The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Credit Engine

Tokyo, Japan

A

11-50 Employees

2016

Key takeaway

Credit Engine's lending platform enhances the quality of consumer finance services by offering customizable features for individual product installment purchases and credit services, thereby facilitating the digitalization of lending operations for financial institutions.

Reference

Core business

Company Profile | Credit Engine, Inc.

オンライン融資管理システム「CE Loan」、オンライン債権回収システム「CE Servicing」など、金融機関の融資業務のデジタル化を推進するサービスを提供しています。

LINE Financial Corporation

Tokyo, Japan

A

- Employees

2018

Key takeaway

LINE Financial is actively developing a variety of financial services, including LINE Securities and LINE Pocket Money, which highlights its commitment to enhancing consumer finance offerings and creating new value for customers.

Reference

Service

LINE Financial Corporation | Business Overview

LINE Financial offers a wide range of financial services, including LINE Securities, LINE Score, LINE Pocket Money.

Aiful

Kyoto, Japan

A

1001-5000 Employees

1978

Key takeaway

The company, Aiful, is a consumer finance provider that offers various card loan and cashing services, emphasizing their 24/7 online application process and a range of borrowing options to meet customer needs.

Reference

Core business

カードローンやキャッシングは消費者金融のアイフル【公式】

カードローンやキャッシングのことなら消費者金融アイフル!24時間365日、WEB完結でお申込み可能です。お客様のニーズにこたえるべく、様々なお借入方法をご用意しております。

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

SV-FINTECH Fund

Kawasaki, Japan

A

- Employees

-

Key takeaway

The company specializes in FinTech and has a deep understanding of financial regulations, making it a trusted partner for IT executives and FinTech entrepreneurs. Their investment track record includes alternative lending, payment solutions, and automated savings, highlighting their expertise in consumer finance.

Reference

Core business

SV-FINTECH Fund | シリコンバレーを中心に投資と事業開発を行うSV FRONTIERと、 株式会社VOYAGE GROUPで立ち上げた、 日米のFinTech企業を対象とした投資ファンドです

シリコンバレーを中心に投資と事業開発を行うSV FRONTIERと、 株式会社VOYAGE GROUPで立ち上げた、 日米のFinTech企業を対象とした投資ファンドです

Tokyo FinTech

Tokyo, Japan

A

1-10 Employees

2017

Key takeaway

The company, GIA Tokyo FinTech, provides insights into the evolving landscape of FinTech, which may include developments in consumer finance, blockchain, and crypto through their events and resources.

Reference

Service

Services | Tokyo FinTech

MUFG Innovation Partners

Tokyo, Japan

A

11-50 Employees

2019

Key takeaway

Mitsubishi UFJ Financial Group is developing an open innovation platform that integrates advanced technologies and startup business models to enhance financial services, particularly through its corporate venture capital arm, MUFG Innovation Partners.

Reference

Product

FINTECH-ENABLED MARKETPLACE | MUFG Innovation Partners

MUIP, established as the corporate venture capital to enable Mitsubishi UFJ Financial Group’s Open Innovation strategy.

Oak Business Consultant

Kasukabe, Japan

A

11-50 Employees

2009

Key takeaway

The company, Oak Financial and Management Consultant, specializes in consumer finance through a range of services including financial planning, forecasting, and risk management. Their expertise in financial performance assessment and strategic development equips clients with the insights needed for informed decision-making and long-term success.

Reference

Product

Online Marketplace Financial Model - Oak Business Consultant

Oak Business Consultant is providing you Online Marketplace Financial Model to help your Business Decision Making and efficient operations.

CoreForth

Tokyo, Japan

A

- Employees

2010

Key takeaway

The company provides valuable information for individuals looking to borrow money quickly.

Reference

Core business

お金借りるコアフォース!すぐに借りたい人にお得な情報を発信

Foreigner's Finances

Japan

A

1-10 Employees

-

Key takeaway

The company's content on foreignersfinances.com provides informational and educational resources related to finance, which may be relevant to consumer finance topics.

Reference

Core business

Welcome

MUFG Investor Services

Tokyo, Japan

A

10001+ Employees

1864

Key takeaway

MUFG Investor Services, a division of Mitsubishi UFJ Financial Group, Inc, specializes in providing comprehensive support across the investment value chain, including fund financing and asset servicing. Their commitment to delivering customized solutions and competitive pricing positions them as a valuable partner for addressing the financing needs of alternative asset managers.

Reference

Service

Fund Financing - MUFG Investor Services

The benefits of working together with MUFG Investor Services on your fund financing needs include competitive pricing, integrated collateral monitoring, efficient use of capital for FX hedging, and a captive balance sheet.

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

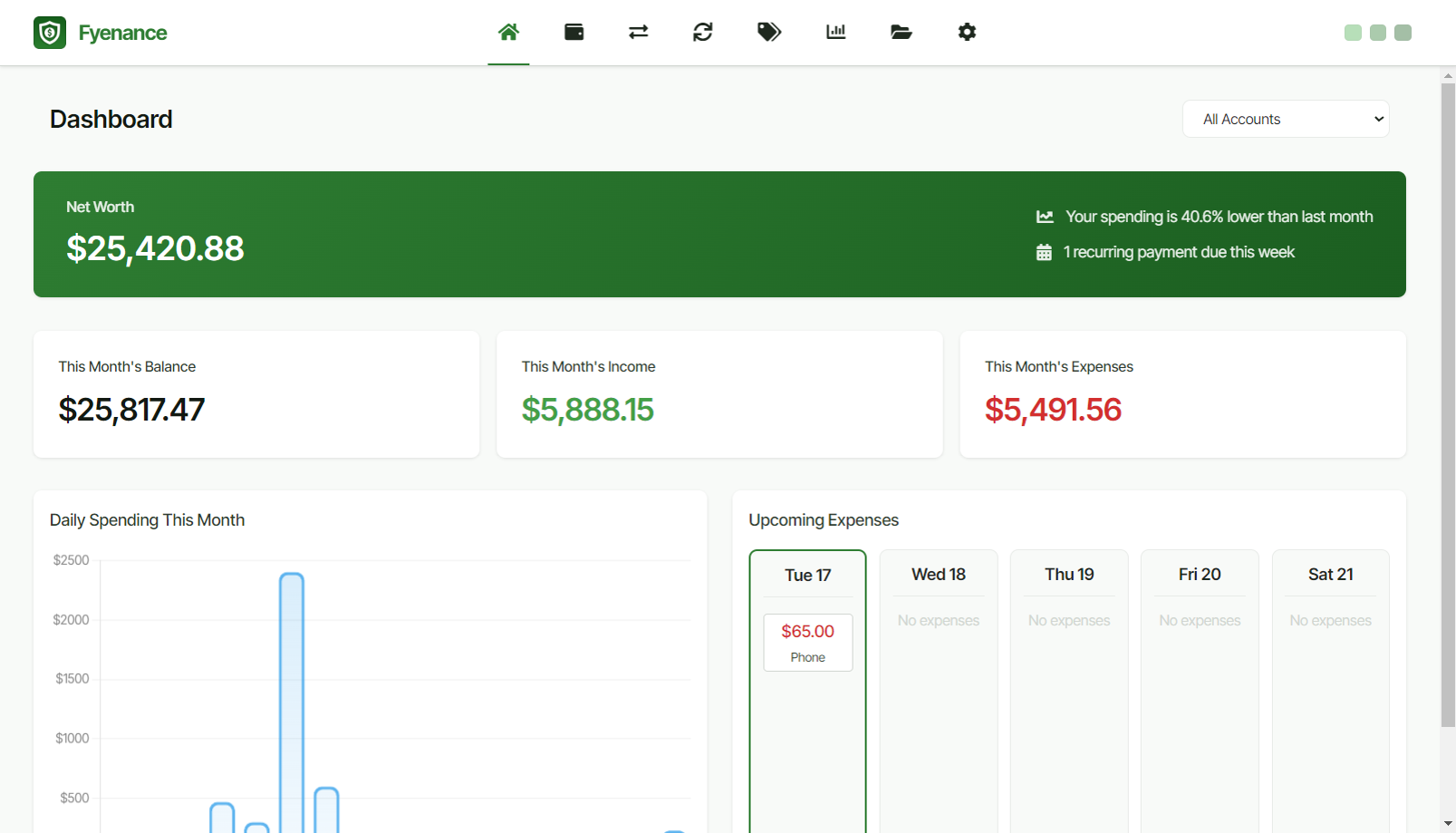

Fyenance

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the Consumer Finance industry in Japan, it is essential to consider several key factors that influence the market. Japan's regulatory environment is strict, with the Financial Services Agency overseeing consumer finance laws to protect borrowers. Compliance with these regulations is crucial for any company operating in this sector. Additionally, the market faces challenges such as an aging population, which may impact demand for consumer loans and credit products. However, there are also significant opportunities, particularly in digital finance and fintech innovations, which are gaining traction among younger consumers. Environmental, social, and governance (ESG) concerns are increasingly relevant, as consumers become more conscious of sustainable practices and corporate responsibility. The competitive landscape is characterized by both traditional banks and emerging fintech startups, creating a dynamic environment where companies must differentiate themselves through technology and customer service. Furthermore, understanding Japan's position in the global market is vital, as international trends can influence local consumer behavior. In summary, thorough research on regulatory compliance, demographic shifts, technological advancements, and the competitive climate is essential for anyone interested in the Consumer Finance industry in Japan.

Some interesting numbers and facts about your company results for Consumer Finance

| Country with most fitting companies | Japan |

| Amount of fitting manufacturers | 2 |

| Amount of suitable service providers | 2 |

| Average amount of employees | 1001-5000 |

| Oldest suiting company | 1864 |

| Youngest suiting company | 2019 |

Some interesting questions that has been asked about the results you have just received for Consumer Finance

What are related technologies to Consumer Finance?

Based on our calculations related technologies to Consumer Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Consumer Finance?

The most represented industries which are working in Consumer Finance are Other, Finance and Insurance, Consulting, Marketing Services

How does ensun find these Consumer Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.