The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Open-Finance.ai

Nes Ziona, Israel

B

11-50 Employees

2021

Key takeaway

Open-Finance.ai empowers financial institutions to leverage customer financial data through open banking technology and AI, enhancing decision-making and consumer outcomes in the finance sector. Their partnership with FICO aims to improve credit and insurance processes, ultimately driving business growth and delivering advanced financial solutions.

Reference

Core business

Open Finance - Open Banking for everyone

Connect with open banking with ease.

Fincom

Israel

B

1-10 Employees

2016

Key takeaway

Fincom offers a leading AML screening solution that significantly reduces operational costs and false positive alert rates, making it highly relevant for consumer finance institutions needing efficient compliance measures. Their patented phonetic fingerprint technology enhances the accuracy of name matching across multiple languages and formats, addressing critical challenges in the financial sector.

Reference

Core business

About - Fincom.co

About Fincom What we do With its track record of success in AML sanctions screening, Fincom stands as the only solution that fully meets the stringent requirements of the current regulation environment. Fincom offers the best AML Screening Solution to date, proven in US banks to reduce Wire/SWIFT screening operational cost and False Positive Alert rate […]

ZZFinancing.com

Jerusalem, Israel

B

1-10 Employees

-

Key takeaway

The company specializes in providing international financing and liquidity solutions, particularly for high-net-worth individuals and business entities, without the need for personal guarantees or credit checks. They offer fast, low fixed-interest loans, ensuring quick access to funds, which is crucial for various personal and business needs.

Reference

Core business

ZZFinancing.com - International Financing Solutions. We solve problems. We provide solutions. FAST LOW FIXED-INTEREST LOANS UP TO $1+ BILLION USD. Quick Liquidity / Fast Funding available in 1-3 weeks. Contact us today.

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Inside Out Finance

Tel-Aviv, Israel

B

1-10 Employees

2020

Key takeaway

Inside Out Finance is a specialized financial firm that supports high-tech companies with their financial needs from incorporation onwards, particularly in establishing operations in Israel and the United States.

Reference

Product

Portfolio – Inside Out Finance

iCapital Ltd.

Tel-Aviv, Israel

B

1-10 Employees

2016

Key takeaway

The company offers an online platform that facilitates the sale of financial products, specifically targeting insurance agencies, financial brokers, and banks. This comprehensive solution is designed to enhance the distribution and management of financial products for various financial institutions.

Reference

Product

Investment firms – iCapital

Coming soon

CFO Direct Ltd - Financial Directors

Raanana, Israel

B

11-50 Employees

2007

Key takeaway

CFO Direct emphasizes the importance of cost efficiency in consumer finance by offering tailored outsourced CFO services that enhance operational accounting and financial management. Their team of dedicated professionals brings significant expertise, particularly in the Life Science sector, to optimize resources and create value for companies.

Reference

Service

Services | cfodirect

WaBo FinTech

Mate Asher Regional Council, Israel

B

1-10 Employees

2015

Key takeaway

WaBo FinTech is a peer-to-peer microloans platform focused on providing financial services to the unbanked, utilizing advanced risk management tools and innovative technologies like blockchain and biometric identification. Their unique approach includes an algorithm that assesses a borrower's creditworthiness based on psycholinguistic analysis, enhancing the likelihood of responsible repayment.

Reference

Core business

Home | WaBo FinTech

InFin Capital Ltd.

Nes Ziona, Israel

B

1-10 Employees

2015

Key takeaway

InFin Capital is a prominent underwriting and advisory firm with extensive experience in managing debt and equity issuances in the Israeli capital market.

Reference

Core business

Home Page - Infin

ABOUT InFin Capital is a leading underwriting and advisory firm, with unique expertise in managing debt and equity issuances in the Israeli capital market InFin is considered as the most active rating advisory firms, providing ongoing advisory services for 18companies, including 5 companies with AA group rating InFin has been involved in over 120 issuances …

Innovative Assessments

Tel-Aviv, Israel

B

1-10 Employees

2015

Key takeaway

The company focuses on enhancing financial inclusion through innovative character-based credit scoring solutions that utilize advanced psychometrics. Their mission is to extend credit to traditionally underserved consumers and businesses, addressing the needs of the underbanked population.

Reference

Core business

Innovative Assessments

Character-based credit scoring solutions for financial inclusion. IA uses advanced psychometrics to augment traditional credit models and help better service underbanked consumers and micro-businesses.

Loan in Click

Tel-Aviv, Israel

B

11-50 Employees

2017

Key takeaway

Loan In Click offers a digital B2B loan solution that enables customers to submit loan requests in just 5 minutes, enhancing the overall consumer finance experience. Their platform also ensures secure file transfers, allowing businesses to efficiently manage a high volume of loan requests.

Reference

Core business

About | Loan in click | Digital B2B loan solution

Use our digital B2B loan solution to enrich your customers. Using the Loan in Click platform will be a Win-Win situation: Your business is upgraded quickly, helping you mitigate risks and reduce HR, IT, and maintenance costs.

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

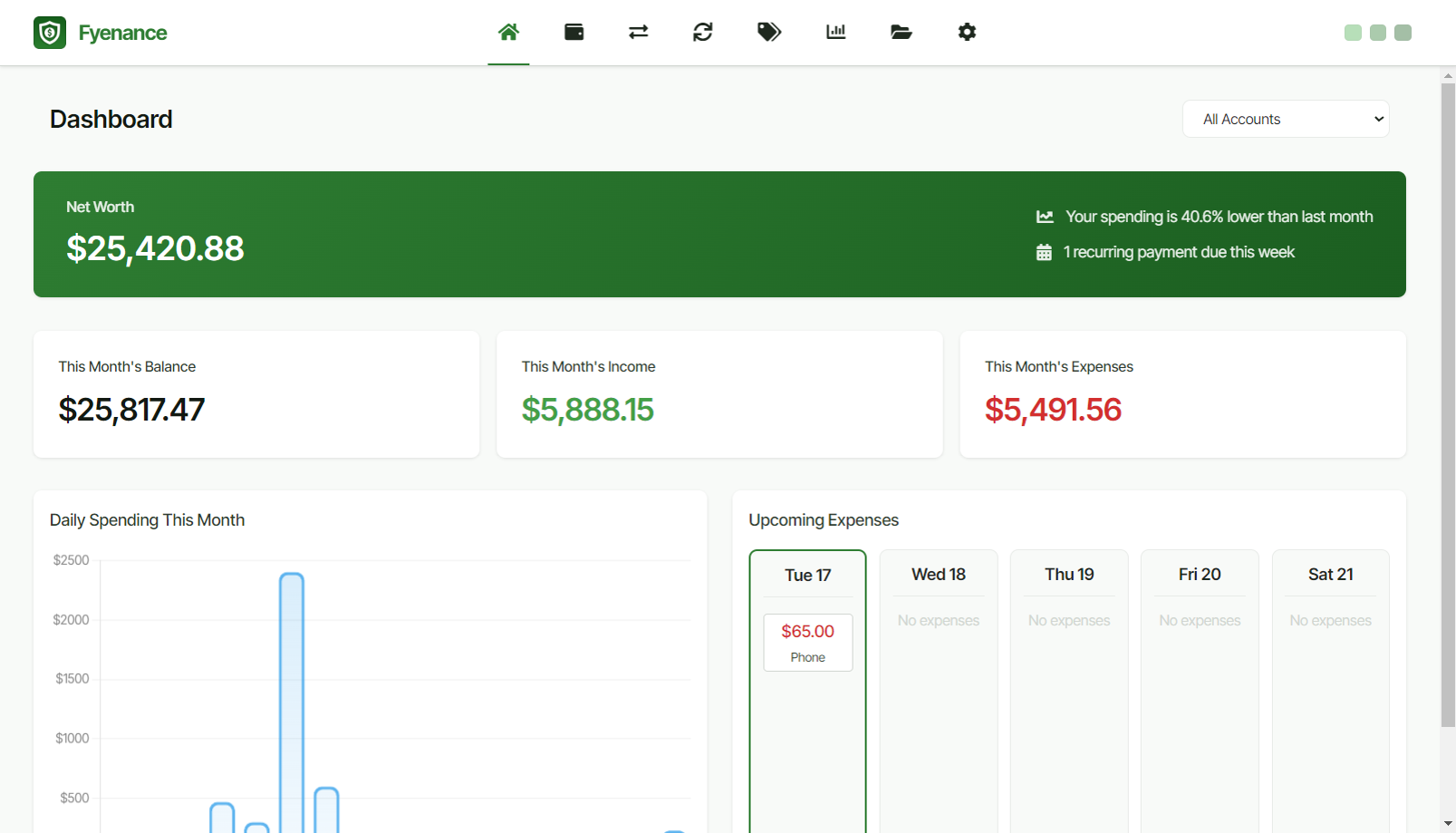

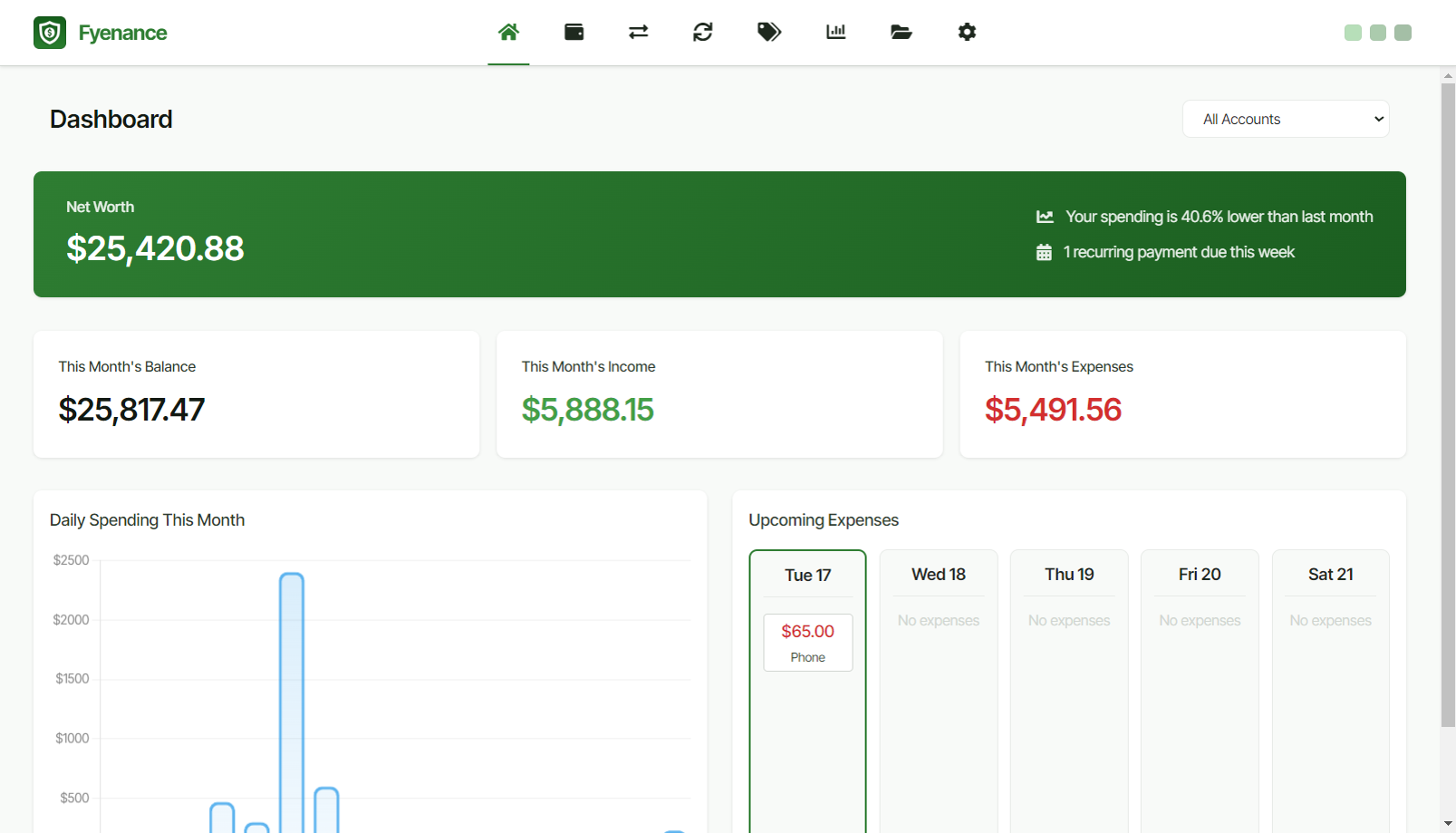

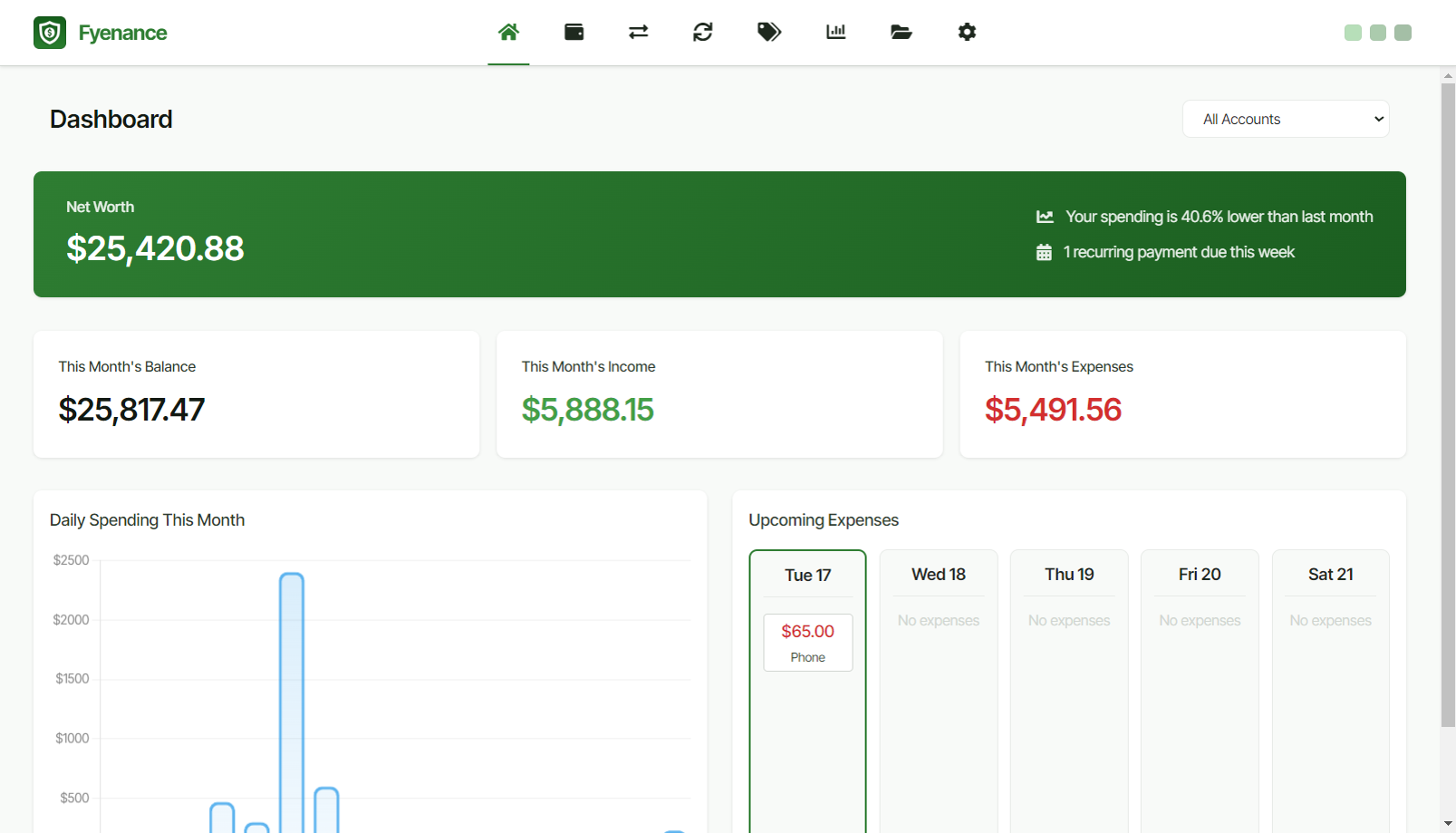

Fyenance

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

The Consumer Finance industry in Israel is shaped by several key considerations. Regulations play a crucial role, as the Israeli government enforces strict guidelines to protect consumers and maintain market stability. Understanding the legal framework, including the supervision by the Bank of Israel and the Consumer Credit Law, is essential for anyone entering this field. Challenges such as competition from traditional banks and emerging fintech companies also impact market dynamics. These companies often leverage technology to provide innovative solutions, creating both opportunities and pressures for established players. Environmental concerns are increasingly relevant, as consumers show growing interest in sustainable finance options. Companies that incorporate ethical practices and transparency into their offerings may gain a competitive edge. Moreover, the local market's relevance in the global context cannot be overlooked. Israel's robust tech ecosystem attracts international investment, fostering collaboration and growth in the consumer finance sector. Additionally, understanding consumer behavior and preferences in the Israeli market is vital, as they can differ significantly from those in other regions. This comprehensive approach ensures that businesses and investors are well-informed and positioned to navigate the unique landscape of consumer finance in Israel.

Some interesting numbers and facts about your company results for Consumer Finance

| Country with most fitting companies | Israel |

| Amount of fitting manufacturers | 18 |

| Amount of suitable service providers | 25 |

| Average amount of employees | 1-10 |

| Oldest suiting company | 2007 |

| Youngest suiting company | 2021 |

Some interesting questions that has been asked about the results you have just received for Consumer Finance

What are related technologies to Consumer Finance?

Based on our calculations related technologies to Consumer Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Who are Start-Ups in the field of Consumer Finance?

Start-Ups who are working in Consumer Finance are Open-Finance.ai

Which industries are mostly working on Consumer Finance?

The most represented industries which are working in Consumer Finance are Finance and Insurance, IT, Software and Services, Other, Consulting, Judiciary

How does ensun find these Consumer Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.