The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Capital C Corporation

Singapore

C

51-100 Employees

-

Key takeaway

Capital C Corporation offers a variety of financial solutions for both SMEs and individuals, including business loans and payday loans. The company leverages fintech and emerging technologies to provide comprehensive financial services, particularly targeting the under-served markets in Singapore and Southeast Asia.

Reference

Core business

Capital C | Fintech Company Empowering Growth for Modern Finance

SG Cash Pte Ltd

Singapore

C

11-50 Employees

2011

Key takeaway

SG Cash specializes in providing short-term financial bridging facilities for Small and Medium Enterprises (SMEs) in Singapore, helping them manage cash flow gaps and seize business opportunities. Their commitment to innovative financing solutions enables businesses to overcome capital challenges and support growth.

Reference

Core business

SG CASH – A licensed corporate lending company

Boost Capital

Singapore

C

11-50 Employees

2019

Key takeaway

Boost Capital offers a platform that facilitates loans and financial services through innovative smartphone technology, enhancing customer satisfaction while reducing operating costs.

Reference

Core business

Boost Capital – Fair financial services

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Incomlend

Singapore

C

51-100 Employees

2016

Key takeaway

Incomlend specializes in providing working capital solutions to SMEs through its global invoice financing marketplace, enabling them to access funds quickly and improve cash flow. With a focus on supply chain financing, Incomlend offers a flexible and reliable alternative for businesses looking to enhance their payment terms and mitigate funding risks.

Reference

Core business

Incomlend Invoice Financing Marketplace

Are you an exporter or an importer? Convert your invoices into cash on Incomlend invoice financing marketplace

b.Smart

Singapore

C

11-50 Employees

2019

Key takeaway

b.Smart is a trusted partner for local SMEs seeking consumer finance, offering a straightforward and transparent approach to accessing funding. With over 20 years of experience, they provide unlimited loan applications for a flat fee, prioritizing the business interests of their clients.

Reference

Core business

YOUR TRUSTEDPARTNER FOR BUSINESS LOANS

IFS CAPITAL LIMITED

Singapore

C

51-100 Employees

1987

Key takeaway

IFS Capital Limited is a regional provider of commercial financing services, including consumer loans through its subsidiary Friday Finance, which emphasizes financial wellness and transparent pricing. Their mission is to ensure that creditworthy individuals have access to affordable capital solutions.

Reference

Core business

About Us — IFS Capital Limited - Financing SMEs Since 1987

Finmo

Singapore

C

11-50 Employees

2021

Key takeaway

Finmo is a fintech platform that simplifies payments and enhances consumer finance by offering real-time payment processing, instant money transfers, and effective cash flow management. Their focus on optimizing transaction methods for speed, convenience, and cost empowers both businesses and consumers to manage their finances more effectively.

Reference

Core business

Finmo | Beyond Payments: New API-Based Treasury Operating System

Finmo is a fintech platform that focuses on providing online payment processing and payment gateway. We aim to empower businesses and consumers to transact with only the most relevant methods that optimise for speed, convenience and cost.

Nufin Data

Singapore

C

11-50 Employees

2017

Key takeaway

Nufin Data specializes in supply chain financing, offering a proprietary platform called NEMO that facilitates quick access to various working capital options. This focus on efficient financing solutions is particularly beneficial for small and medium-sized enterprises and corporate clients.

Reference

Core business

Nufin Data - Supply Chain Financing Platform

Contemi Solutions

Singapore

C

251-500 Employees

2001

Key takeaway

Contemi Solutions is a trusted technology provider that enables financial services, including banking and asset management, to succeed in the digital age. Their expertise in digitalization and solutions for banking and capital markets is particularly relevant to the consumer finance sector.

Reference

Core business

Enabling Financial Services Digitalization | Contemi Solutions

Contemi, a trusted technology solutions company in Asia, UK, Europe, ANZ, enables banks, insurers, brokers, MGAs, asset & wealth managers & other financial service providers to succeed in the digital age.

GoBear

Singapore

C

101-250 Employees

2014

Key takeaway

Finder provides a platform for comparing various financial products, including credit cards, mortgages, and personal loans, helping consumers make informed financial decisions. Their focus on top deals and exclusive offers can assist individuals in managing their finances more effectively.

Reference

Core business

finder.com – Countless comparisons to help you make better decisions

Compare credit cards, mortgages, money transfers, personal loans, small business loans, and other financial tools and products.

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

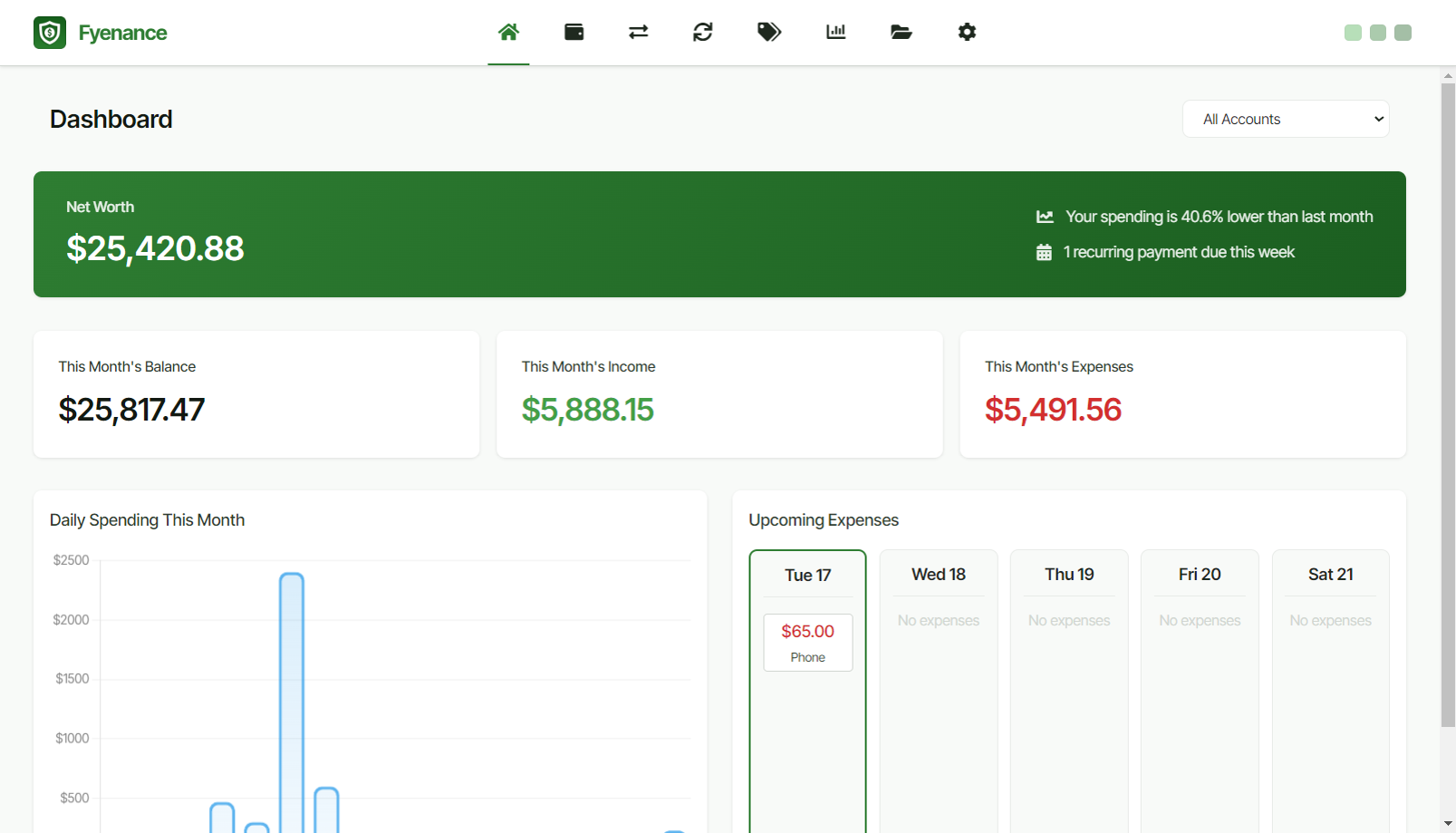

Fyenance

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the Consumer Finance industry in Singapore, several key considerations are crucial for informed decision-making. The regulatory framework is a primary factor, as the Monetary Authority of Singapore (MAS) oversees financial institutions to ensure compliance with stringent standards. This includes understanding licensing requirements and consumer protection laws. Moreover, the competitive landscape is intense, with both traditional banks and fintech companies vying for market share, making it essential to evaluate the unique value propositions of different players. Understanding consumer behavior is also vital, as preferences for digital solutions are rising, particularly among younger demographics. This shift presents opportunities for innovation in product offerings, such as personal loans, credit cards, and digital payment solutions. However, challenges such as data privacy concerns and economic fluctuations may impact the industry’s growth trajectory. Environmental concerns are increasingly relevant, as companies are urged to adopt sustainable practices and address climate change impacts within their financial products. Lastly, the global market relevance of Singapore as a financial hub means that local companies often engage with international markets. This interconnectedness can lead to both opportunities for expansion and challenges in navigating foreign regulations. Overall, a comprehensive understanding of these factors will provide valuable insights for anyone interested in the Consumer Finance industry in Singapore.

Some interesting numbers and facts about your company results for Consumer Finance

| Country with most fitting companies | Singapore |

| Amount of fitting manufacturers | 45 |

| Amount of suitable service providers | 41 |

| Average amount of employees | 51-100 |

| Oldest suiting company | 1987 |

| Youngest suiting company | 2021 |

Some interesting questions that has been asked about the results you have just received for Consumer Finance

What are related technologies to Consumer Finance?

Based on our calculations related technologies to Consumer Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Who are Start-Ups in the field of Consumer Finance?

Start-Ups who are working in Consumer Finance are Finmo

Which industries are mostly working on Consumer Finance?

The most represented industries which are working in Consumer Finance are Finance and Insurance, IT, Software and Services, Consulting, Other, Education

How does ensun find these Consumer Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.