The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Capital Financial Solutions LLC.

Olympia, United States

B

11-50 Employees

2008

Key takeaway

Capital Financial specializes in consumer finance, offering innovative financing solutions tailored to meet the needs of both prime and non-prime credit customers. Their "second look financing" program is particularly beneficial for healthcare providers, enhancing access to quality credit financing for patients seeking services like LASIK, dental care, and cosmetic procedures.

Reference

Core business

Patient Financing | Payment Processing | Everyone's Approved | Dental Financing

We partner with some of the nation’s leading healthcare organizations and provide exceptional in-office and online financing programs to non-prime consumers through our “second look financing” solution.

ConsumerDirect

Irvine, United States

B

11-50 Employees

2003

Key takeaway

ConsumerDirect® focuses on empowering consumers to manage their financial health through innovative technologies. They offer a range of services including credit scores, reports, and fraud insurance, aiming to enhance financial literacy and privacy.

Reference

Core business

ConsumerDirect, Inc® | The People First Financial Platform®

Rate Reset

McLean, United States

B

1-10 Employees

2008

Key takeaway

FINOFR is dedicated to simplifying the loan process through its digital lending platform, which provides consumers with instant, self-serve financial offers. Their mission is to ensure equal access to financial opportunities, empowering individuals to achieve their dreams with easy-to-understand and personalized financial solutions.

Reference

Core business

Welcome | HOME

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Genesis Financial Solutions

Beaverton, United States

B

251-500 Employees

2001

Key takeaway

Concora Credit specializes in providing access to consumer finance, particularly for non-prime consumers, through flexible credit solutions and partnerships with retailers and healthcare providers. Their commitment to transparency and exceptional service ensures that customers can easily access the financing they need.

Reference

Core business

Genesis Financial Solutions | Home

FairFinCare LLC

Dover, United States

B

11-50 Employees

2020

Key takeaway

FFC connects clients with leading financial service providers, offering a comprehensive experience to help achieve financial goals. Their seasoned experts analyze individual needs and provide detailed information on services and pricing from various institutions, emphasizing a commitment to confidentiality and informed decision-making.

Reference

Core business

FFC

FINANCIAL SERVICES

Encina Lender Finance LLC

Atlanta, United States

B

11-50 Employees

2020

Key takeaway

Encina Lender Finance provides a variety of financing options, including revolving lines of credit and term loans, specifically targeting consumer lending among other asset classes.

Reference

Core business

Encina Lender Finance | A Specialty Finance Company

Freedom Financial Network

United States

B

1001-5000 Employees

2002

Key takeaway

Freedom Financial Network is dedicated to helping individuals improve their finances and make informed decisions. They offer loans ranging from $5,000 to $50,000, emphasizing their commitment to empowering everyday Americans toward a better financial future.

Reference

Core business

Consumer Debt Help Leader | Freedom Financial Network

FINCA Impact Finance

Washington, United States

B

5001-10000 Employees

1984

Key takeaway

The company focuses on empowering individuals to take control of their financial futures through accessible and flexible financial products, which are essential for achieving financial health. By leveraging technology and streamlining processes, they aim to provide tailored credit and savings solutions, particularly for low-income entrepreneurs and small businesses.

Reference

Core business

Lenders - FINCA Microfinance Global Services LLC

Financial Partners FINCA is supported by over 50 diverse financial partners across the globe, including impact investment funds, microfinance investment vehicles, national and supranational development institutions, and multinational commercial banks.

Fidelity Finance Loan

United States

B

1-10 Employees

-

Key takeaway

The company specializes in addressing clients' financing needs, offering a range of solutions through partnerships with national lenders.

Reference

Core business

Fidelity Finance Loan

Commercial Finance Partners

Boca Raton, United States

B

1-10 Employees

2012

Key takeaway

Commercial Finance Partners specializes in providing flexible financing solutions for small to middle-market companies, including accounts receivable financing, SBA loans, and asset-based loans. Their expertise in non-bank financing helps businesses navigate the funding landscape effectively.

Reference

Core business

Commercial Finance & Business Lending | Commercial Finance Partners

Tired of trying to get a bank loan? Let Commercial Finance Partners, a Commercial Lender, meet your Commercial Finance & Business Lending needs today, with Fast Funding!

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

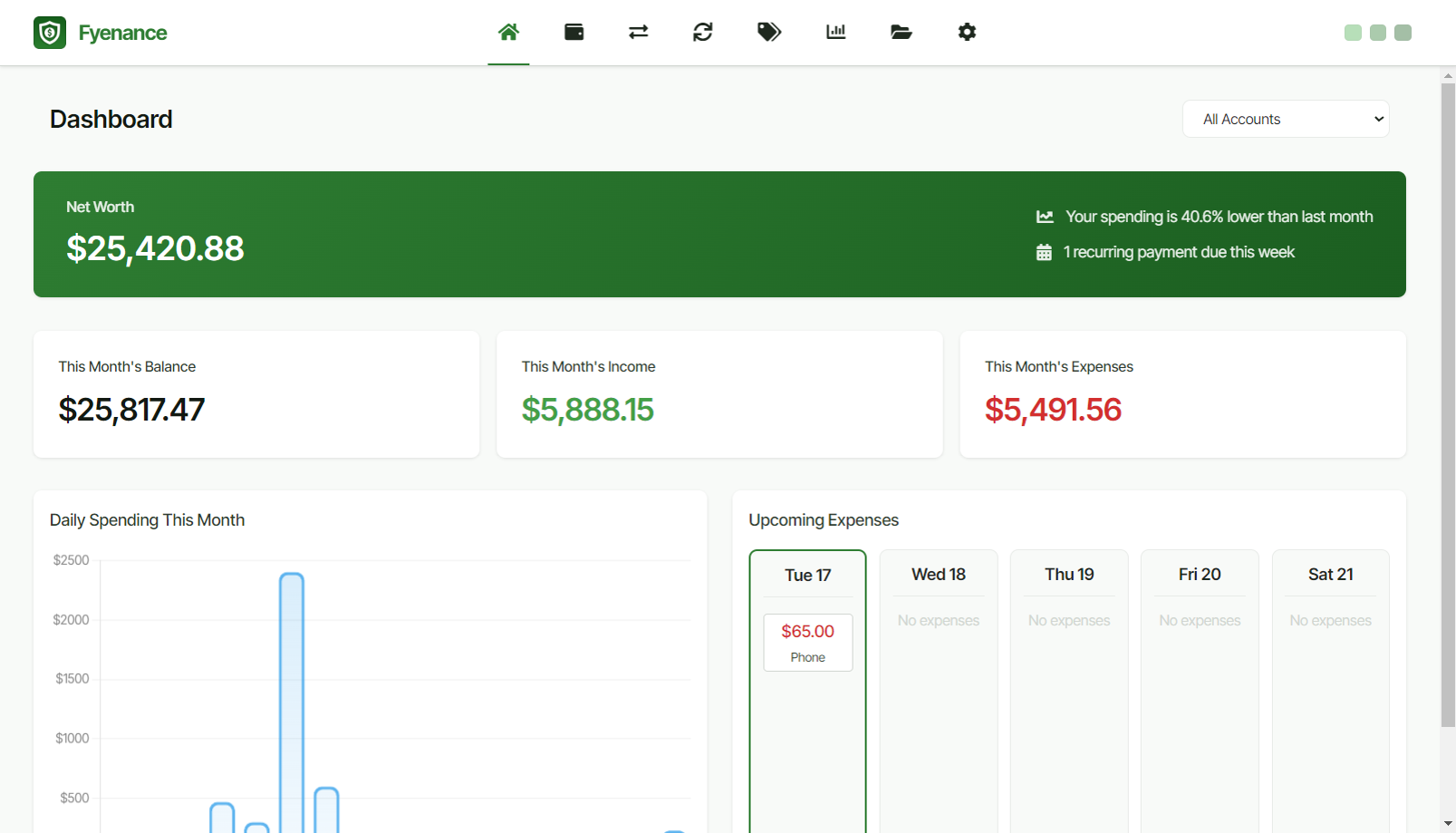

Fyenance

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the Consumer Finance industry in the United States, several key considerations are essential. Regulations play a critical role, as this sector is heavily governed by federal and state laws, including the Truth in Lending Act and the Fair Credit Reporting Act, which aim to protect consumers from predatory practices. Understanding compliance requirements is crucial for companies operating in this space. The competitive landscape is marked by traditional banks, credit unions, and emerging fintech companies, all vying for market share. Innovations in technology, such as mobile payments and artificial intelligence, present significant opportunities for growth and efficiency. Challenges include managing credit risk and adapting to changing consumer behavior, particularly in a post-pandemic environment where digital transformation has accelerated. Environmental concerns are becoming increasingly relevant, with a growing emphasis on sustainable finance and the impact of lending practices on social issues. Additionally, the global market relevance of consumer finance is noteworthy, as U.S. companies often look to expand internationally, navigating different regulatory frameworks and cultural norms. Thus, an in-depth understanding of these factors is vital for anyone interested in the Consumer Finance industry in the United States.

Some interesting numbers and facts about your company results for Consumer Finance

| Country with most fitting companies | United States |

| Amount of fitting manufacturers | 2344 |

| Amount of suitable service providers | 3058 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 1984 |

| Youngest suiting company | 2020 |

Some interesting questions that has been asked about the results you have just received for Consumer Finance

What are related technologies to Consumer Finance?

Based on our calculations related technologies to Consumer Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Consumer Finance?

The most represented industries which are working in Consumer Finance are Finance and Insurance, Other, IT, Software and Services, Real Estate, Consulting

How does ensun find these Consumer Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.