The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

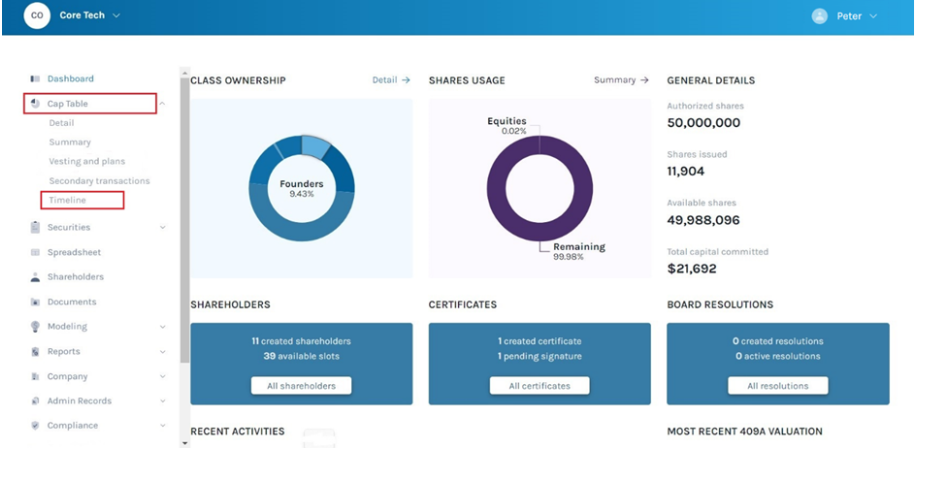

Captable.io

San Francisco, United States

B

1-10 Employees

2013

Key takeaway

LTSE Equity offers a comprehensive cap table management solution designed specifically for startups, enabling founders to effectively plan, manage, and collaborate on their equity. Their approach not only simplifies cap table management but also enhances the narrative of your startup, making it an appealing choice for founders.

Reference

Core business

Startup Cap Table Management | LTSE Equity

Built for founders, by founders. LTSE Equity is a full-lifecycle cap table management solution for planning, managing, and collaborating on startup equity.

Cyndx

New York, United States

B

11-50 Employees

2013

Key takeaway

Cyndx offers specialized cap table management software designed to streamline equity management and prepare for fundraising, making it an essential tool for fast-growing startups. Their platform enhances efficiency in managing ownership and simplifying scenario modeling, ensuring compliance and security for businesses.

Reference

Product

Cap Table Management Software - Cyndx

Streamline equity management, prepare for fundraises, and more. Cyndx Owner is cap table management software for fast-growing startups. Request a demo today!

Global Shared Services

United States

B

51-100 Employees

2003

Key takeaway

The company offers specialized cap table management services for technology firms, emphasizing the importance of having an accurate understanding of ownership stakes to make informed decisions that benefit stakeholders and enhance profitability. Their expertise in financial and accounting services aims to empower businesses of all sizes, ensuring accessible support for effective cap table management.

Reference

Product

Virtual Cap Table Management for Technology Companies | Global Shared Services

Your technology firm needs an accurate picture of ownership stakes to make decisions that benefit stakeholders, the company as a whole, and boost your bottom line.

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Pulley

San Francisco, United States

B

11-50 Employees

2019

Key takeaway

Pulley is a platform that simplifies cap table management for startups, allowing them to easily issue and track equity. With support for both US and international employees, Pulley helps founders and teams make informed decisions about their equity, making it a preferred choice for managing complex cap tables.

Reference

Product

Cap table management | Easy to manage, complex cap tables | Pulley

Pulley's flexible data models make it easy to manage cap tables and equity platforms for companies of any size. Spend less time managing equity and more time growing your startup.

TheCapitalNet

Menlo Park, United States

B

11-50 Employees

2018

Key takeaway

TheCapitalNet specializes in providing SaaS solutions for private market transactions, including a comprehensive application for investors to manage their deal flow and operations. Their focus on customer-centricity and continuous product improvement positions them as a valuable resource for effective cap table management.

Reference

Product

Solutions – TheCapitalNet

For Investors and Fund Managers Deal pipeline and deal flow management A growing asset class that needs to continue to attract value creators (unicorns), stage agonistic capital, and engage with al…

MCAP

New York, United States

B

11-50 Employees

2008

Key takeaway

MCAP LLC specializes in financial technology and market making, utilizing proprietary technology to enhance trading solutions and market access for institutional customers. Their focus on innovative technologies and execution quality suggests a commitment to improving the trading experience in complex global financial markets.

Reference

Core business

Market Makers | MCAP Markets

MCAP LLC is a technology focused market maker of American Depository Receipts (ADRs), foreign ordinary shares, US Treasuries, Agencies, MBS and Municipal sec...

Caplight

San Francisco, United States

B

1-10 Employees

2021

Key takeaway

Caplight offers advanced tools for cap table management, enabling shareholders and institutional investors to trade pre-IPO assets with confidence. Their platform provides valuable insights into trade history and price movements in private markets, which can help monitor and manage equity stakes effectively.

Reference

Core business

Caplight | Private Markets Reimagined

The leading platform for Private Market Data & Trading. Caplight provides insights on the recent trade history of broker-dealers, insights on historical price movements in the private market, and real-time alerts for price movements

WestCap

San Francisco, United States

B

51-100 Employees

1997

Key takeaway

WestCap focuses on investing in innovative, tech-enabled businesses, which suggests a strong emphasis on strategic growth and resource allocation that could be beneficial for effective cap table management. Their partnership with founder-led companies indicates a commitment to supporting their portfolio in achieving long-term success.

Reference

Product

Our Investments - WestCap Group

WestCap is fueling the success of the world's most disruptive asset-light, tech enabled marketplace solutions.

NorthCap Consulting

Dallas, United States

B

51-100 Employees

-

Key takeaway

NorthCap specializes in Enterprise Data Management and Integration Services, offering expert Cloud Data Management Services that could be integral to optimizing cap table management through effective data strategies and support.

Reference

Service

Managed Services – NorthCap

MCAP Inc

Orlando, United States

B

51-100 Employees

-

Key takeaway

MCAP Technologies LLC is a financial technology company that develops software for various financial markets, including customized trading solutions and electronic trading platforms like QwickBonds. They focus on technology-driven financial services and target opportunities in digital financial technologies.

Reference

Core business

MCAP Inc. is a technology-driven financial services firm.

MCAP Inc. is a publicly listed company (OTC: MCAP) that focuses on technology-driven financial services. The Company targets opportunities driven by digital financial technologies. The Company also considers business acquisitions or partnerships that make sense for MCAP shareholders.

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

Cap Table Software

Go to product

Key considerations for individuals interested in the Cap Table Management industry in the United States include understanding the regulatory environment, particularly the guidelines set by the Securities and Exchange Commission (SEC) regarding equity management and reporting. The industry faces challenges such as the need for transparency and accuracy in managing ownership stakes, which can be complex due to varying state laws and financial regulations. Opportunities exist in the increasing demand for technology solutions to streamline cap table management, especially among startups and growing companies that require efficient equity tracking and reporting systems. Moreover, the competitive landscape is marked by a mix of established financial technology firms and emerging startups, each striving to innovate and provide comprehensive solutions. Global market relevance is also significant, as many U.S. companies operate internationally, necessitating an understanding of global compliance issues related to equity management. Environmental concerns may influence investment decisions, as sustainability becomes a priority for many investors, prompting companies to consider how their equity structures align with environmental, social, and governance (ESG) criteria. Overall, a thorough analysis of these factors is essential for anyone looking to navigate the complexities of the Cap Table Management industry in the U.S.

Some interesting numbers and facts about your company results for Cap Table Management

| Country with most fitting companies | United States |

| Amount of fitting manufacturers | 2564 |

| Amount of suitable service providers | 3318 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 1997 |

| Youngest suiting company | 2021 |

Some interesting questions that has been asked about the results you have just received for Cap Table Management

What are related technologies to Cap Table Management?

Based on our calculations related technologies to Cap Table Management are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Who are Start-Ups in the field of Cap Table Management?

Start-Ups who are working in Cap Table Management are Caplight

Which industries are mostly working on Cap Table Management?

The most represented industries which are working in Cap Table Management are Finance and Insurance, IT, Software and Services, Other, Real Estate, Consulting

How does ensun find these Cap Table Management Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.