The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

China Rapid Finance

Changning District, China

D

1001-5000 Employees

2001

Key takeaway

China Rapid Finance is a leader in consumer finance, focusing on the emerging middle class in China by using big data algorithms to derive credit scores. They have established partnerships with major Internet platforms to efficiently identify and contact creditworthy individuals, thereby reducing customer acquisition costs.

Reference

Core business

China Rapid Finance | pioneers in consumer credit

Global Finance Capital

Kowloon, China

D

- Employees

2012

Key takeaway

Global Finance Capital specializes in providing smart financing solutions, including Non-Recourse Loans for project funding. With over 30 years of experience, they offer flexible credit facilities for both businesses and individuals, leveraging collateral transfer facilities to enhance capital access.

Reference

Core business

Our Company | Global Finance Capital

Finfo Union

Kowloon, China

D

- Employees

2017

Key takeaway

Finfo Union Limited focuses on enhancing consumer finance through innovative data analysis and financial technology, particularly in improving credit scoring services and managing credit risk. Their offerings include consumer credit reports and a comprehensive credit risk management platform, aimed at creating a sustainable financial environment in Hong Kong.

Reference

Product

Product - Finfo Union

Finfo Union Limited was established in Hong Kong in September 2017. We are a Credit Reference Agency specializing in serving Non-Bank Financial Institutions.

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Hong Kong Finance (International) Company Limited

Hong Kong Island, China

D

251-500 Employees

1994

Key takeaway

Hong Kong Finance is dedicated to providing a wide range of financial solutions, including flexible credit facilities for individuals. Their expertise and commitment to exceptional service position them as a key player in the consumer finance sector.

Reference

Core business

Our Company | Asia's No. 1 Loan Company - Hong Kong Finance

Macquarie Investment Advisory (Beijing) Co., Ltd.

Dongcheng District, China

D

11-50 Employees

2004

Key takeaway

The company is a global financial services organization that empowers individuals to innovate and invest, which aligns with the principles of consumer finance. Their diverse team and commitment to profitability suggest a strong foundation for supporting consumer financial needs.

Reference

Core business

Banking and Financial Services

FundingReach

Hong Kong Island, China

D

11-50 Employees

2017

Key takeaway

The company is a Fintech platform that focuses on innovative risk mitigation solutions, including automated compliance screening and customer due diligence, which are crucial for consumer finance. They utilize Big Data and Machine Learning to enhance credit and compliance processes, making them a trusted partner for over 1,000 financial institutions.

Reference

Core business

HOME | FundingReach

Here we are for FinTech innovations. We leverage Big Data and Machine Learning, bring you with RegTech and CreditTech solutions.

FinMonster

Kowloon, China

D

11-50 Employees

2019

Key takeaway

FinMonster provides an efficient platform that connects businesses with various financial institutions, enhancing access to services like SME loans and trade finance. This support enables businesses to obtain lower-cost banking services and faster access to liquidity, helping them remain competitive in the market.

Reference

Core business

FinMonster Corporate Banking Comparison | Market Intelligence powered by Refinitiv

FinMonster is a Corporate Banking Comparison Platform to connect 30+ banks and apply to SME loans, Trade Finance, Account Opening, etc | Partnered with Refinitiv, FinMonster offers exclusive loan market intelligence from terms, news and analysis to help you make better business decision and reduce financing cost.

iPYGG

Hong Kong Island, China

D

11-50 Employees

2020

Key takeaway

ONEFi, a pioneering AI-driven financial management company, offers a B2B2C platform that connects individual users with global banks and web3 exchanges, making institutional wealth management accessible to a broader audience. With a focus on innovative financial technologies, including automated investment solutions and secure data access, ONEFi is positioned to transform consumer finance through its next-generation asset management and global account consolidation services.

Reference

Core business

ONEFi 全球資產管理平台 |管理全球銀行賬戶 | SBT | 海外資產配置

ONEFi 是一間屢獲殊榮的AI智能理財公司,以開放銀行及Web3為基礎,為新世代、HNWI及企業提供全球銀行開戶、匯款及海外資產配置,現時擁有多個專利於自動投資方案及個人稅務自動化等,願景是為下一代打造未來AI理財顧問,為金融機構及虛擬資產管理公司提供新一代一站式平台,讓金融機構在 1 分鐘內獲得銀行發出的資金證明,以人工智能專業地將高成本、耗時的盡職審查過程自動化及大幅改善。 現時,ONEFi App於短短9個月擁有超過於2萬用戶及超過4000萬條交易記錄,同時ONEFi於日本及內地將於2023年第二季推出。ONEFi 也入選香港科學園創科培育計劃、全球最大初創加速器 - Startupbootcamp FinTech Cohort 21、阿里巴巴HKAI LAB Cohort 5及Jumpstarter 2023 Top 100初創。

Convoy Global Holdings

Hong Kong Island, China

D

1001-5000 Employees

1993

Key takeaway

Convoy Financial Services Limited (CFS) is a prominent financial advisory firm in Hong Kong, highlighting its expertise and commitment to delivering exceptional service. With a strong infrastructure and professional training, CFS is well-equipped to meet the diverse financial needs of its customers.

Reference

Core business

Convoy l Convoy Financial Services

uFinance

Kowloon, China

D

11-50 Employees

2015

Key takeaway

uFinance HK Limited has partnered with United Asia Finance Limited to offer low-interest student loans and personal finance services, specifically designed to alleviate financial pressure for college students. Their approach utilizes big data analysis for risk assessment, allowing them to provide installment loan plans without traditional income verification.

Reference

Core business

uFinance 大專學生資訊貸款平台

好多同學的讀書生涯都會遇到財務壓力,uFinance 專為大專學生提供低息貸款滿足同學財務需要,讓你可以輕輕鬆鬆體驗充實嘅校園生活並抓緊每一個寶貴的課外學習機會。為了向學生提供一個更合適的財務支援,不會以傳統收入為批核標準,利用大數據分析及評估風險,即使不需收入證明都可向學生提供最多48個月的分期理財貸款計劃。除了學生貸款需要外,uFinance 亦有提供學生一站式資訊,包括搵工、保險、贊助及進修等資訊,讓大專生於踏入社會之前有堅實的基礎去面對不同的挑戰。

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

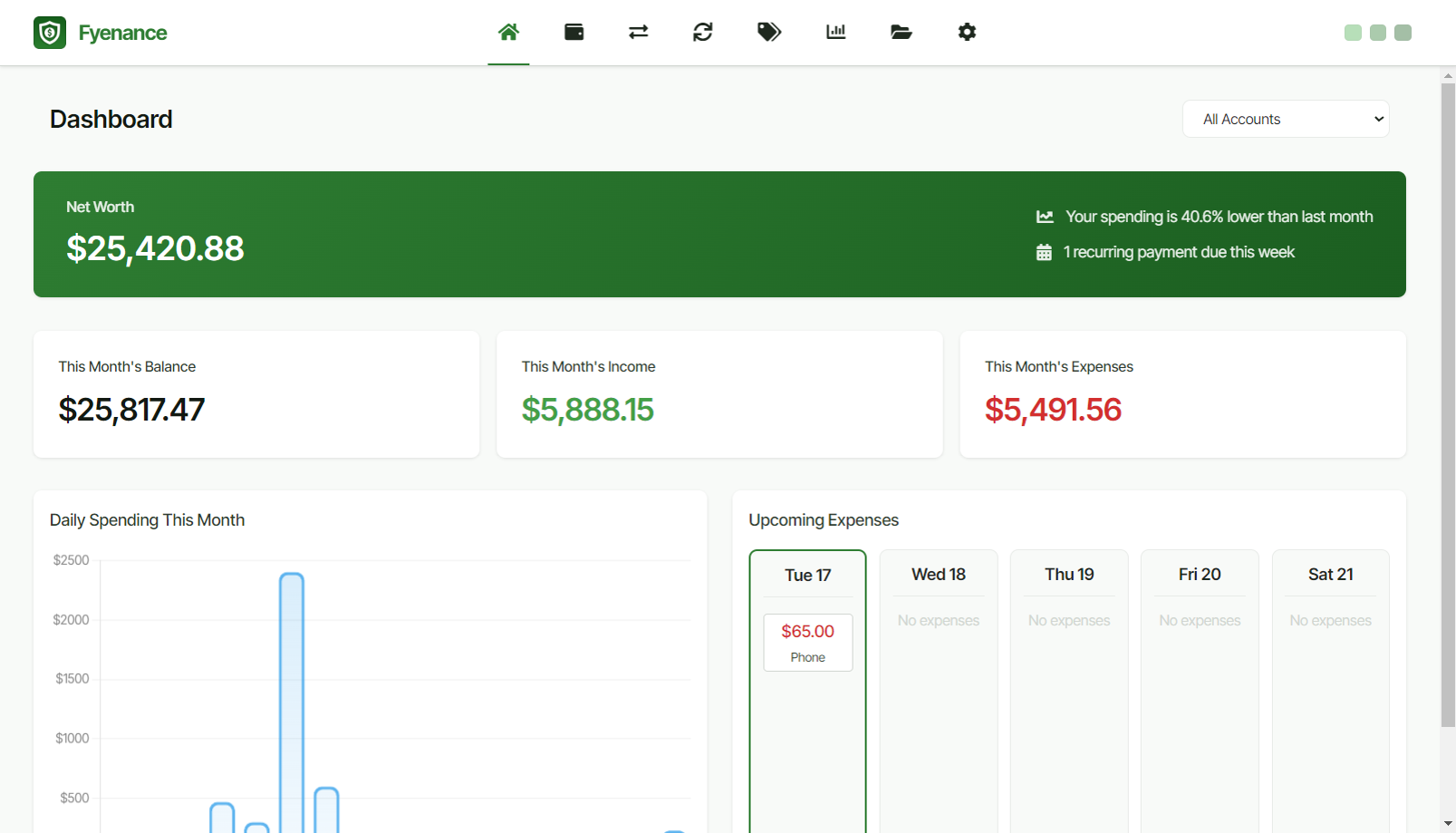

Fyenance

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the Consumer Finance industry in China, it is crucial to understand the regulatory landscape, as the government imposes strict guidelines on lending practices and financial services. Recent regulations aim to curb excessive borrowing and promote responsible lending, impacting how companies operate. The competitive landscape is dominated by both traditional banks and emerging fintech firms, which offer innovative solutions catering to the growing middle class. This demographic shift presents significant opportunities for companies that can provide tailored financial products and services. Moreover, challenges such as high levels of consumer debt and economic fluctuations can affect market stability. Environmental concerns are also becoming more relevant, with a growing emphasis on sustainable finance practices. Companies that integrate environmental, social, and governance (ESG) criteria may find a competitive edge in the market. Additionally, the global relevance of China's Consumer Finance industry cannot be overlooked, as it increasingly influences international financial trends and investment strategies. Understanding these factors will be key for anyone looking to navigate this dynamic sector successfully.

Some interesting numbers and facts about your company results for Consumer Finance

| Country with most fitting companies | China |

| Amount of fitting manufacturers | 31 |

| Amount of suitable service providers | 39 |

| Average amount of employees | 251-500 |

| Oldest suiting company | 1993 |

| Youngest suiting company | 2020 |

Some interesting questions that has been asked about the results you have just received for Consumer Finance

What are related technologies to Consumer Finance?

Based on our calculations related technologies to Consumer Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Consumer Finance?

The most represented industries which are working in Consumer Finance are Finance and Insurance, Other, IT, Software and Services, Consulting, Media and Entertainment

How does ensun find these Consumer Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.