The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

D+H

Canada

A

1001-5000 Employees

1875

Key takeaway

Finastra provides a comprehensive portfolio of end-to-end lending solutions, including consumer lending, which enhances the digital borrower experience and streamlines operations. Their approach ensures that businesses and consumers have access to efficient and transparent lending processes.

Reference

Product

Finastra Embedded Consumer Lending | Finastra

ECN Capital

Canada

A

51-100 Employees

2007

Key takeaway

The company provides secured consumer loans and credit card portfolios through its key businesses, including Triad Financial Services and Source One Financial Services.

Reference

Core business

Home - ECN Capital

Finjoy Capital

Vancouver, Canada

A

11-50 Employees

2018

Key takeaway

Finjoy addresses the lack of access to affordable personal loans by providing a user-friendly platform that allows customers to quickly find and apply for financial solutions. Utilizing technology and data analysis, Finjoy enhances the borrowing experience and aims to improve financial health, making it easier for individuals to achieve their financial goals.

Reference

Core business

About Us | Finjoy Capital – Making More Possible

Getting a loan should be simple, so we've made it simple. Find out how it works so you can make a great financial decision on your next personal loan!

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Business Financial Mortgage Corp

Canada

A

1-10 Employees

2018

Key takeaway

Business Financial is a licensed mortgage brokerage that has funded over $1 billion, indicating its expertise in providing capital solutions for business owners.

Reference

Core business

Home - Business Financial Mortgage Corp.

Current Financial Corp

Edmonton, Canada

A

1-10 Employees

-

Key takeaway

Current Financial specializes in providing innovative lending solutions and flexible equipment financing options for various industries, making it an ideal partner for businesses seeking to grow and succeed. With access to substantial capital, they can offer funding of up to $2.5 million and beyond, tailored to meet the specific needs of their clients.

Reference

Core business

Current Financial Corp | Financing Solutions For Your Business

Current Financial is your first choice when it comes to flexible equipment financing and capital solutions for your business.

Financeit

Canada

A

251-500 Employees

2007

Key takeaway

Financeit specializes in consumer financing, providing simple and flexible solutions that help businesses increase sales by making it easier for customers to access the funds they need.

Reference

Core business

Offer consumer financing for your customers | Financeit

From consumer financing to workflow integration, Financeit is the end-to-end solution that helps your business boost its sales. Sign up FREE today!

Financial Modeling Case Competition & World Championships

Vancouver, Canada

A

11-50 Employees

-

Key takeaway

The Corporate Finance Institute (CFI) focuses on enhancing the skills and productivity of finance and banking professionals through practical training and resources. CFI offers a wide range of on-demand courses and certifications, making it a valuable resource for individuals looking to advance their careers in consumer finance.

Reference

Core business

Corporate Finance Institute

Advance your career in finance & banking with CFI's accredited online courses & certifications — trusted by millions of professionals & firms worldwide.

CashCash Inc.

Brampton, Canada

A

1-10 Employees

2018

Key takeaway

CashCash Inc. is committed to making finance accessible, affordable, and user-friendly for everyone, highlighting their expertise in innovative financial solutions and FinTech. Their dedicated team focuses on tailoring experiences to meet diverse financial needs.

Reference

Core business

CashCash Inc

We make technology accessible!

Lm Financial Services

Mississauga, Canada

A

11-50 Employees

-

Key takeaway

LM Financial Inc. is an alternative lender that specializes in non-traditional home equity loans, providing diverse lending solutions to Canadians. With over 10 years of experience, the company focuses on helping individuals consolidate debt and access financing, particularly for those with equity in their homes.

Reference

Core business

Company Overview - LM Financial Services

National loan provider and finance expertsLM Financial Inc. provides lending solutions and financial strategies to people across Canada. Whether you are trying to consolidate bad debt or you need money for a significant time in your life; if you have equity in your home LM Financial Inc. is there for you.With a well-defined and proven

Fair Capital Partners

Vancouver, Canada

A

1-10 Employees

-

Key takeaway

FairCap is a prominent alternative lender specializing in private debt and direct lending, particularly in the lower to middle market in North America. They actively seek to provide flexible debt capital solutions for borrowers, positioning themselves as a key player in the consumer finance sector.

Reference

Core business

Home | Fair Capital Partners

Fair Capital Partners ("FairCap") is a leading Canadian alternative asset manager focused on North American direct lending private debt opportunities.

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

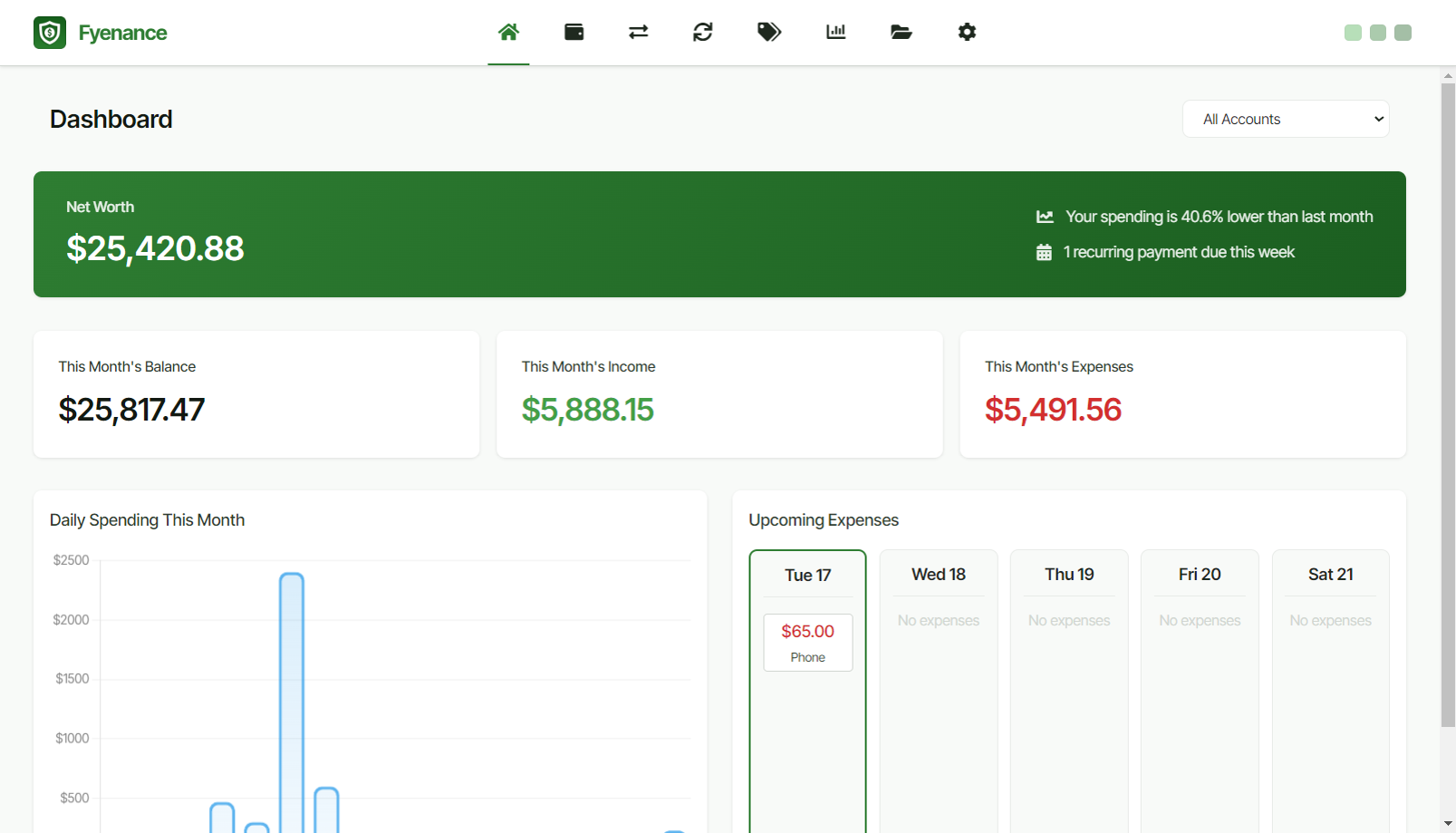

Fyenance

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

The Consumer Finance industry in Canada is shaped by several key considerations that potential entrants should be aware of. Regulatory compliance is crucial, as the industry is governed by both federal and provincial laws, including the Bank Act and the Consumer Protection Act. Understanding the impact of these regulations on lending practices, interest rates, and consumer rights is essential. Challenges such as increasing competition from fintech companies and traditional banks have created a dynamic landscape. These competitors leverage technology to enhance customer experiences and streamline operations. Opportunities exist in niche markets, such as underserved populations and innovative financial products tailored to specific needs. Environmental concerns are becoming more prominent, with consumers increasingly favoring companies that demonstrate sustainability and social responsibility. This trend can influence product offerings and marketing strategies. Additionally, the global market relevance of Canadian consumer finance is significant, especially as Canadian firms explore expansion into emerging markets where financial access is limited. Investors and stakeholders should also monitor economic indicators, changes in consumer behavior, and technological advancements that could impact market dynamics. Overall, a comprehensive understanding of these factors will aid in making informed decisions within the Canadian Consumer Finance sector.

Some interesting numbers and facts about your company results for Consumer Finance

| Country with most fitting companies | Canada |

| Amount of fitting manufacturers | 262 |

| Amount of suitable service providers | 379 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 1875 |

| Youngest suiting company | 2018 |

Some interesting questions that has been asked about the results you have just received for Consumer Finance

What are related technologies to Consumer Finance?

Based on our calculations related technologies to Consumer Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Consumer Finance?

The most represented industries which are working in Consumer Finance are Finance and Insurance, Other, IT, Software and Services, Real Estate, Automotive

How does ensun find these Consumer Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.