for commercial real estate borrowers and property developers in Australia.

Reference

Core business

Wholecap

Cake Equity

Gold Coast City, Australia

A

11-50 Employees

-

Key takeaway

Cake Equity simplifies cap table management by providing powerful modeling tools that allow founders to forecast valuations, assess investment needs, and understand the impact of options on equity holdings. Their mission is to empower entrepreneurs with straightforward equity management, making it easier to build and scale their companies.

Reference

Product

Cap Table Modeling | Cake Equity

Forecast your current and future valuation, amount of investment you seek, or look at what adjusting your options does to your equity holdings; use the modelling tool to make more informed decisions. SAFE notes, Convertible notes

Zerocap

Melbourne, Australia

A

1-10 Employees

2017

Key takeaway

Zerocap is a prominent digital asset investment firm that offers a market-leading Wealth Portal for managing digital assets. Their commitment to governance and compliance, along with institutional backing, positions them as a trusted player in the crypto industry.

Reference

Core business

Zerocap - Digital Asset Trading Firm

Invest with Zerocap, the institutional-leading firm for Bitcoin investment in Australia and many other digital assets.

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Columbus Capital

Sydney, Australia

A

51-100 Employees

2006

Key takeaway

ColCap Financial Group specializes in offering Australian residential mortgage loans, which is relevant for cap table management as it reflects their expertise in financial services and investment strategies. With a significant loan portfolio and a focus on growth, ColCap positions itself as a key player in the mortgage funding market.

Reference

Core business

ColCap

Capsifi

Sydney, Australia

A

11-50 Employees

2013

Key takeaway

Capsifi transforms business models into strategic assets for innovation and digital transformation, providing a comprehensive framework that reduces project risk and enhances decision-making. Their platform supports the design and management of business models, which is crucial for effective cap table management.

Reference

Core business

Company - Capsifi

Core Capital Pty Ltd

Dunsborough, Australia

A

1-10 Employees

2011

Key takeaway

Core Capital is a private equity property developer that offers experienced property investment and corporate trustee services for investors.

Reference

Service

services | CoreCapital

Kapal Depreciation Software

Gold Coast City, Australia

A

1-10 Employees

2020

Key takeaway

Kapal, founded by industry experts including Sean, a Tax Depreciation expert, and Mark, a leading adviser in the property industry, offers automated asset management software designed to streamline asset management processes.

Reference

Core business

Home - Kapal Asset Software

NEXT CAPITAL (SERVICES A) PTY LIMITED

Sydney, Australia

A

11-50 Employees

2005

Key takeaway

Next Capital is a prominent independent Australian private equity firm that focuses on buy-out funding for small to medium growth businesses, typically valued between A$50 million and A$200 million.

Reference

Core business

Portfolio | Next Capital

Cape

Sydney, Australia

A

11-50 Employees

2020

Key takeaway

Cape offers an all-in-one platform for expense management that empowers companies to streamline their spending, enhance visibility, and maintain budget controls. With tools designed for growth, Cape helps businesses manage their finances more effectively, making it a valuable resource for those looking to optimize their capital management.

Reference

Product

Cape expense management for tech companies - Do more with less

Don’t let poor spend management hold back growth. Whether you’re pre-seed or valued in the billions, Cape's got the tools you need to grow.

Capital Select

City of Melville, Australia

A

1-10 Employees

-

Key takeaway

Capital Select is a comprehensive financial broking business that connects clients with over 50 financial institutions to find tailored financial solutions, whether for personal loans or business growth. Their expertise and access to a diverse range of lenders position them well to support clients in managing their financial needs effectively.

Reference

Core business

Licenses - Capital Select

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

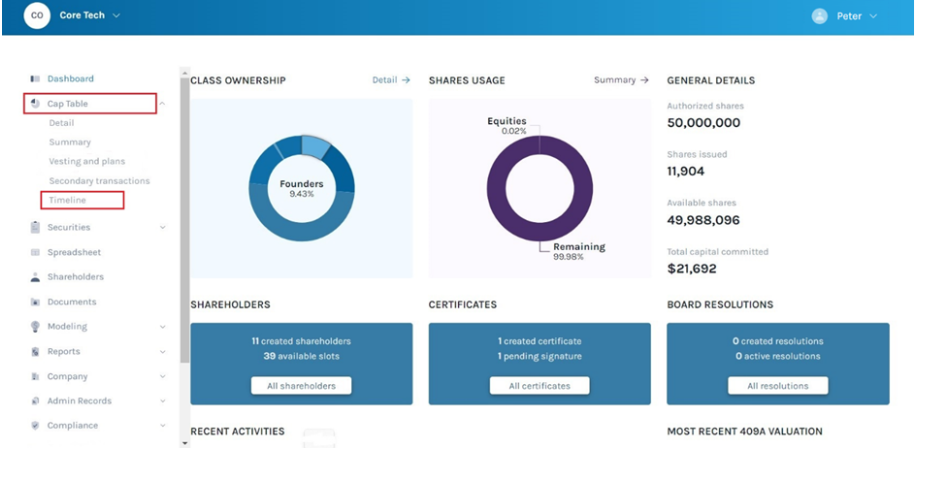

Cap Table Software

Go to product

When exploring the Cap Table Management industry in Australia, several key considerations come into play. Primarily, understanding the legal and regulatory framework is crucial, as compliance with the Corporations Act and relevant tax legislation is essential for companies managing equity. The industry faces challenges such as data security and the need for transparency, which have become increasingly important in a digital landscape. Additionally, companies must navigate the competitive landscape, which includes both local startups and established international players offering innovative solutions. Opportunities exist in the growing demand for efficient equity management tools, particularly among startups and SMEs looking to streamline their operations. Environmental concerns are gaining traction, with an emphasis on sustainable practices, making it essential for firms to consider their ecological footprint. Global market relevance is also a factor, as Australian firms increasingly seek to align with international standards and practices in cap table management, enhancing their attractiveness to investors. By keeping these factors in mind, individuals and organizations can make informed decisions when engaging with the Cap Table Management sector in Australia.

Some interesting numbers and facts about your company results for Cap Table Management

| Country with most fitting companies | Australia |

| Amount of fitting manufacturers | 220 |

| Amount of suitable service providers | 317 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 2005 |

| Youngest suiting company | 2020 |

Some interesting questions that has been asked about the results you have just received for Cap Table Management

What are related technologies to Cap Table Management?

Based on our calculations related technologies to Cap Table Management are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Cap Table Management?

The most represented industries which are working in Cap Table Management are Finance and Insurance, IT, Software and Services, Other, Consulting, Real Estate

How does ensun find these Cap Table Management Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.