The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

QisstPay

Islamabad, Pakistan

E

51-100 Employees

2020

Key takeaway

The company specializes in consumer finance by offering a range of loan products, including personal and business loans, designed to provide quick and transparent access to funds. Their platform streamlines the lending process, enhancing operational efficiency and supporting financial inclusion for unbanked communities.

Reference

Core business

QisstPay - A secured borrowing platform for customer and business

Operating in two countries as a leading lending enabler, creating financial inclusion through loans.

Finja

Lahore, Pakistan

E

101-250 Employees

2016

Key takeaway

Finja is a financial services platform that addresses the payment, collection, and credit needs of professionals, merchants, and SMEs. With a focus on the underbanked segment, Finja utilizes AI and data-driven methods to offer innovative lending and payment products, facilitating seamless financial solutions.

Reference

Core business

Finja

FFO Support Program-(FFOSP)

Sheikhupura, Pakistan

E

251-500 Employees

2016

Key takeaway

FFO Support Program (FFOSP) is a rapidly growing Non-Banking Micro Finance Company in Pakistan, offering appraisal-backed individual and group lending, with a strong focus on financial inclusion and support for women micro-entrepreneurs. Their services extend beyond traditional finance, incorporating insurance, capacity building, and social sector initiatives to create a transformative impact at the household level.

Reference

Core business

FFO – Support Program

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Al-Mawakhat Microfinance - AMCL

Lahore, Pakistan

E

11-50 Employees

2022

Key takeaway

Al-Mawakhat is a Non-Banking Micro Finance Company that offers product-based financial assistance to support the economic development of the country. They provide interest-free services and low-cost monthly installments, making it easier for individuals to acquire the necessary tools to grow their businesses.

Reference

Product

Our Products

IZAK 10 Corp

Karachi Division, Pakistan

E

51-100 Employees

2015

Key takeaway

Izak10 Corporation (Pvt) Ltd specializes in credit management solutions, including debt management for both regular loans and microloans, indicating their expertise in consumer finance. Their focus on adapting to evolving digital technologies and changing regulations further enhances their ability to support institutions in this sector.

Reference

Core business

Credit Management Solutions

FINANCIERO CONSULTANTS

Karachi Division, Pakistan

E

1-10 Employees

2016

Key takeaway

Financiero Consultants is dedicated to building lasting relationships with clients and providing strategic business solutions. Their expertise spans various sectors, including Fintech, which is relevant to consumer finance.

Reference

Core business

Financiero Consultants

Strategic Alliance with Calgary Consulting Group, Canada

Trellis Housing Finance Limited

Karachi Division, Pakistan

E

1-10 Employees

2020

Key takeaway

Trellis Housing Finance Limited is a specialized private lending institution in Pakistan that focuses on providing affordable housing solutions to low-income and informal employment customers. Their commitment to social impact aligns with sustainable development goals, making them a key player in consumer finance for underserved markets.

Reference

Core business

Home - Trellis Housing Finance Limited

GharHo Click here to fill the Inquiry Form then you […]

Escorts Investment Bank

Lahore, Pakistan

E

- Employees

1996

Key takeaway

Escorts Investment Bank Limited (EIBL) offers a range of financial products and services, including individual finance options. With flexible investment terms and a commitment to innovative solutions, EIBL caters to the needs of individual investors.

Reference

Product

Individual Finance – Escorts Investment Bank

Financials Unlimited

Abbottabad, Pakistan

E

51-100 Employees

2016

Key takeaway

The company specializes in providing innovative AI-based FinTech solutions that enhance business efficiency and decision-making processes. Their commitment to developing advanced, technology-driven systems positions them as leaders in the consumer finance sector.

Reference

Core business

Career – Financials Unlimited

B&S Financial Consultants

Lahore, Pakistan

E

1-10 Employees

-

Key takeaway

B&S Financial Consultants specializes in providing comprehensive back-end support services, allowing entrepreneurs to concentrate on their core business activities. With expertise in areas like Accounting, Business Consulting, and HR Management, they aim to foster sustainable growth for organizations through innovative solutions and a dedicated team.

Reference

Service

SERVICES | B&S Financial Consultants

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

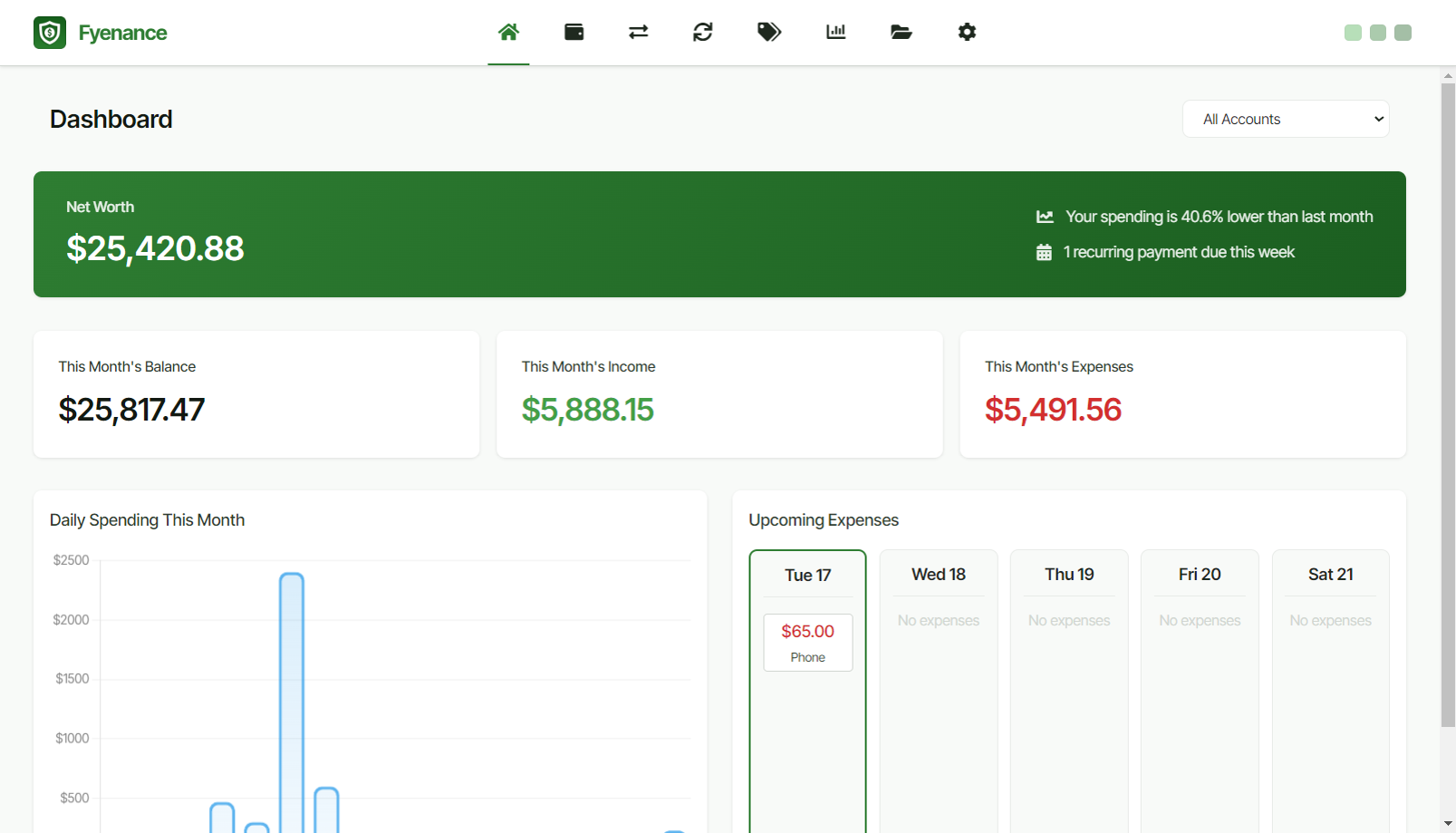

Fyenance

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the Consumer Finance industry in Pakistan, several key considerations are vital for informed decision-making. Understanding the regulatory framework is crucial, as the State Bank of Pakistan oversees financial institutions and enforces compliance with laws aimed at consumer protection and financial inclusion. Additionally, the industry faces challenges such as high levels of informality, which can limit access to credit for a significant portion of the population. However, opportunities abound, particularly with the increasing penetration of digital finance solutions and mobile banking, which are reshaping how consumers access financial services. The competitive landscape features a mix of established banks and emerging fintech firms, each vying for market share in a rapidly evolving environment. It is imperative to assess the customer-centric innovations these companies offer, as they play a significant role in attracting and retaining clients. Moreover, global market trends, such as the rise of sustainable finance, are beginning to influence local practices. Environmental concerns are increasingly relevant, pushing companies to adopt responsible lending practices and consider the social impact of their operations. Overall, a comprehensive understanding of these factors will provide valuable insights for anyone looking to engage with the Consumer Finance sector in Pakistan.

Some interesting numbers and facts about your company results for Consumer Finance

| Country with most fitting companies | Pakistan |

| Amount of fitting manufacturers | 23 |

| Amount of suitable service providers | 32 |

| Average amount of employees | 51-100 |

| Oldest suiting company | 1996 |

| Youngest suiting company | 2022 |

Some interesting questions that has been asked about the results you have just received for Consumer Finance

What are related technologies to Consumer Finance?

Based on our calculations related technologies to Consumer Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Who are Start-Ups in the field of Consumer Finance?

Start-Ups who are working in Consumer Finance are Al-Mawakhat Microfinance - AMCL

Which industries are mostly working on Consumer Finance?

The most represented industries which are working in Consumer Finance are Finance and Insurance, IT, Software and Services, Consulting, Other, Business Services

How does ensun find these Consumer Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.