The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

JRV Financial Services

Barueri, Brazil

C

1-10 Employees

2013

Key takeaway

JRV Financial Services offers a range of solutions for financial and payment institutions, including business consulting and operational infrastructure assembly, ensuring compliance with BACEN.

Reference

Core business

JRV Financial Services - Financial Partnership for Your Business

FINCS

São Paulo, Brazil

C

1-10 Employees

2005

Key takeaway

FINCS (Financial Components and Solutions) offers a comprehensive solution for fixed income traders, providing financial calculation components that integrate seamlessly with various applications. With over a decade of experience serving financial institutions, the company specializes in software solutions tailored for the finance sector.

Reference

Core business

FINCS | Componentes e Soluções Financeiras

Macro Assessoria E Fomento Comercial

Santa Rosa, Brazil

C

1-10 Employees

-

Key takeaway

Finanzi offers immediate payment for installment sales, ensuring a quick and efficient cash flow for businesses. They provide credit analysis and purchase various financial instruments, including invoices and promissory notes, enhancing the security of transactions.

Reference

Core business

Finanzi | Fundo de Investimento em Direitos Creditórios

Fundo de Investimento em Direitos Creditórios

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

EV2 CRÉDITO PJ & HOME EQUITY

Porto Alegre, Brazil

C

1-10 Employees

2018

Key takeaway

The company offers loans with competitive rates and low installments, providing immediate cash for businesses to enhance their operations.

Reference

Core business

Empresarial - EV2 Empréstimos e Financiamentos

Empresário ou Empreendedor: aproveite essas taxas com condições imperdíveis para alavancar o seu negócio.

Facmaster Factoring

Maringá, Brazil

C

51-100 Employees

-

Key takeaway

Facmaster Securitizadora S/A is a financial market player with over 20 years of experience, specializing in the securitization of commercial credits, which can enhance the financial health of businesses.

Reference

Core business

Facmaster Securitizadora S/A – Securitização de Créditos Comerciais

PONTE FACTORING FOMENTO COMERCIAL EIRELI

Jundiaí, Brazil

C

1-10 Employees

1999

Key takeaway

To open accounts with the company, you need to provide the Social Contract, RG and CPF of the partners, monthly revenue, and proof of the company's address. The company specializes in providing financial management solutions for small and medium enterprises, focusing on the acquisition of receivables for immediate cash flow.

Reference

Service

Services | Ponte Factoring

SA Home Loans

Gravataí, Brazil

C

501-1000 Employees

1999

Key takeaway

The company specializes in home finance, offering competitive mortgage products and tailored solutions to help clients achieve their home ownership goals. They aim to be South Africa's most trusted home loan provider, recently introducing a significantly discounted rate, making their offerings a compelling alternative to traditional bank financing.

Reference

Product

Our Products |Personal Lending | Quick Cash | SA Home Loans

Fattor Crédito Mercantil S.A

Jaguariúna, Brazil

C

11-50 Employees

2016

Key takeaway

Fattor is a private capital securitizer that primarily focuses on acquiring receivables in the market and raising financial resources through the issuance of debentures.

Reference

Core business

Fattor Crédito Mercantil - Oferencedo serviços mercantil e investimentos

Fattor Crédito Mercantil - Oferencedo serviços mercantil e investimentos

Funchal Factoring

São Paulo, Brazil

C

51-100 Employees

-

Key takeaway

During this period, the company has gained significant experience and offers various financial services such as receivables anticipation, production support, and trustee management. With a team of highly qualified professionals, they ensure quick operations, aiming to enhance cash flow and improve the financial health of businesses.

Reference

Core business

Funchal Factoring

MBM Fomento

São Paulo, Brazil

C

1-10 Employees

2021

Key takeaway

MBM Fomento offers strategic financial services designed to help businesses settle debts and accelerate growth through receivables anticipation. Their efficient factoring process provides quick access to funds with minimal bureaucracy, making it suitable for clients of all sizes, from startups to large enterprises.

Reference

Core business

Antecipação De Recebíveis | MBM Fomento | Brasil

Resolva Seus Problemas De Crédito, Antecipe Conosco Com Taxas Competitivas Suas NF-e, Quite Dívidas Ou Pague Seu Fornecedor A Vista. Cresça E Resolve Seus Problemas Com A MBM Fomento. Antecipação De recebíveis Factoring Fomento Mercantil Antecipação De Boleto

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

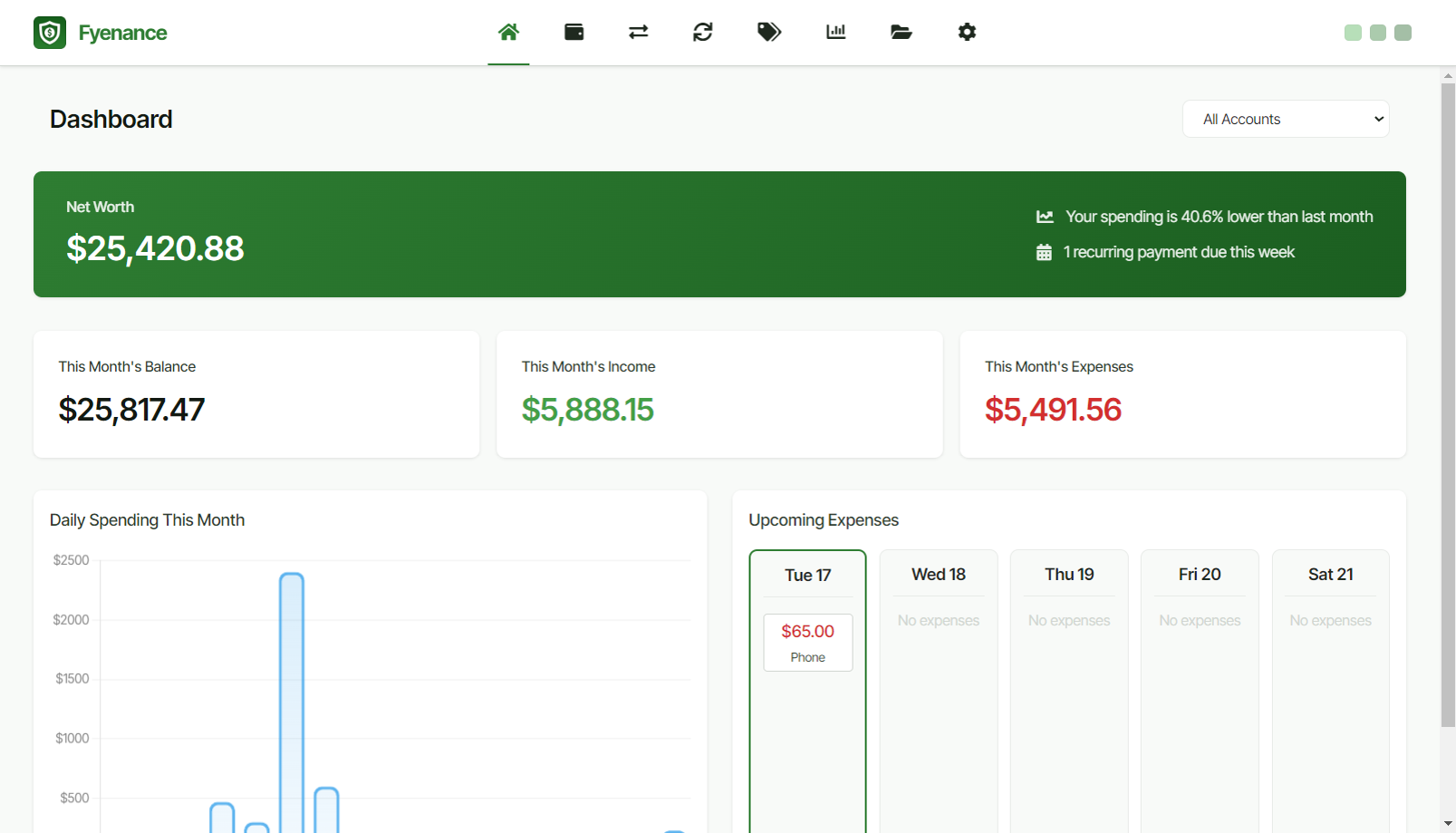

Fyenance

Go to product

Service

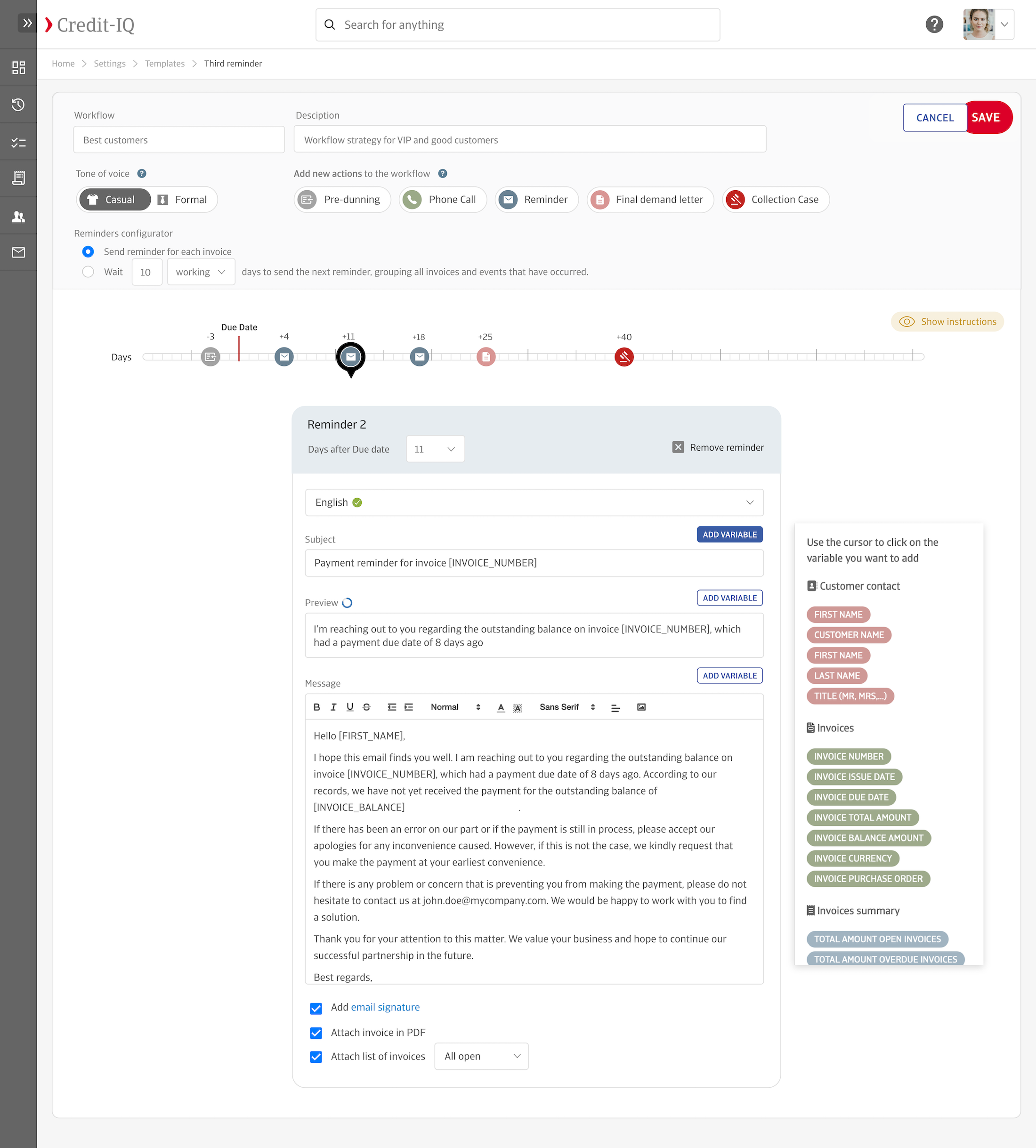

Credit-IQ

Go to product

Service

Gold Buyers

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Accounts Receivable Automation Platform

Accounting, Finance, SaaS, E-commerce, Legal Services, Retail

Credit-IQ is a comprehensive solution designed to automate and enhance accounts receivable (AR) processes for businesses across multiple industries. Our platform tackles common challenges by reducing manual work, accelerating payment collection, and improving cash flow. Credit-IQ seamlessly integrates with popular bookkeeping software to automate invoice reminders, manage unpaid invoices, and provide valuable cash flow insights. By leveraging automated workflows and customizable email templates, our platform helps businesses strengthen customer relationships and experience faster, more consistent payments. Credit-IQ addresses specific needs in sectors such as E-commerce, Legal Services, and Retail, offering multi-language support and personalized AR processes suited to diverse business operations. With Credit-IQ, enterprises scale AR operations effectively, while small and medium businesses reduce payment delays and streamline financial management.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

The finance industry in Brazil is shaped by several key considerations that potential entrants should be aware of. Regulatory frameworks are critical, as Brazil's Central Bank and the Securities and Exchange Commission (CVM) impose strict guidelines to ensure stability and protect investors. Navigating these regulations can be challenging, particularly for foreign investors. Additionally, the competitive landscape is marked by a mix of traditional banks, fintech startups, and international financial institutions, creating both opportunities and challenges. Emerging fintech companies have revolutionized access to financial services, appealing especially to underserved populations. However, economic volatility and inflation rates pose risks that can affect investment returns and operational stability. Environmental concerns are increasingly relevant, with a growing emphasis on sustainable finance and responsible investing. Companies are urged to adopt practices that align with global sustainability goals, reflecting a shift in consumer preferences and regulatory expectations. Furthermore, the global market relevance of Brazil's finance sector is significant, given its status as the largest economy in South America. As such, understanding the geopolitical landscape, currency fluctuations, and international trade agreements is essential for anyone looking to invest or work in this sector. Overall, thorough research into these aspects will provide valuable insights for navigating Brazil's dynamic finance industry.

Some interesting numbers and facts about your company results for Finance

| Country with most fitting companies | Brazil |

| Amount of fitting manufacturers | 3 |

| Amount of suitable service providers | 4 |

| Average amount of employees | 1-10 |

| Oldest suiting company | 1999 |

| Youngest suiting company | 2021 |

Some interesting questions that has been asked about the results you have just received for Finance

What are related technologies to Finance?

Based on our calculations related technologies to Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Who are Start-Ups in the field of Finance?

Start-Ups who are working in Finance are MBM Fomento

Which industries are mostly working on Finance?

The most represented industries which are working in Finance are Finance and Insurance, Other, Administration, Consulting, IT, Software and Services

How does ensun find these Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.