The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Lendo Group

Oslo, Norway

A

251-500 Employees

-

Key takeaway

Lendo Group is a prominent marketplace for loans in Scandinavia, including consumer loans, credit cards, and mortgages. Their digital service enhances transparency in the loan market, helping customers make informed financial decisions.

Reference

Product

Products - Lendo Group

We are committed to constantly innovate and improve our products. We believe a customer-centric approach is central in all decision-making. Therefore, we always put our customers first.Over time this has led to a comprehensive offering to our customers, presented with a broad portfolio of products that creates significant and correct volumes for our bank partners.

Commercial Banking Applications AS

Oslo, Norway

A

11-50 Employees

1983

Key takeaway

Commercial Banking Applications AS (CBA) offers a comprehensive suite of solutions, including the IBAS GFF - Global Financing & Loans Management Factory, which directly addresses the needs of consumer finance through its focus on financing and loans management. Their commitment to banking automation and industry standards ensures that their offerings are both innovative and reliable for banks worldwide.

Reference

Product

Financing & Loans Management

Folkefinans

Oslo, Norway

A

11-50 Employees

2006

Key takeaway

Nordiska Financial Partner Norway AS is a leading provider of practical and everyday financial services, specializing in mobile loans for consumers and businesses. Their future focus is on delivering higher customer value through digitized processes that ensure accessible financial solutions, emphasizing responsible lending and a thorough understanding of borrowers' financial obligations.

Reference

Core business

Start

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Fintech Innovation

Oslo, Norway

A

11-50 Employees

2016

Key takeaway

Fintech Innovation is dedicated to creating innovative financial services and solutions, emphasizing the use of emerging technologies like open banking and personal finance management. Their focus on the fintech sector aligns with the evolving landscape of consumer finance.

Reference

Core business

Fintech Innovation | Building the next generation of financial services

Fintech Innovation is the parent company to an ecosystem of fintech companies, which are dedicated to delivering the full benefits of emerging financial technologies, for open banking, global payments settlement, and personal finance management.

Vopy

Bærum, Norway

A

11-50 Employees

2014

Key takeaway

Vopy offers a comprehensive suite of white label financial services, including digital wallets, payment cards, and instant money transfers, enabling companies to enhance their customer offerings with embedded finance solutions. Their goal is to promote financial inclusion and provide access to investment opportunities, particularly for emerging markets.

Reference

Product

Explore Vopy's add ons - Vopy

Once entering Vopy, you get a universe of smart and safe fintech products to choose from.

Factoring Finans

Trondheim, Norway

A

11-50 Employees

-

Key takeaway

Factoring Finans offers tailored financing solutions that free up capital for businesses, allowing them to grow. They provide immediate cash by taking over invoices and also offer loans for vehicles or equipment, ensuring flexibility to meet the specific needs of companies.

Reference

Core business

Factoring Finans - Finansieringsløsninger tilpasset bedriftens behov

Factoring Finans frigjør kapital i din bedrift og gir deg handlingsrom til å vokse. Vi holder til i Trondheim, gjerne kom innom for en prat!

Tide Capital

Oslo, Norway

A

1-10 Employees

-

Key takeaway

Tide Capital specializes in providing innovative financing solutions for low emissions transport and sustainable industrial infrastructure, emphasizing the importance of focused financial strategies in the de-carbonization of the economy. Their technology platform enhances transparency in climate impact tracking, which supports effective ESG reporting and compliance with sustainable investment standards.

Reference

Core business

Tide Capital | energy transition financing

Tide Capital is pioneering new possibilities in sustainable finance. Financing solutions for low emissions maritime, battery electric commercial mobility, battery electric heavy equipment and energy transition industrial infrastructure. We use innovative digital technology for transparent climate impact tracking, empowering ESG reporting and EU SFDR Art. 9 compliance.

Axo Finans

Oslo, Norway

A

1-10 Employees

2008

Key takeaway

Axo Finans serves as a financial agent, facilitating the comparison of consumer loans and refinancing options from over 20 banks and lenders. They assist customers in submitting loan applications and present individual interest rates alongside loan offers, helping borrowers find the best deal.

Reference

Core business

Axo Finans: Sammenlign priser på forbrukslån og refinansiering

Axo Finans er din finansagent for forbrukslån og refinansiering. Sammenlign lånetilbud fra over 20 banker og lån opptil 600 000

Ai finans AS

Oslo, Norway

A

1-10 Employees

2020

Key takeaway

The company specializes in consumer finance by collaborating with banks that offer refinancing options, even for those with payment issues. Their focus on personalized financial solutions helps individuals achieve better terms and a fresh financial start.

Reference

Core business

Ai Finans - Vi gir deg gratis og rask hjelp

Vi hjelper personer med en utfordrende økonomisk situasjon til å få bedre betingelser og en ny økonomisk start. Eksperter på refinansiering.

Viridis Kapital

Oslo, Norway

A

1-10 Employees

2021

Key takeaway

Viridis Kapital specializes in providing financing solutions for capital-intensive "green" equipment, addressing the unique challenges of the environmental and corporate governance sectors. With a focus on leasing options, they support the rapid growth of green industries, making it easier for vendors and manufacturers to offer sustainable solutions to their customers.

Reference

Core business

Green - Viridis Kapital

Providing financing for "green" ESG equipments of all types.

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

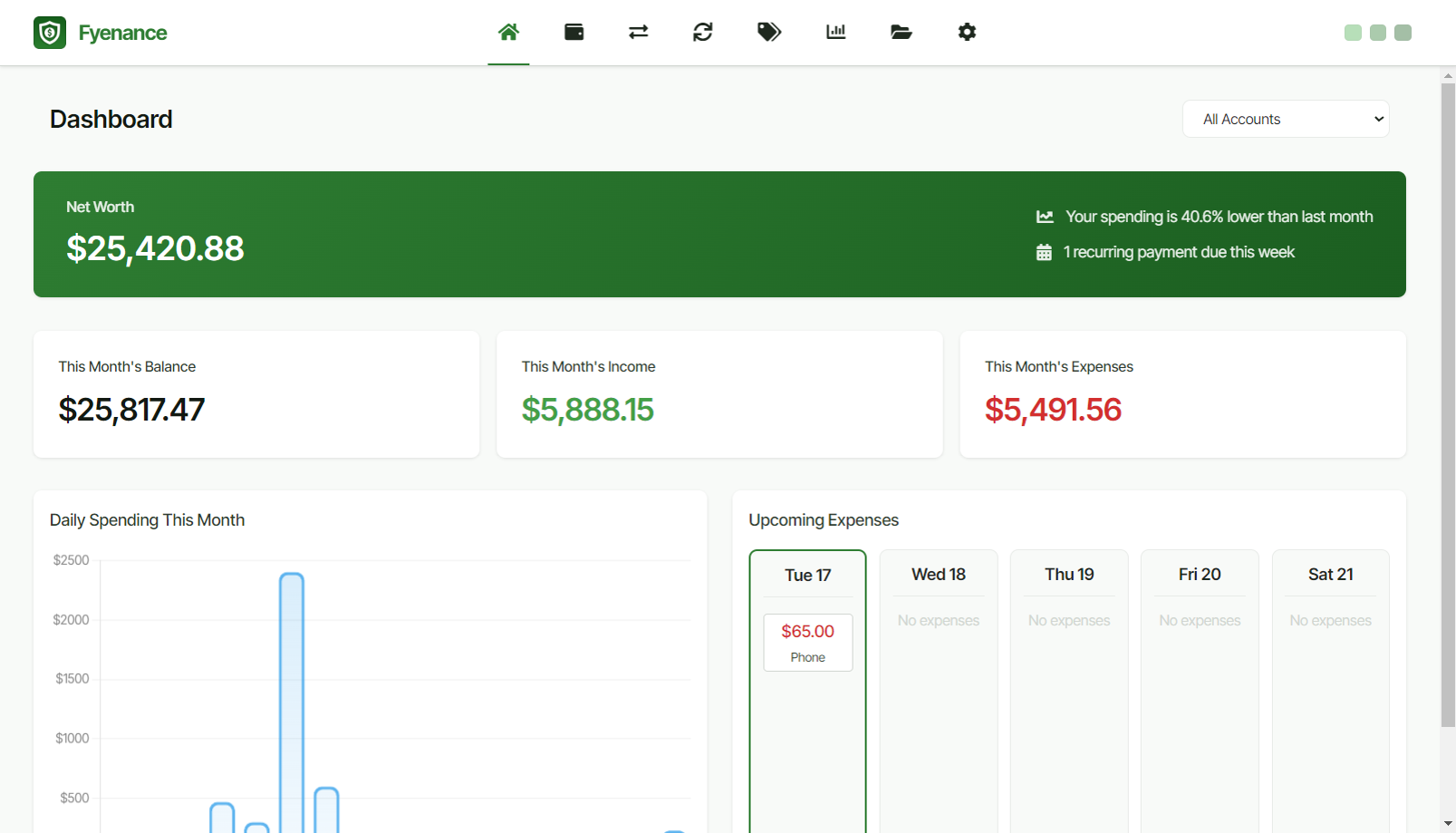

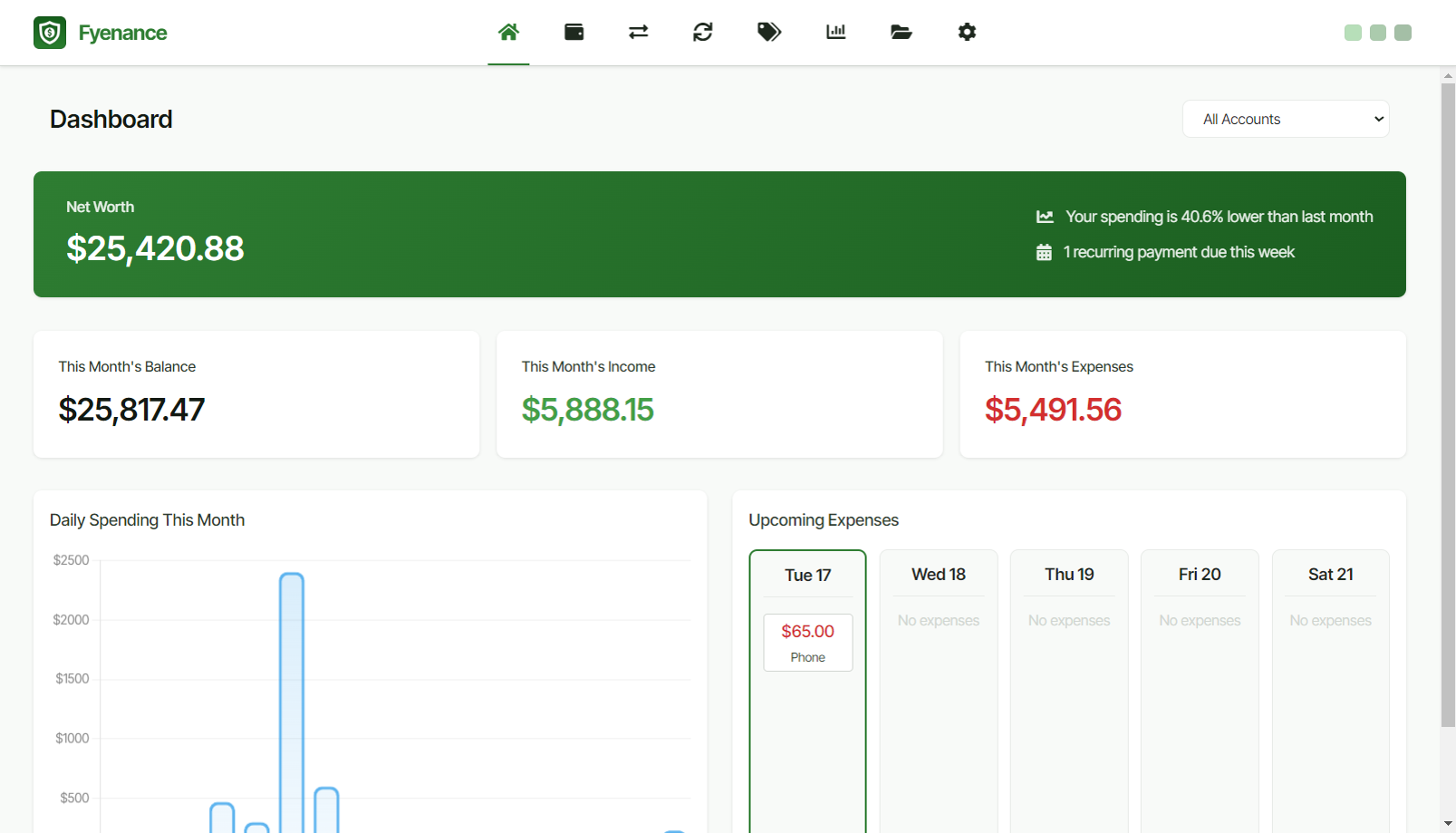

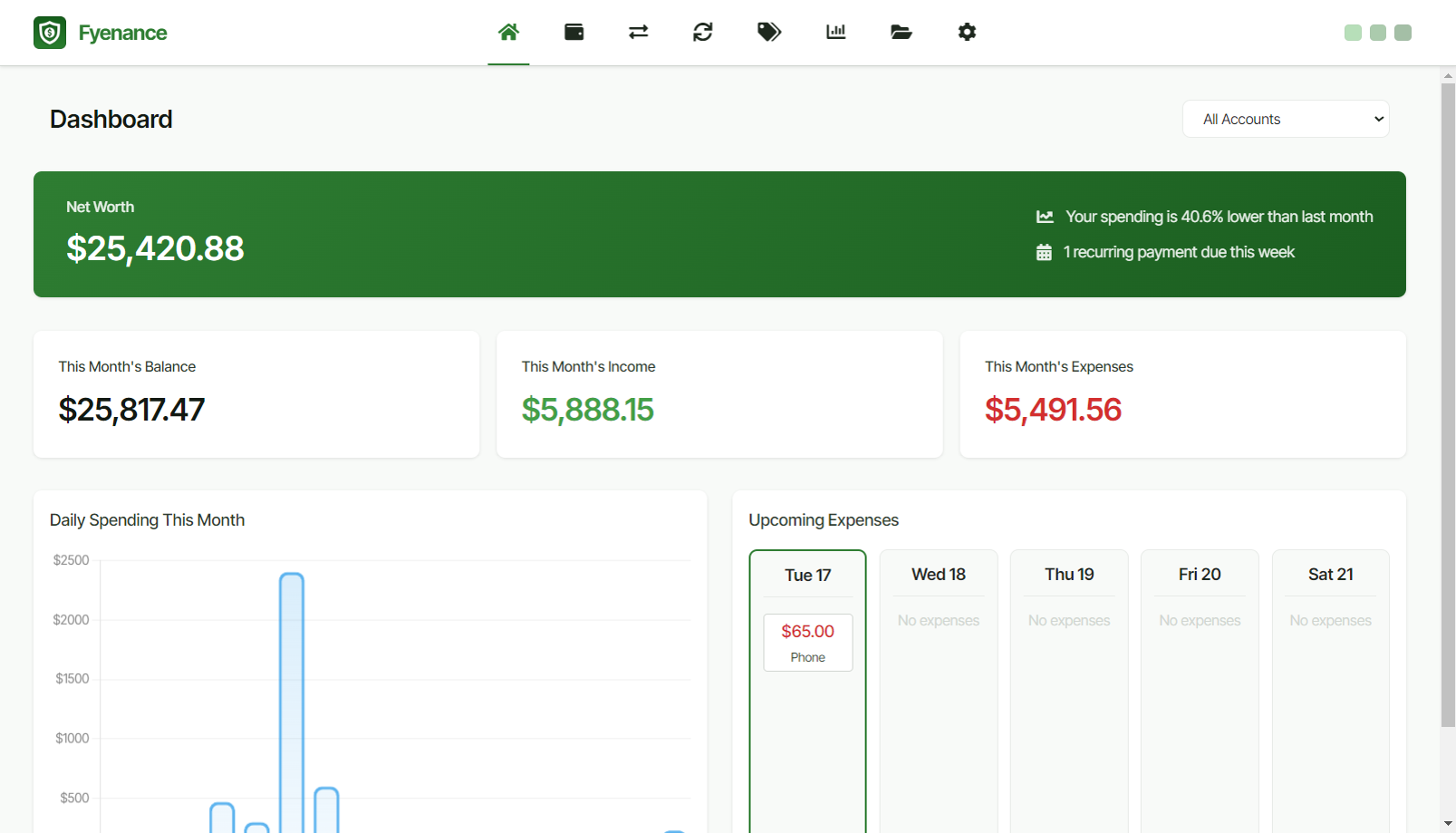

Fyenance

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the Consumer Finance industry in Norway, several key considerations emerge. The regulatory landscape is crucial, as Norway adheres to strict financial regulations set by the Financial Supervisory Authority, ensuring transparency and consumer protection. This regulatory framework influences lending practices and compliance requirements, making it essential for companies to stay updated on any changes. Additionally, the competitive landscape is characterized by a blend of traditional banks and new fintech players, which creates both challenges and opportunities in terms of innovation and customer engagement. Environmental concerns are increasingly relevant, as consumers are becoming more aware of sustainable finance options and ethical lending practices, pushing companies to adopt greener policies. Moreover, the rise of digital banking and mobile payment solutions presents significant growth potential, especially as consumer preferences shift towards convenience and accessibility. It's also important to consider the global market relevance, as Norway's stable economy and high standard of living attract foreign investments, influencing local financial services. Overall, understanding these factors will provide valuable insights for anyone interested in navigating the Consumer Finance sector in Norway.

Some interesting numbers and facts about your company results for Consumer Finance

| Country with most fitting companies | Norway |

| Amount of fitting manufacturers | 7 |

| Amount of suitable service providers | 6 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 1983 |

| Youngest suiting company | 2021 |

Some interesting questions that has been asked about the results you have just received for Consumer Finance

What are related technologies to Consumer Finance?

Based on our calculations related technologies to Consumer Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Who are Start-Ups in the field of Consumer Finance?

Start-Ups who are working in Consumer Finance are Viridis Kapital

Which industries are mostly working on Consumer Finance?

The most represented industries which are working in Consumer Finance are Finance and Insurance, IT, Software and Services, Other, Real Estate

How does ensun find these Consumer Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.