The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Shareworks by Morgan Stanley

Calgary, Canada

A

501-1000 Employees

1999

Key takeaway

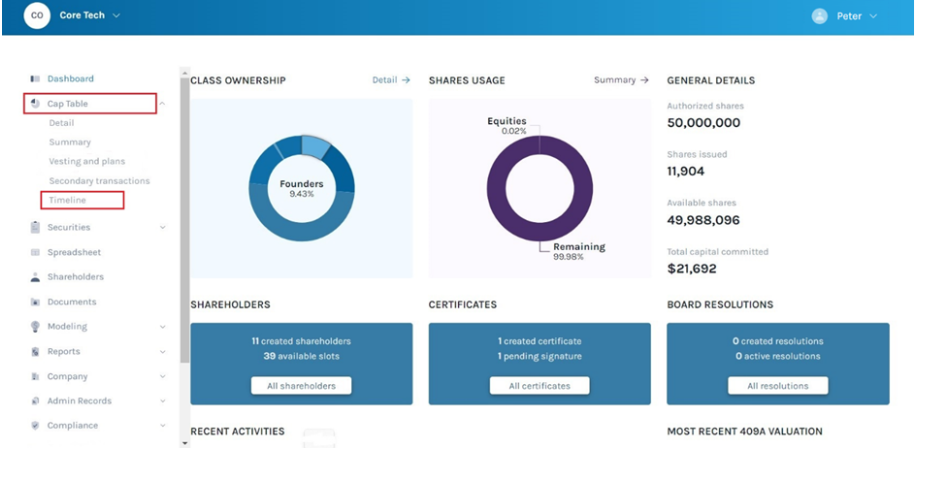

Morgan Stanley at Work offers a comprehensive cap table management software through its Shareworks platform, designed to support companies in effectively managing their equity compensation. This solution is part of a broader financial wellness initiative that empowers employees with the tools and guidance they need to achieve financial well-being.

Reference

Product

Cap Table Management Software | Shareworks Equity Compensation Solutions

Discover our cloud-based cap table management software built for every stage of your companies growth.

UpCapital Investments Corp

Vancouver, Canada

A

1-10 Employees

2020

Key takeaway

The company, UpCapital Investments Corp., offers comprehensive Go-to-Market services that include legal and accounting support, which are essential for effective cap table management. Their expertise in corporate strategy and financial risk, particularly through experienced leadership, positions them well to assist clients in navigating the complexities of public listings and related financial structures.

Reference

Product

UpCapital Investments Corp.

Fair Capital Partners

Vancouver, Canada

A

1-10 Employees

-

Key takeaway

FairCap is a prominent alternative investment firm that specializes in private debt and direct lending in the lower to middle market in North America. They are actively seeking to partner with qualifying companies to provide flexible debt capital solutions, making them a key player in the credit investment landscape.

Reference

Core business

Home | Fair Capital Partners

Fair Capital Partners ("FairCap") is a leading Canadian alternative asset manager focused on North American direct lending private debt opportunities.

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Cap N Hand

Richmond Hill, Canada

A

1-10 Employees

2009

Key takeaway

The company specializes in Group Retirement and Capital Accumulation Plan (CAP) management, offering tailored education and communication programs to enhance employee engagement and financial well-being. With over 30 years of experience, they focus on designing effective workplace retirement and savings programs.

Reference

Service

Cap N Hand

Guiding your employees to financial success!

Mortgage Company of Canada

Markham, Canada

A

11-50 Employees

2008

Key takeaway

Capital Asset Lending is a prominent provider of non-traditional residential mortgages, managing multiple funds that may be of interest to accredited investors. Their focus on capital preservation and stable returns aligns with investment strategies that could enhance cap table management for stakeholders.

Reference

Core business

Home | Capital Asset Lending

Capital Asset Lending is one of the largest licensed mortgage administrators of non-traditional residential mortgages in Canada, serving investors, mortgage brokers, and borrowers. We manage 3 funds: Mortgage Company of Canada Inc. (MCOCI), First Mortgage LP (FMLP), and First Mortgage Trust (FMT).

Markets Compass

Ottawa, Canada

A

1-10 Employees

2014

Key takeaway

The company, Markets Compass, is a leading provider of market outlooks and risk management solutions, indicating a strong focus on investment strategies. Their upcoming Capital Management service suggests a commitment to enhancing their offerings in financial management.

Reference

Service

Capital Management (coming soon) – Markets Compass

MAVAN Capital Partners

Kelowna, Canada

A

1-10 Employees

2017

Key takeaway

MAVAN Capital Partners is a firm focused on actively investing in technology companies, emphasizing their extensive experience in management across various industries. Their commitment to connecting investors with innovative Canadian companies suggests a strong network and opportunity access in the tech investment landscape.

Reference

Product

Camdo - Mavan Capital Partners

Capital Hands

Mississauga, Canada

A

1-10 Employees

2017

Key takeaway

WiseCap is a financing solutions provider that emphasizes building strong client relationships and delivering tailored financial options to help businesses and individuals across Canada achieve their growth potential.

Reference

Core business

About Us - WiseCap

WiseCap is the culmination of a variety of business backgrounds and years of experience in the finance industry.

Caprivi Solutions

Oakville, Canada

A

11-50 Employees

2008

Key takeaway

Caprivi Solutions specializes in capital management through its CapEx360™ Software, which streamlines and optimizes capital expenditure management. Their software supports businesses in making informed investment decisions and enhancing operational efficiency across the entire CapEx lifecycle.

Reference

Core business

Best CapEx Software | Caprivi Solutions

CapEx Software that tackles budgeting, forecasting, requests, approvals, planning and post investment review.

CapM Search Partners

Canada

A

1-10 Employees

-

Key takeaway

The company, CapM Search Partners, emphasizes its expertise in private equity and venture capital, which are crucial for effective cap table management. Their strong network and deep understanding of client needs position them as trusted advisors in the capital markets.

Reference

Service

Expertise – CapM Search Partners

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

Cap Table Software

Go to product

When exploring the Cap Table Management industry in Canada, several key considerations come into play. Regulatory compliance is paramount, as companies must adhere to the guidelines set by the Canadian Securities Administrators (CSA), which govern equity management and reporting. Understanding the nuances of Canadian tax laws is also crucial, especially regarding stock options and equity compensation. The industry faces challenges such as the need for robust cybersecurity measures to protect sensitive financial data and the demand for user-friendly technology solutions. Opportunities are abundant, particularly for startups and tech firms, given the increasing trend of remote work and digital transformation in managing equity. The competitive landscape includes established software providers and emerging startups, each vying to offer innovative solutions. Global market relevance is significant, as Canadian firms are often influenced by trends from the U.S. and other countries in the tech sector. Additionally, environmental, social, and governance (ESG) considerations are becoming increasingly important, prompting companies to integrate sustainable practices into their operations. Keeping abreast of these factors can provide valuable insights for those interested in the Cap Table Management sector in Canada.

Some interesting numbers and facts about your company results for Cap Table Management

| Country with most fitting companies | Canada |

| Amount of fitting manufacturers | 281 |

| Amount of suitable service providers | 386 |

| Average amount of employees | 1-10 |

| Oldest suiting company | 1999 |

| Youngest suiting company | 2020 |

Some interesting questions that has been asked about the results you have just received for Cap Table Management

What are related technologies to Cap Table Management?

Based on our calculations related technologies to Cap Table Management are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Cap Table Management?

The most represented industries which are working in Cap Table Management are Finance and Insurance, IT, Software and Services, Other, Consulting, Real Estate

How does ensun find these Cap Table Management Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.