The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Finiata

Berlin, Germany

A

101-250 Employees

2016

Key takeaway

Finiata offers a platform that provides tailored credit solutions for various working capital needs, enabling businesses to enhance their financial offerings. Their system simplifies business lending, allowing for quick fund disbursement and integration with customer transaction data to facilitate better credit decisions.

Reference

Core business

Finiata - we simplify business lending

Grow your sales by providing financing to your B2B customers

LGFinance

Emsdetten, Germany

A

1-10 Employees

-

Key takeaway

LGFinance offers a comprehensive credit management module that meets all criteria for approval, utilizing current variable interest rates and providing daily automated revaluation of portfolios. The company, located in Emsdetten, combines municipal practice with financing sector experience to develop its platform tailored to the specific needs of community associations.

Reference

Core business

LGFinance

financial.com

Munich, Germany

A

51-100 Employees

-

Key takeaway

Financial.com offers a wealth management desktop that enables advisors to deliver expert advice and global investment strategies efficiently. Their active trader application integrates LSEG market data with trading functionality, enhancing the workflow for financial professionals.

Reference

Core business

Company - financial.com

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Verband deutscher Kreditplattformen

Berlin, Germany

A

1-10 Employees

2019

Key takeaway

The company is dedicated to enhancing access to alternative debt capital for consumers and businesses through digital financing and investment initiatives. Their commitment to transparency and industry standards further supports their goal of fostering trust in the financial ecosystem.

Reference

Core business

About – Fintech Lenders

Colombo Finance Consulting GmbH i. L.

Brunswick, Germany

A

1-10 Employees

-

Key takeaway

The company, Colombo Finance, specializes in consumer finance by providing expert advice and tailored financial solutions to help clients optimize their assets, manage investments, and achieve their financial goals. Their online financing process ensures quick access to funds, with a commitment to transparency and customer satisfaction throughout the service.

Reference

Core business

Le financement 100% en Ligne – Réponse en 24h | COLOMBO FINANCE

finanziat GmbH

Cologne, Germany

A

1-10 Employees

-

Key takeaway

finanziat specializes in franchise establishments, aiming to connect you with the right partners to meet your unique needs. They emphasize that overcoming the crucial hurdle of "financing" is essential for success.

Reference

Service

SERVICE | finanziatmme

ndgit

Munich, Germany

A

11-50 Employees

2016

Key takeaway

ndgit is a leading middleware platform for financial service providers, actively promoting the development and distribution of Open Banking-based products through its innovative API solutions. This focus on integrating financial services into the digital customer journey aligns with the growing trend in consumer finance.

Reference

Product

ndgit: Open Finance Solutions

Fiduciam Deutschland

Frankfurt, Germany

A

1-10 Employees

2014

Key takeaway

Fiduciam specializes in secured lending to SMEs, highlighting its ability to successfully complete complex transactions. Unlike traditional banks, Fiduciam streamlines the loan application process, which may be particularly relevant for businesses seeking efficient financing solutions.

Reference

Core business

Fiduciam – Secured lending to SMEs

Financialytic GmbH

Bonn, Germany

A

1-10 Employees

-

Key takeaway

Financialytic GmbH specializes in providing analytics and consulting services to the finance industry, focusing on areas such as Risk Management and Credit Risk Modelling. Their extensive experience and commitment to knowledge transfer have equipped over 500 finance professionals with advanced skills in quantitative finance, making them a valuable resource for consumer finance insights.

Reference

Core business

Main - Fiancialytic: Consulting - Analytics - Insight

Financialytic uniquely combines the latest expertise in quantitative methods with multi-year industry experience at top-tier financial institutions.

CrossLend

Berlin, Germany

A

101-250 Employees

2014

Key takeaway

CrossLend is actively transforming Europe's lending and investment ecosystem, which directly relates to consumer finance by facilitating capital flow and offering innovative solutions for digital lending. Their focus on streamlining these processes is essential for enhancing access to finance for individuals and companies alike.

Reference

Core business

Company - CrossLend Platform

Building the European Capital Markets Union Rewiring the investment & lending ecosystem Who we are

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

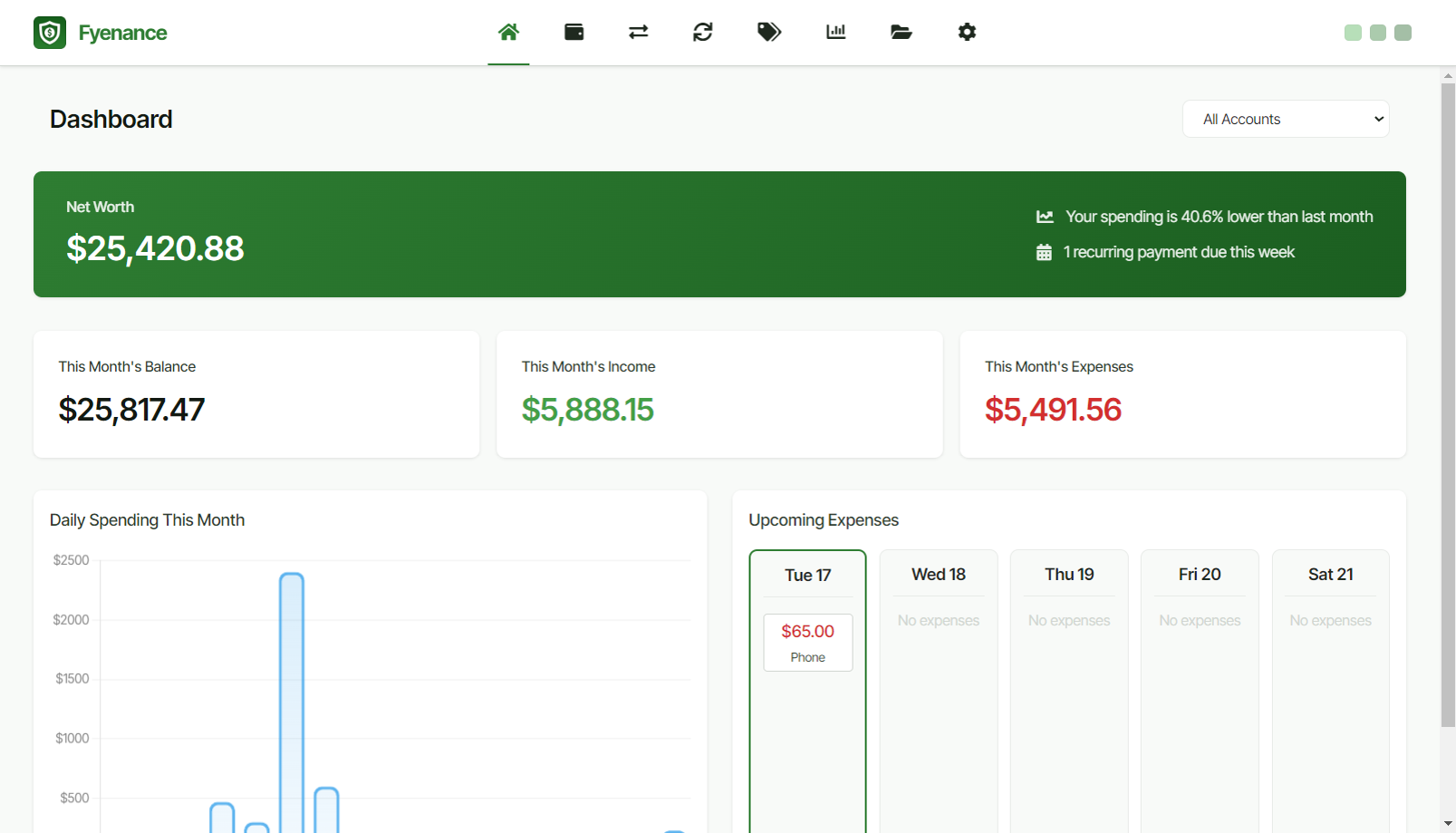

Fyenance

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the Consumer Finance industry in Germany, several key considerations must be taken into account. First, regulations play a crucial role, with authorities like the Federal Financial Supervisory Authority (BaFin) overseeing compliance and consumer protection laws. Understanding these regulations is essential for navigating the market effectively. Challenges such as increasing competition, especially from fintech startups, require traditional institutions to innovate and enhance customer experiences. Opportunities exist in the growing demand for digital financial services, particularly among younger consumers who prefer online banking solutions. Environmental concerns are increasingly relevant, as consumers and companies alike focus on sustainability. This shift influences investment strategies and product offerings. The competitive landscape is characterized by a mixture of established banks and new entrants, prompting a need for differentiation through technology and customer service. Additionally, Germany's position as a leading economy in Europe offers global market relevance, making it imperative for companies to adapt to international trends while catering to local consumer preferences. Overall, understanding these dynamics can provide valuable insights for anyone interested in entering or investing in the Consumer Finance sector in Germany.

Some interesting numbers and facts about your company results for Consumer Finance

| Country with most fitting companies | Germany |

| Amount of fitting manufacturers | 187 |

| Amount of suitable service providers | 332 |

| Average amount of employees | 1-10 |

| Oldest suiting company | 2014 |

| Youngest suiting company | 2019 |

Some interesting questions that has been asked about the results you have just received for Consumer Finance

What are related technologies to Consumer Finance?

Based on our calculations related technologies to Consumer Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Consumer Finance?

The most represented industries which are working in Consumer Finance are Finance and Insurance, Other, IT, Software and Services, Consulting, Real Estate

How does ensun find these Consumer Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.