The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Cignifi Inc.

São Paulo, Brazil

C

11-50 Employees

2010

Key takeaway

Cignifi's Credit & Marketing Analytics Platform offers advanced AI-driven tools that help lenders and financial services reach underserved customers with limited credit histories. By leveraging behavioral scoring based on mobile phone interactions, Cignifi enables clients to acquire new customers and uncover financial opportunities.

Reference

Core business

Home | Cignifi

FINCS

São Paulo, Brazil

C

1-10 Employees

2005

Key takeaway

FINCS is a B2B Vertical SaaS FinTech company that specializes in providing comprehensive financial calculation solutions specifically designed for fiduciary agents, securitizers, and custodians. With over 10 years of experience, it offers software components that integrate securely and flexibly with various applications, catering to the needs of both sell-side and buy-side institutions.

Reference

Core business

FINCS | Componentes e Soluções Financeiras

SA Home Loans

Gravataí, Brazil

C

501-1000 Employees

1999

Key takeaway

The company specializes in home finance, offering tailored mortgage solutions and a competitive rate of 19.6%, providing consumers with an appealing alternative to traditional banks. Their focus on an exceptional client experience underscores their commitment to making home ownership more accessible.

Reference

Product

Our Products |Personal Lending | Quick Cash | SA Home Loans

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

CredSmart Soluções Financeiras

São Paulo, Brazil

C

11-50 Employees

2017

Key takeaway

CredSmart offers a wide range of financial solutions beyond just loans, including various products and services to meet diverse consumer needs. As an authorized banking correspondent, they provide specialized financial solutions like payroll loans and personal loans, ensuring clients access to the best credit options available.

Reference

Core business

Empréstimo Consignado | Credsmart

CredSmart Soluções Financeiras. Nossos clientes contam com uma Plataforma inteligente, encontramos a melhor Solução em Credito para você!

Macro Assessoria E Fomento Comercial

Santa Rosa, Brazil

C

1-10 Employees

-

Key takeaway

Finanzi offers quick and immediate payment for sales made on credit, enhancing consumer finance by ensuring a secure and efficient transaction process. They provide services such as purchasing promissory notes and analyzing credit to facilitate safer sales.

Reference

Core business

Finanzi | Fundo de Investimento em Direitos Creditórios

Fundo de Investimento em Direitos Creditórios

FinMatch

São Paulo, Brazil

C

11-50 Employees

2020

Key takeaway

FinMatch offers tailored financial solutions designed to help consumers achieve their dreams, emphasizing low interest rates and flexible repayment terms. As an intermediary between banks, fintechs, and clients, FinMatch provides a quick and secure way to access personal loans and other financial products.

Reference

Core business

Empréstimo seguro e rápido | FinMatch - FinMatch

Solicite seu Empréstimo Pessoal, você descobre de forma rápida e prática qual a melhor opção para seu bolso e momento. Conheça também os outros produtos financeiros da FinMatch;

Capital Empreendedor

Itaí, Brazil

C

11-50 Employees

2017

Key takeaway

Capital Empreendedor is a leading marketplace that connects businesses to over 360 financial institutions, utilizing Open Finance technology to find the best credit options. Their platform streamlines the process, allowing entrepreneurs to discover various lines of credit tailored to their needs.

Reference

Core business

Capital Empreendedor - Sua Plataforma de Crédito Empresarial

A Capital Empreendedor é um marketplace de crédito para empresas. Nosso objetivo é garantir o MELHOR crédito para o empreendedor brasileiro.

AF Crédito

Palhoça, Brazil

C

11-50 Employees

-

Key takeaway

AF Crédito is a leading franchise in Financial Solutions, specializing in a wide range of highly demanded services such as Personal Loans, Secured Loans, and Financing.

Reference

Core business

AFCrédito - Franquia de Crédito

Somos mais que uma franquia, somos uma consultoria financeira A AF Crédito é uma franquia líder em Soluções Financeiras, especializada em oferecer uma ampla gama de serviços altamente demandados, incluindo Crédito Consignado, Crédito Pessoal, Capital de Giro, Venda de Seguros, Consórcios e Energia Solar Fotovoltaica. Encontre a AF mais próxima de você Conheça um pouco mais sobre o que a AF Crédito pode fazer por você: CONSÓRCIOS Consórcio é uma compra coletiva em que pessoas pagam parcelas mensais e, periodicamente, um ou mais são sorteados para receber o bem desejado. Saiba Mais FINANCIAMENTOS Financiamento é uma maneira de adquirir algo imediatamente e pagar ao longo do tempo em parcelas com acréscimo de juros. Saiba Mais EMPRÉSTIMOS Empréstimo é quando uma instituição financeira oferece dinheiro a uma pessoa, que deve devolvê-lo em parcelas com juros. É usado para quitar dívidas ou fazer compras. Saiba Mais SEGUROS Seguro é um contrato em que você paga para uma empresa cobrir riscos e oferecer compensação financeira em caso de problemas. Saiba Mais SOLUÇÕES EM ENERGIA SOLAR Reduza sua conta de energia elétrica com nossas soluções em energia solar. Saiba Mais Parceiros: unidades + 0 de clientes + 0 As melhores condições de crédito do mercado você encontra só aqui! Encontre a unidade AF Crédito mais próxima de você e faça sua simulação. Por que escolher a AF Crédito? Única franquia financeira com banco próprio de adiantamento de FGTS Melhor taxa do mercado Marca consolidada “>”>Soluções exclusivas para cada cliente Própria corretora de seguros Mais de 80 parceiros homologados

Maxinvestor Fundo De Investimento Em Direitos Creditorios Nao Padronizados Multissetorial Lp

São Paulo, Brazil

C

11-50 Employees

1983

Key takeaway

MaxInvestor FIDC has over 35 years of expertise in the consumer finance market, specializing in the anticipation of credit by calculating discounts and purchasing future receivables. The company emphasizes transparency and partnership, ensuring a dynamic approach to consumer finance solutions.

Reference

Core business

Max Investor - FIDC

FinanZero

São Paulo, Brazil

C

51-100 Employees

2015

Key takeaway

FinanZero is a pioneering fintech in the Brazilian credit market, offering a digital loan comparison service since 2016. With over 70 partners, FinanZero aims to simplify access to personal loans, helping consumers find the best rates and options for their financial needs.

Reference

Core business

FinanZero: O Melhor Buscador de Empréstimos

FinanZero é o seu buscador de empréstimos rápido e seguro! A gente busca as melhores taxas e você escolhe a melhor opção para o seu bolso.

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

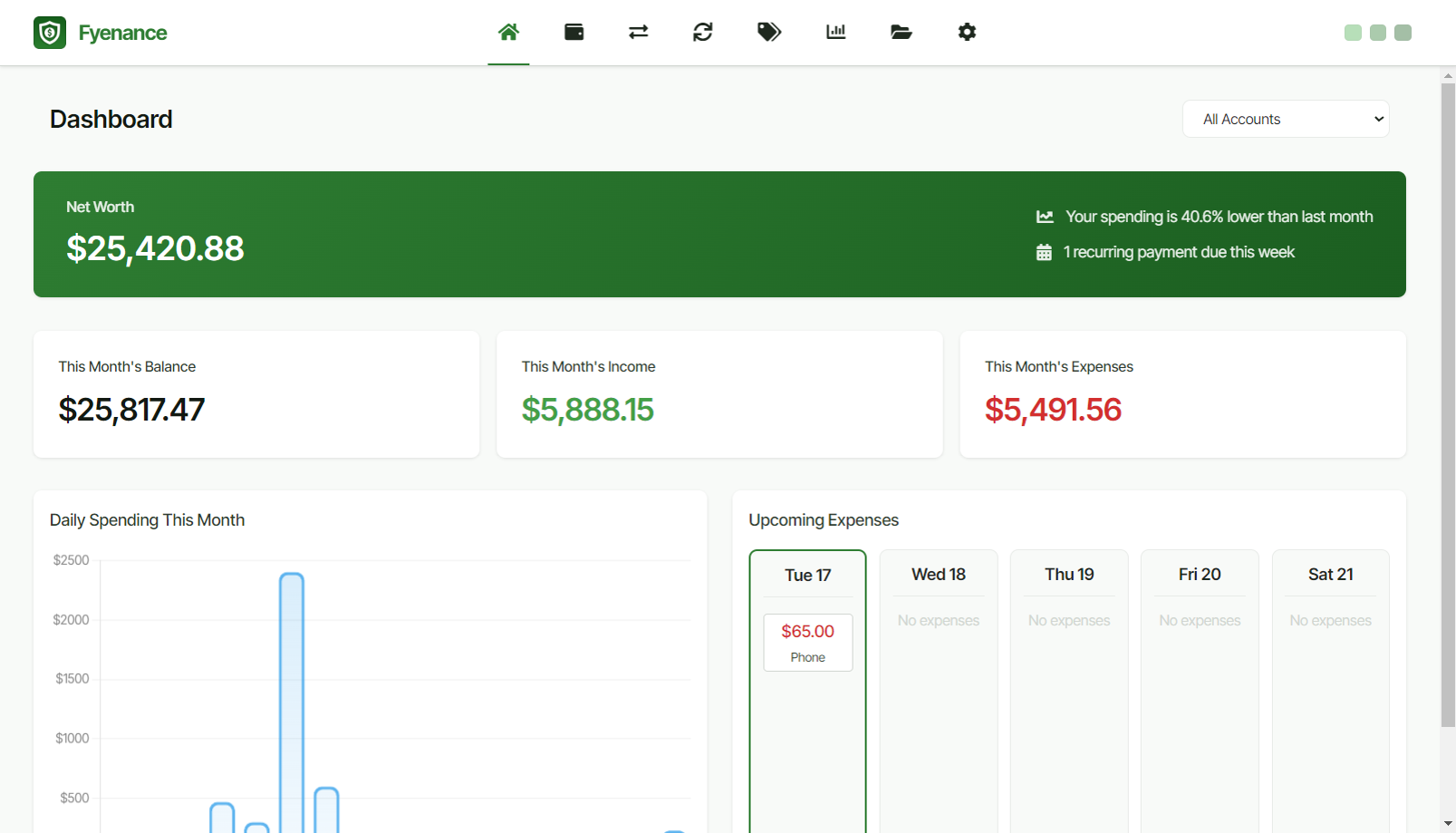

Fyenance

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the Consumer Finance industry in Brazil, several key considerations come into play. Firstly, understanding the regulatory landscape is crucial, as Brazil has specific laws governing financial institutions, including the Central Bank of Brazil's regulations on lending practices and consumer protection. Compliance with these regulations is essential for any company operating in this space. The competitive landscape is also significant, with a mix of traditional banks and fintech companies vying for market share. Fintechs are increasingly popular, offering innovative solutions that cater to a tech-savvy population. This presents both challenges and opportunities for traditional financial institutions to adapt and innovate. Economic factors, such as inflation rates and employment levels, can directly impact consumer borrowing and spending habits. Additionally, the growing emphasis on sustainability and environmental concerns may influence consumer preferences, prompting companies to adopt ethical lending practices. Finally, the global relevance of Brazil's Consumer Finance sector should not be overlooked, as it is part of the larger Latin American market, which is seeing increased foreign investment and interest. Understanding these multifaceted aspects will provide valuable insights for anyone looking to navigate the Consumer Finance industry in Brazil effectively.

Some interesting numbers and facts about your company results for Consumer Finance

| Country with most fitting companies | Brazil |

| Amount of fitting manufacturers | 9 |

| Amount of suitable service providers | 6 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 1983 |

| Youngest suiting company | 2020 |

Some interesting questions that has been asked about the results you have just received for Consumer Finance

What are related technologies to Consumer Finance?

Based on our calculations related technologies to Consumer Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Consumer Finance?

The most represented industries which are working in Consumer Finance are Finance and Insurance, IT, Software and Services, Other, Consulting, Utilities

How does ensun find these Consumer Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.