The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

TCG Finance Ltd (Trade Finance & Equity Fund)

Mexico

D

51-100 Employees

1997

Key takeaway

TCG Finance is a financial services company that has been supporting middle-market companies with diverse financing solutions since 1997. They specialize in structuring international financing and providing investment banking services, which are crucial for businesses seeking to raise equity and access various forms of capital in Mexico and Latin America.

Reference

Product

Products | TCG Finance LTD

FINANCIALMERC SA DE CV

Mexico

D

11-50 Employees

2011

Key takeaway

Financialmerc specializes in consumer finance by providing innovative software that allows companies to quickly assess their clients' credit histories and determine credit eligibility in under a minute. With over 10 years of experience, they support businesses in efficiently implementing and managing credit bureaus within their operations.

Reference

Core business

Financialmerc

Finamo

Culiacán Rosales, Mexico

D

1-10 Employees

-

Key takeaway

Fínamo is a Mexican FinTech with over 10 years of experience in the consumer finance sector, providing specialized credit solutions that enhance liquidity for small and medium-sized enterprises (SMEs).

Reference

Core business

Fínamo | Home

La FinTech mexicana que impulsa el crecimiento de las Pymes con soluciones crediticias que les otorgan liquidez de forma fácil y ágil.

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Finvero

Mexico

D

11-50 Employees

2021

Key takeaway

The company offers financial solutions designed to enhance personal finance management, helping users find the best scoring model for their needs. Their platform facilitates quick and secure transactions, allowing for investment in high-yield opportunities and promoting innovative credit offerings.

Reference

Core business

finvero Vende a crédito sin tarjeta y aumenta tus ventas

Hay que ayudar a nuestros usuarios con sus finanzas personales… la nueva venta empieza por dar servicio

Volkswagen Financial Services - México

Puebla City, Mexico

D

251-500 Employees

1973

Key takeaway

Volkswagen Financial Services offers products and services designed to help you grow your wealth. They provide easy management of your contracted products, allowing you to access and resolve any issues conveniently.

Reference

Core business

Volkswagen Financial Services

Creditas México

Mexico

D

1001-5000 Employees

2012

Key takeaway

Creditas is a leading Brazilian fintech specializing in secured loans, offering amounts ranging from R$ 5,000 to R$ 3 million with competitive interest rates starting at 1.09% per month plus IPCA.

Reference

Core business

Creditas – The Leading Brazilian Fintech in Secured Loans

The largest fintech for secured loans in Brazil.

Fairplay

Mexico

D

11-50 Employees

2019

Key takeaway

Fairplay is a financial ally for growing businesses, specializing in providing flexible and rapid financing for e-commerce. Their platform supports online business growth by offering the capital needed to take ventures to the next level.

Reference

Core business

Fairplay | Financiamiento para Ecommerce

Obtén el capital que necesitas para hacer crecer tu negocio en línea. Financiamiento para Ecommerce flexible y rápido. Solicita tu crédito hoy.

Bancorp

Mérida, Mexico

D

11-50 Employees

2008

Key takeaway

Mission Loans specializes in consumer finance by offering a range of loan products that allow homeowners to turn their home equity into cash. With a commitment to a customer-centric approach, they provide refinancing options without lender fees for life, making it easier for clients to achieve their financial goals.

Reference

Core business

Home - Mission Loans

We are your home equity experts! Turn your home’s equity into cash Check Your Home’s […]

Fundary

Mexico

D

11-50 Employees

2016

Key takeaway

The company has received unanimous approval from regulatory authorities to operate as the first crowdfunding institution in Mexico, highlighting its capability to provide tailored financing solutions, including the option to request loans of up to 10 million pesos.

Reference

Core business

Inicio - Fundary

FINANCIAMIENTO E INVERSIÓN A TU MEDIDA Hemos recibido la aprobación de la CNBV, la SHCP y BANXICO de forma unánime, sin salvedades y publicada en el Diario Oficial de la Federación para operar como la primera Institución de Financiamiento Colectivo en México. SOLICITA UN CRÉDITO ¡Solicita hasta 10 millones de pesos! Pre aprobación en 5

FORT Capital Resources

Mexico

D

1-10 Employees

-

Key takeaway

The company specializes in providing commercial financing solutions, particularly focusing on specific sectors such as Core IT, Data Centers, Medical, and more. Their approach emphasizes transparency and a seamless integration of financing options into the buying process, which can be beneficial for consumer finance needs.

Reference

Core business

FORT CAPITAL RESOURCES

We bring together finance, sales, operations, and accounting on one platform to make financing your customer transactions seamless, transparent, and fast. FORT’s platform integrates financing options into the buying flow, impacting all of your business functions, from the board/executive level to ac

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

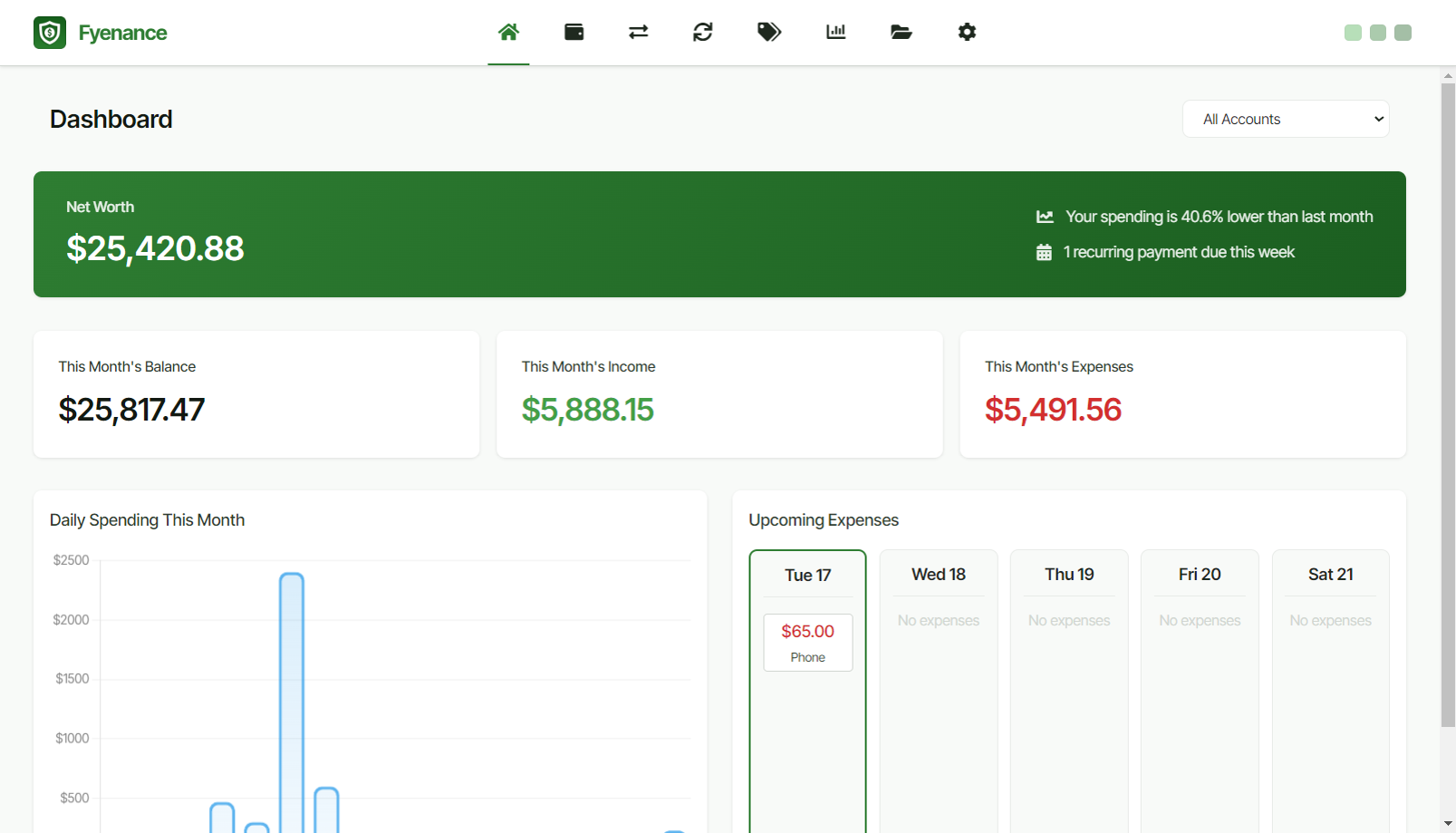

Fyenance

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the Consumer Finance industry in Mexico, several key considerations are essential. Regulatory frameworks significantly influence operations; the Comisión Nacional Bancaria y de Valores (CNBV) oversees financial institutions, ensuring compliance with laws designed to protect consumers and maintain market stability. Understanding these regulations is crucial for any potential investor or company. The industry faces challenges such as high levels of informality and a large unbanked population, which present both obstacles and opportunities. Leveraging technology and fintech innovations can help bridge these gaps, providing services to underserved segments. The competitive landscape is evolving, with traditional banks competing alongside emerging fintech companies. This dynamic creates a vibrant market with diverse offerings, but it also increases competition for customer loyalty. Environmental concerns are becoming more pertinent as consumers and regulators alike demand sustainable practices in financial services. Additionally, the global market relevance is notable; as Mexico integrates more with international financial markets, understanding global economic trends and their impact on local consumer behavior becomes vital. Keeping these factors in mind will help individuals and companies make informed decisions when navigating the consumer finance sector in Mexico.

Some interesting numbers and facts about your company results for Consumer Finance

| Country with most fitting companies | Mexico |

| Amount of fitting manufacturers | 7 |

| Amount of suitable service providers | 4 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 1973 |

| Youngest suiting company | 2021 |

Some interesting questions that has been asked about the results you have just received for Consumer Finance

What are related technologies to Consumer Finance?

Based on our calculations related technologies to Consumer Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Who are Start-Ups in the field of Consumer Finance?

Start-Ups who are working in Consumer Finance are Finvero

Which industries are mostly working on Consumer Finance?

The most represented industries which are working in Consumer Finance are Finance and Insurance, Other, IT, Software and Services, Consulting, Judiciary

How does ensun find these Consumer Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.