The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

BackOffice Legal Management

Barueri, Brazil

C

51-100 Employees

2014

Key takeaway

The company focuses on long-term security and peace of mind through its capital planning and legal management services.

Reference

Core business

BackOffice Capital Planning | Legal Management

Andere Capital - Investment & Business Accelerator

São Paulo, Brazil

C

11-50 Employees

2017

Key takeaway

Ändere Capital has facilitated a strategic partnership between its startup CASHTAG and NETZ, focusing on providing flexible credit solutions to the gas station market through a digital platform. This collaboration highlights the company's commitment to innovation and market expansion within the fintech sector.

Reference

Core business

About | Ändere Capital

Capital Lab Ventures

São Paulo, Brazil

C

1-10 Employees

2016

Key takeaway

The company, Capital Lab Ventures, is a proprietary capital firm that partners with technology-driven entrepreneurs to enhance their startups' growth and scalability. They focus on supporting local companies with global ambitions, which could be relevant in the context of cap table management for emerging ventures.

Reference

Core business

Capital Lab Ventures | Venture Capital

Venture Capital

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Light Capital Group

São Paulo, Brazil

C

11-50 Employees

-

Key takeaway

Light Capital Group is a global tech-focused investment firm with a team that has extensive experience in venture and capital markets, which may be relevant for understanding cap table management. Their focus on creating equity value suggests a strong understanding of investment stages and financial structuring.

Reference

Core business

Light Capital Group

Light Capital Group is a global tech-focused investment firm. Our team has extensive entrepreneurial, technology, venture & capital markets experience, creating billions in equity value.

Kush

São Paulo, Brazil

C

1-10 Employees

2011

Key takeaway

Fundanna is a pioneering Regulation Crowdfunding platform dedicated to cannabis businesses, enabling a wider range of investors to support early-stage companies in this sector. Their focus on providing funding opportunities addresses the unique challenges faced by cannabis entrepreneurs.

Reference

Service

Equity Crowdfunding

Kaszek

São Paulo, Brazil

C

1-10 Employees

2011

Key takeaway

The company emphasizes its commitment to providing expertise in various areas, including strategy and fundraising, which are crucial for effective cap table management. Additionally, their focus on technology and innovation suggests they may leverage these elements to enhance growth and value creation for their investments.

Reference

Core business

Fintual - Kaszek

METIS ADVISORS

São Paulo, Brazil

C

1-10 Employees

2017

Key takeaway

The company offers financial advisory services that can assist clients in strategic decision-making, which is crucial for effective cap table management. With a proven track record of over 272 strategic transactions, they emphasize independent advice and trust-based relationships to ensure client success.

Reference

Service

map-alliance - Metis Advisors

3Capital Partners

São Paulo, Brazil

C

11-50 Employees

2018

Key takeaway

3Capital Partners provides advisory services for sellers and buyers in transactions involving sales, capitalization, or corporate restructuring, which is crucial for effective cap table management. Their expertise in identifying and executing strategic acquisitions helps companies optimize their growth and prepare for capital infusion or sale.

Reference

Core business

3Capital Partners | Advisory M&A by Experts

A 3Capital Partners oferece aconselhamento aos seus clientes que são vendedores (sell-side) ou compradores (buy-side) em operações de venda, capitalização ou reestruturação corporativa.

FINCS

São Paulo, Brazil

C

1-10 Employees

2005

Key takeaway

The company, FINCS, offers comprehensive financial calculation solutions tailored for fiduciary agents, securitizers, and custodians, which may be relevant for effective cap table management. Their expertise in developing software components for financial institutions could provide valuable tools for managing complex financial data.

Reference

Core business

FINCS | Componentes e Soluções Financeiras

Clarion Asset Management

São Paulo, Brazil

C

1-10 Employees

-

Key takeaway

Clarion, a Brazilian asset manager with extensive experience in global fixed income and investment management, emphasizes the importance of referring to the offering documents of its funds for detailed information.

Reference

Core business

Corporate Governance - Clarion Asset Management

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

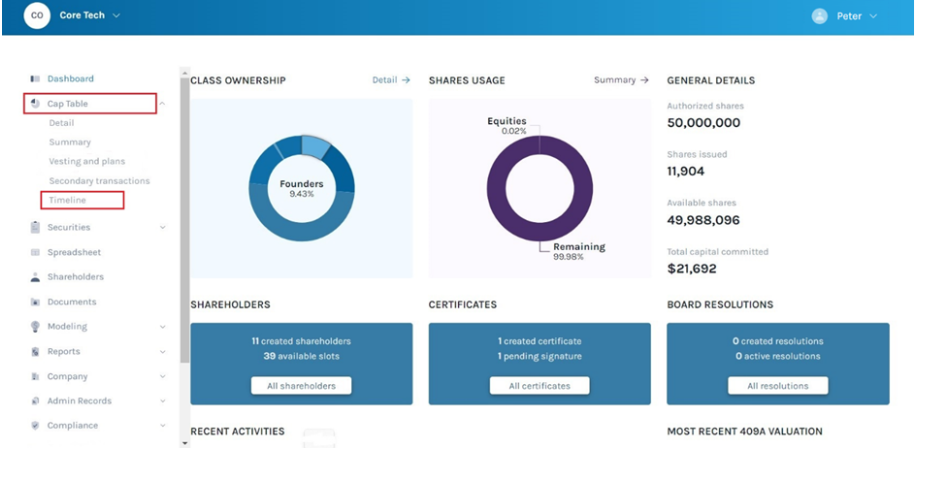

Product

Cap Table Software

Go to product

In Brazil, the Cap Table Management industry is shaped by several key considerations. Regulatory compliance is paramount, with the need to adhere to Brazilian corporate law and securities regulations, which govern shareholding structures and investor rights. The complexity of local tax laws also influences how companies manage their capital tables. The challenges include navigating bureaucratic processes and ensuring transparency, as many startups face difficulties in maintaining accurate records amidst rapid growth. However, opportunities abound as the Brazilian startup ecosystem expands, driven by increased venture capital investment and a growing number of tech entrepreneurs. This growth creates a demand for efficient cap table management solutions that facilitate equity distribution and stakeholder communication. The competitive landscape features both local and international firms, each vying to provide innovative software solutions tailored to the unique needs of Brazilian companies. Additionally, the global market relevance of cap table management is significant, as Brazilian firms seek to attract foreign investment and align with international best practices. Understanding these factors is crucial for anyone interested in entering or investing in the Cap Table Management industry in Brazil, as they provide a comprehensive view of the operational environment and potential for growth in this sector.

Some interesting numbers and facts about your company results for Cap Table Management

| Country with most fitting companies | Brazil |

| Amount of fitting manufacturers | 4 |

| Amount of suitable service providers | 2 |

| Average amount of employees | 1-10 |

| Oldest suiting company | 2005 |

| Youngest suiting company | 2018 |

Some interesting questions that has been asked about the results you have just received for Cap Table Management

What are related technologies to Cap Table Management?

Based on our calculations related technologies to Cap Table Management are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Cap Table Management?

The most represented industries which are working in Cap Table Management are Finance and Insurance, IT, Software and Services, Other, Consulting, Judiciary

How does ensun find these Cap Table Management Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.