The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

CapBridge

Singapore

C

101-250 Employees

2015

Key takeaway

CapBridge offers a fully digital platform that simplifies the investment process, allowing individuals to access high-quality investment opportunities with low minimums. This approach democratizes investment access, previously reserved for institutions and high net worth individuals, making it easier for users to manage their cap tables effectively.

Reference

Product

Table - CapBridge

CAP Advisory Group Pte. Ltd.

Singapore

C

11-50 Employees

2011

Key takeaway

CAP is a service-first accounting firm that offers a full suite of accounting and advisory services to SMEs, ensuring transparency and flexibility. Their team is dedicated to transforming the accounting experience for emerging brands, allowing business owners to focus on growth while they manage financial complexities.

Reference

Core business

About Us

CAP is a service - first accounting service for emerging brands and businesses, through across business cycles. As accountants we seek to innovate and bring better services for our clients.

Capitale Ventures

Singapore

C

1-10 Employees

2020

Key takeaway

Capitale Ventures specializes in structuring venture capital and private placements, which are essential components of cap table management for growing businesses. Their expertise in complex transactions supports entrepreneurs in navigating funding strategies that can enhance their growth and transition to publicly traded companies.

Reference

Core business

Growth Capital For Business | Capitale Ventures

Capitale Ventures structures Venture Capital, Private Placements, PIPE Investments and M&A transactions for growing businesses.

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Capital C Corporation

Singapore

C

51-100 Employees

-

Key takeaway

Capital C Corporation offers comprehensive financial solutions for SMEs and individuals, which may indirectly support cap table management through its investment in promising businesses and partnerships. Their focus on fintech and technological innovations can enhance financial management practices for stakeholders and investors.

Reference

Core business

Capital C | Fintech Company Empowering Growth for Modern Finance

Mana-Mana Capital

Singapore

C

1-10 Employees

2016

Key takeaway

Mana Mana Capital specializes in providing access to equity capital and investment opportunities, particularly in the hospitality and real estate sectors. Their client-centric approach and expertise in mergers and acquisitions may be beneficial for effective cap table management.

Reference

Core business

Mana Mana Capital | Official Website

Mana Mana Capital is a trusted advisory firm specializing in mergers and acquisitions, equity placements, brokerage and direct investments, notably in the hospitality sector.

Charismatic Debt Equity Fund

Singapore, Singapore

C

1-10 Employees

2014

Key takeaway

Charismatic Capital Ltd offers investment opportunities through its Charismatic Debt Equity Fund, which provides ethical and socially responsible lending against listed shares. This fund also facilitates quick cash out for shareholders through discounted block trades, positioning itself as a financial partner for major shareholders of globally listed companies.

Reference

Core business

Charismatic Capital Fund – Charismatic Capital Fund

SAC Capital

Singapore

C

11-50 Employees

2004

Key takeaway

SAC Capital Private Limited is a leading Catalist Sponsor that offers capital-raising solutions, including underwriting and share placement services for companies preparing for IPOs. Their extensive experience in M&A processes and advisory roles positions them as a trusted partner in the Singapore Capital Markets.

Reference

Core business

About us – SAC Capital

Kapital Connection

Singapore

C

11-50 Employees

-

Key takeaway

Kapital Connection connects lenders with SME borrowers, facilitating access to working capital and medium-term financing. Their use of technology enhances the user experience and risk management, addressing funding challenges for SMEs.

Reference

Core business

Kapital Connection | Home

SWAEN CAPITAL PTE. LTD.

Singapore

C

11-50 Employees

2009

Key takeaway

Swaen Capital is dedicated to providing comprehensive wealth management solutions, emphasizing a client-first approach. Their commitment to understanding clients' needs and creating optimal strategies may be relevant for effective cap table management.

Reference

Core business

SWAEN CAPITAL PROFILE | swaencapital

JCube Capital Partners

Singapore

C

11-50 Employees

2018

Key takeaway

JCube Capital Partners offers comprehensive support for fund managers and wealth management professionals, emphasizing a systematic approach to minimizing risk and maximizing investment performance. Their strong network and expertise in financial markets make them a valuable resource for effective cap table management.

Reference

Core business

JCube Capital Partners – The Future of Investments

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

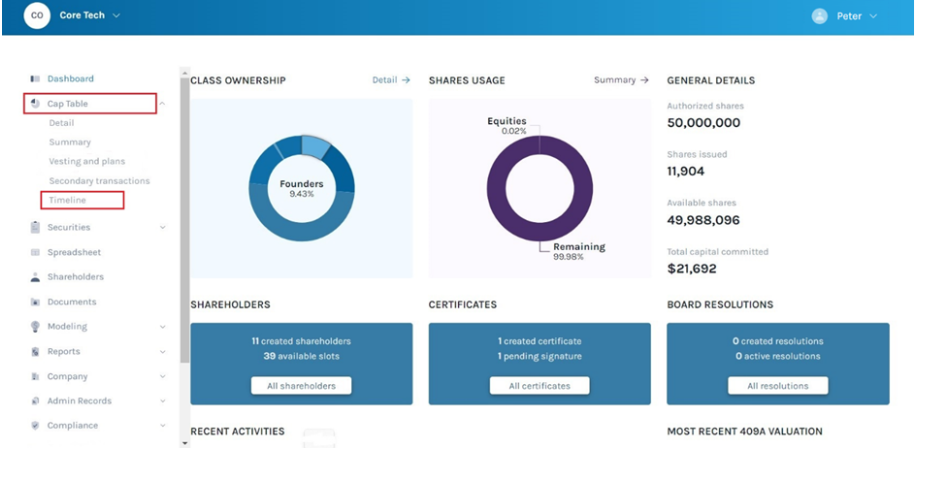

Cap Table Software

Go to product

In Singapore's Cap Table Management industry, several key considerations are essential for informed decision-making. First, understanding the regulatory landscape is crucial. The Monetary Authority of Singapore (MAS) oversees compliance with securities regulations, impacting how companies manage their cap tables. Additionally, the rise of digital transformation in financial services means that technology adoption, including cloud solutions and blockchain, can enhance efficiency and transparency in cap table management. Challenges in this industry often revolve around data security and privacy, as sensitive ownership information must be protected against cyber threats. On the other hand, opportunities abound due to Singapore's vibrant startup ecosystem, which creates a demand for effective equity management solutions. Companies entering this market should also consider the competitive landscape, which includes both local firms and global players offering similar services. Environmental concerns are increasingly relevant, with investors preferring companies that adopt sustainable practices. Lastly, the global market relevance of cap table management is growing, with cross-border investments and international regulations influencing operational strategies. Staying abreast of these factors will provide valuable insights for anyone exploring the Cap Table Management industry in Singapore.

Some interesting numbers and facts about your company results for Cap Table Management

| Country with most fitting companies | Singapore |

| Amount of fitting manufacturers | 46 |

| Amount of suitable service providers | 59 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 2004 |

| Youngest suiting company | 2020 |

Some interesting questions that has been asked about the results you have just received for Cap Table Management

What are related technologies to Cap Table Management?

Based on our calculations related technologies to Cap Table Management are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Cap Table Management?

The most represented industries which are working in Cap Table Management are Finance and Insurance, IT, Software and Services, Consulting, Other, Administration

How does ensun find these Cap Table Management Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.