The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Weiss Analytics

Natick, United States

B

1-10 Employees

2015

Key takeaway

Weiss Analytics specializes in advanced real estate analytics, offering innovative products such as house-specific home price indexes and automated valuation models. Their expertise in repeat sales home price indexes significantly enhances market analysis resolution.

Reference

Core business

Home | Weiss Analytics | Home Investor And Lender Tools

Weiss Analytics is a pioneer in next generation home price analytics. We produce house specific home price indexes; automated home valuation products for the web; and provide custom residential research and advisory services to the industry. Building on our unique expertise in repeat sales home price indexes, we have increased the resolution of market analysis by nearly 10,000-fold.

Bird.i

Glasgow, United Kingdom

A

11-50 Employees

2014

Key takeaway

The company emphasizes its commitment to providing advanced real estate data intelligence and tools, which are essential for navigating market shifts and enhancing decision-making in the housing landscape. Through a comprehensive national homebuilding database and regional events, they equip industry professionals with personalized solutions and localized market insights.

Reference

Product

Data intelligence - Housing Market & Real Estate Data - Zonda

Realty Invest Network

Ikota, Nigeria

E

251-500 Employees

-

Key takeaway

REALTY INVEST NETWORK SOLUTIONS LTD operates a comprehensive real estate business model that integrates various elements such as realtech and crowdfunding, enhancing their ability to deliver exceptional results in the real estate sector. Additionally, they emphasize a strategic approach to real estate investment, providing professionals with the tools to make informed decisions about their assets.

Reference

Product

Data Analytics – Realty Invest Network

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

The Real Estate CRM

Doha, Qatar

C

1-10 Employees

2017

Key takeaway

The company offers a comprehensive property management software that includes features for property analytics and effective data analysis, making it a valuable tool for enhancing property sales and tenant experiences. With a focus on improving IT stability and performance, their platform supports various aspects of real estate management.

Reference

Product

Property Analytics - The Real Estate CRM!

Restb.ai

Barcelona, Spain

A

11-50 Employees

2015

Key takeaway

Restb.ai is a leading provider of visual insights in the real estate sector, utilizing AI and technology to enhance property marketing and appraisal processes. Their innovative solutions offer unique and actionable data derived from property imagery, unlocking new opportunities for real estate professionals.

Reference

Core business

Restb.ai

Restb.ai is real estate's leading provider of visual insights. We provide companies with property intelligence built on computer vision and AI

7Square

Montreal, Canada

A

1-10 Employees

2020

Key takeaway

The company offers a comprehensive set of analytics and data specifically for real estate, including information on nearby schools, enabling clients to make informed decisions. Their focus on integrating advanced analytics with artificial intelligence highlights their commitment to providing valuable insights in the real estate market.

Reference

Core business

7Square: Real Estate Analytics & Insights

Terradatum

Glen Ellen, United States

B

11-50 Employees

1989

Key takeaway

Terradatum offers a web-based program that enhances real estate analytics by allowing users to explore MLS data through interactive maps and customizable reports. This focus on accurate analytics is highlighted as essential for navigating the real estate market, especially in challenging times.

Reference

Product

BrokerMetrics | Lone Wolf Technologies

Data Nerds

Kelowna, Canada

A

11-50 Employees

2014

Key takeaway

Estated is a company that specializes in aggregating, digitizing, and standardizing property data, making it accessible to consumers through their API and product offerings. Their focus on real estate data positions them as industry leaders in property analytics.

Reference

Core business

Data Nerds - Industry leading real estate and property data API

The Habistat

Ottawa, Canada

A

1-10 Employees

2020

Key takeaway

The company specializes in data analytics and visualizations, making it a top choice for Canadian real estate professionals who need insights and transparency.

Reference

Core business

The Habistat

Data analytics and visualizations for Canadian real estate professionals

Real Estate Analytics (8PROP)

Singapore

C

51-100 Employees

2019

Key takeaway

The company, 8PROP Property Intelligence, offers real estate market trends and high-quality property insights, empowering buyers and renters to make informed, data-backed decisions.

Reference

Core business

8PROP Property Intelligence

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

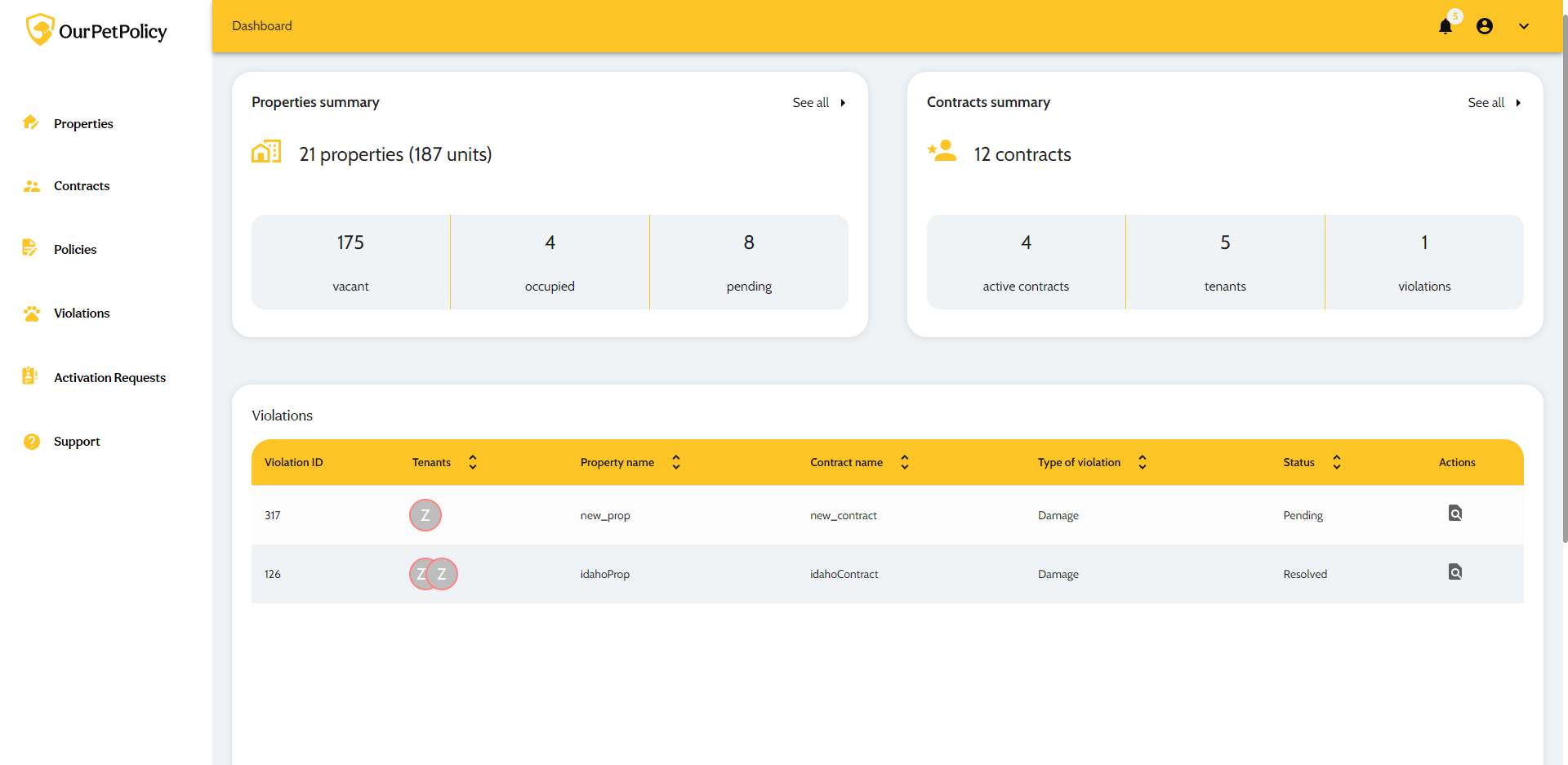

OurPetPolicy Platform

Go to product

Real estate analytics involves the use of data analysis and statistical techniques to gain insights into the real estate market. This field combines various data sources, such as property values, market trends, and economic indicators, to help investors, developers, and real estate professionals make informed decisions. By leveraging advanced analytics tools, users can identify patterns, forecast future market conditions, and optimize investment strategies. Integrating geographic information systems (GIS) with data analytics further enhances the ability to visualize and interpret spatial data related to property locations and market dynamics.

Real estate analytics leverages data to provide valuable insights that significantly enhance property investment decisions. By analyzing trends in property values, rental yields, and market demand, investors can identify lucrative opportunities and mitigate risks. Moreover, advanced analytics tools can evaluate factors such as location demographics, economic indicators, and historical sales data, offering a comprehensive view of potential investments. This data-driven approach enables investors to make informed choices, ensuring better returns on their property investments while aligning with market dynamics.

Real estate analytics relies on a variety of data sources to provide comprehensive insights. Public Records These include property deeds, tax assessments, and ownership records, which offer fundamental information about properties and ownership history. MLS Data Multiple Listing Service (MLS) data is invaluable as it contains detailed information on properties for sale or rent, including pricing, features, and sales history. Market Reports Reports from real estate firms and market analysts contribute essential data on market trends, pricing forecasts, and demographic information, helping to inform investment decisions. Economic Indicators Data on interest rates, employment rates, and economic growth also play a crucial role in evaluating real estate markets, as they impact buyer behavior and market demand. Social Media and Online Platforms Insights from social media and property listing websites can reveal consumer sentiment and market activity, providing a modern perspective on real estate dynamics.

Real estate analytics plays a crucial role in risk management by providing valuable insights into market trends and property performance. By analyzing data such as historical prices, occupancy rates, and demographic information, investors and developers can identify potential risks associated with property investments. Additionally, predictive analytics can forecast market fluctuations, enabling stakeholders to make informed decisions based on reliable data. This proactive approach helps in mitigating risks related to market downturns, ensuring better asset management and strategic planning for future developments.

1. Data Integration

Look for tools that seamlessly integrate various data sources, such as market trends, property values, and demographic information. This integration allows for comprehensive analysis and informed decision-making.

2. Visualization Capabilities

Effective real estate analytics tools should offer robust visualization features. These allow users to easily interpret complex data through charts, graphs, and maps, facilitating better insights into market conditions.

3. Predictive Analytics

Choose platforms that include predictive analytics capabilities. These features help forecast future trends based on historical data, enabling users to anticipate market movements and make strategic investments.

4. Custom Reporting

The ability to generate custom reports tailored to specific needs is crucial. Look for tools that allow users to create reports that focus on the metrics and insights most relevant to their objectives.

5. User-Friendly Interface

A user-friendly interface enhances the experience, making it easier for users of all skill levels to navigate the tool. Intuitive design helps in quick data access and effective analysis without extensive training.

Some interesting numbers and facts about your company results for Real Estate Analytics

| Country with most fitting companies | United States |

| Amount of fitting manufacturers | 5532 |

| Amount of suitable service providers | 9280 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 1989 |

| Youngest suiting company | 2020 |

20%

40%

60%

80%

Some interesting questions that has been asked about the results you have just received for Real Estate Analytics

What are related technologies to Real Estate Analytics?

Based on our calculations related technologies to Real Estate Analytics are Big Data, E-Health, Retail Tech, Artificial Intelligence & Machine Learning, E-Commerce

Which industries are mostly working on Real Estate Analytics?

The most represented industries which are working in Real Estate Analytics are Real Estate, IT, Software and Services, Other, Finance and Insurance, Marketing Services

How does ensun find these Real Estate Analytics Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.