The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Healthcare Financing of America LLC

United States

B

11-50 Employees

2018

Key takeaway

The company specializes in facilitating financial solutions for both patients and providers through innovative technology and regulatory expertise. It offers an all-digital healthcare loan platform that connects patients with financial providers, creating affordable financing options and ensuring quick fund disbursement for providers.

Reference

Core business

Healthcare Financing Company, Medical Loans & Patient Financing | HFA

HFA is a Healthcare Financing Company that works with providers to offer Medical Loans and Patient Financing options that increase patient utilization and deliver a better medical billing experience.

Future Funding Company

New York, United States

B

11-50 Employees

2020

Key takeaway

Future Funding Company specializes in simplifying the financing process for businesses, offering a loan finder service that connects them with various lenders. They provide multiple funding options, including merchant cash advances and short or long-term loans, tailored to different credit situations and cash flow needs.

Reference

Service

Services | Future Funding Co.

Fidelity Finance Loan

United States

B

1-10 Employees

-

Key takeaway

The company is a recognized provider of financing solutions, offering expertise and partnerships with national lenders to meet the diverse needs of small to medium-sized businesses.

Reference

Core business

Fidelity Finance Loan

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Commercial Finance Partners

Boca Raton, United States

B

1-10 Employees

2012

Key takeaway

Commercial Finance Partners specializes in providing creative and flexible financing solutions for small to middle-market companies. Their diverse product offerings, including accounts receivable financing, SBA loans, and asset-based loans, cater to various business financing needs.

Reference

Core business

Commercial Finance & Business Lending | Commercial Finance Partners

Tired of trying to get a bank loan? Let Commercial Finance Partners, a Commercial Lender, meet your Commercial Finance & Business Lending needs today, with Fast Funding!

Capital Blue Financial Group

Washington, United States

B

1-10 Employees

-

Key takeaway

Capital Blue Financial Group is a recognized company that addresses clients' financing needs through expertise and partnerships with national lenders, offering a range of financing solutions for small to medium-sized businesses.

Reference

Core business

Capital Blue Financial Group

General Financial

Orlando, United States

B

1-10 Employees

1987

Key takeaway

The company highlights its role as a leader in the finance and leasing industry, emphasizing its ability to provide personalized service backed by financial strength. They specialize in various financial solutions, including equipment financing, business acquisitions, and cash back loans, all aimed at enhancing capital access for greater productivity and profitability.

Reference

Core business

General Financial: Empowering Financial Growth

GE Finances is your trusted partner for comprehensive financial solutions. From wealth management to retirement planning, our experienced team is committed to helping you achieve your financial goals. With personalized strategies and expert advice, we provide the guidance you need to navigate complex financial landscapes. Secure your future and maximize your financial potential with GE Finances.

Proven Financial Service

United States

B

1-10 Employees

-

Key takeaway

Proven Financial Service is a well-regarded financial company that addresses the financing needs of clients, particularly small to medium-sized businesses, through its expertise and partnerships with national lenders, offering a comprehensive range of financing solutions.

Reference

Core business

Proven Financial Service

Fort Dearborn Partners

Chicago, United States

B

11-50 Employees

1990

Key takeaway

The company, Fort Dearborn Partners, highlights its expertise in financial advisory services, notably serving as the exclusive financial advisor for the refinancing of Reliable Knitting Works. Their target market includes manufacturers and distributors with sales between $20 million and $1 billion, indicating a strong focus on enhancing business performance and shareholder value through innovative financial strategies.

Reference

Service

Financing

Direct Finance

Newport Beach, United States

B

11-50 Employees

2016

Key takeaway

Direct Finance is dedicated to providing clients with direct financing solutions at competitive prices, simplifying the financing process for various needs, including residential and commercial loans. Their commitment to exceptional service and strategic partnerships ensures a wide range of loan products for both first-time homebuyers and experienced investors.

Reference

Product

Startup Funding - Direct Finance

Direct Finance offers flexible and creative solutions for your residential, commercial, multi-family, non-traditional and low document loans.

Fidelity Mortgage Lenders

California City, United States

B

11-50 Employees

1971

Key takeaway

Fidelity is a prominent loan provider specializing in financing for commercial and non-owner-occupied residential properties, offering support for refinancing and purchases. With over forty years of experience, the company effectively caters to the needs of borrowers seeking funding that larger institutions may not provide.

Reference

Service

Commercial Loans

Business owners and investors choose Fidelity Mortgage Lenders for our quality commercial loans, characterized by attractive payment terms, speed, and discretion. Our services extend across several states, and our loans range from $50,000 to $20 million, accommodating various property financing needs. Borrowing is simplified with no prepayment penalties, a concise application process, and flexible terms tailored to individual requirements. With swift funding, responsive customer service, and a commitment to hassle-free transactions, we ensure a smooth experience from application to closure for those seeking to purchase or refinance commercial properties.

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

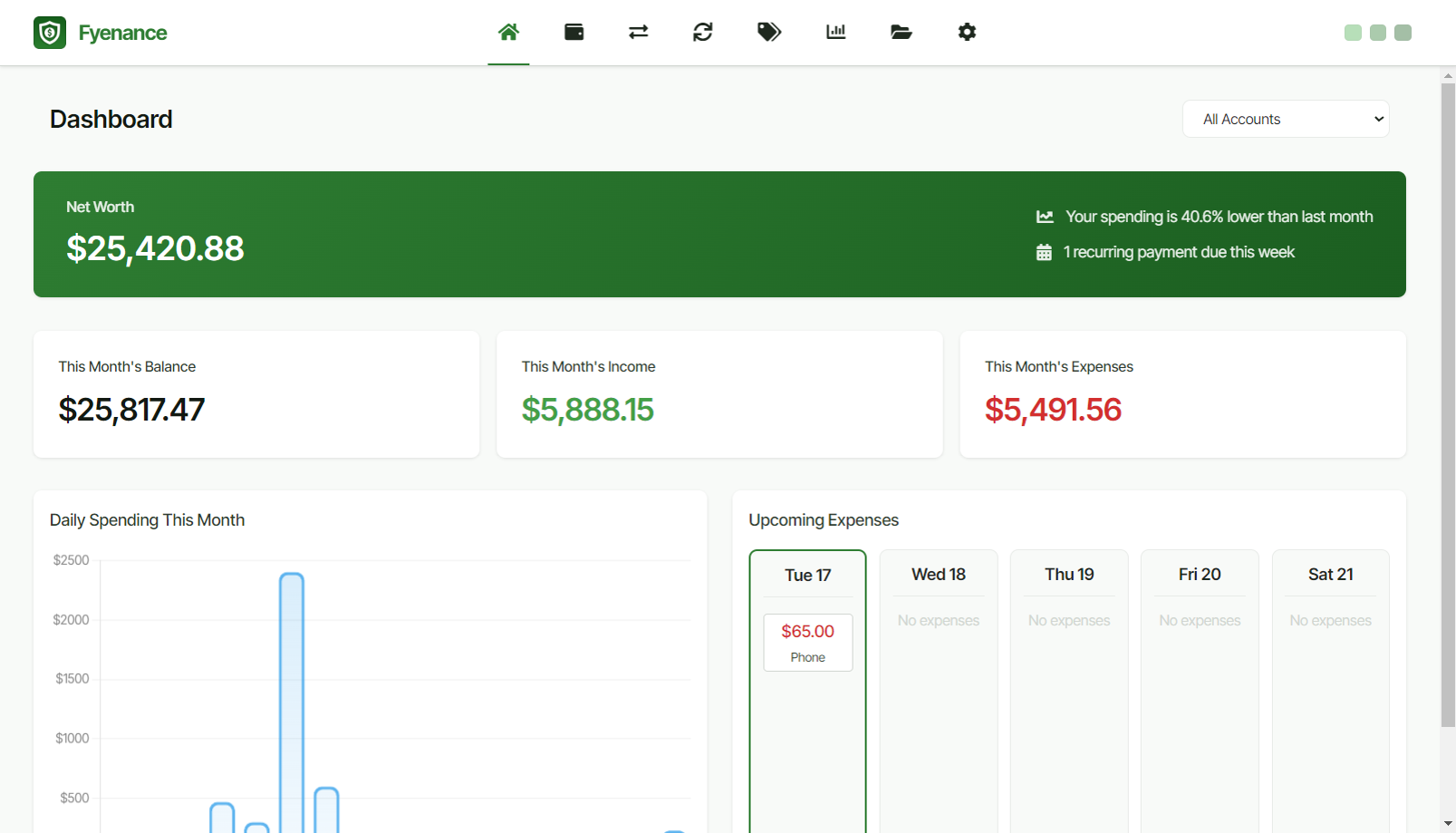

Fyenance

Go to product

Service

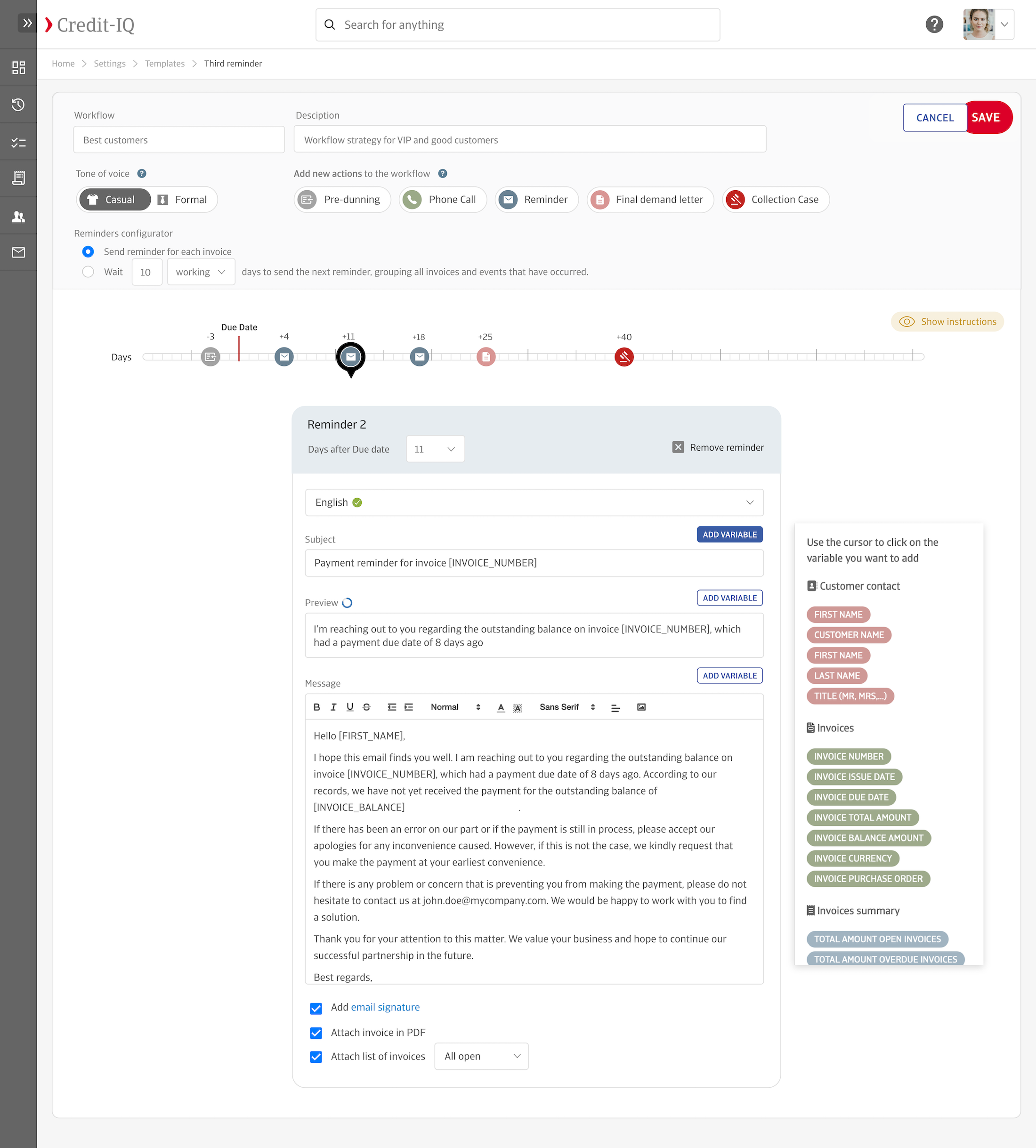

Credit-IQ

Go to product

Service

Gold Buyers

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Accounts Receivable Automation Platform

Accounting, Finance, SaaS, E-commerce, Legal Services, Retail

Credit-IQ is a comprehensive solution designed to automate and enhance accounts receivable (AR) processes for businesses across multiple industries. Our platform tackles common challenges by reducing manual work, accelerating payment collection, and improving cash flow. Credit-IQ seamlessly integrates with popular bookkeeping software to automate invoice reminders, manage unpaid invoices, and provide valuable cash flow insights. By leveraging automated workflows and customizable email templates, our platform helps businesses strengthen customer relationships and experience faster, more consistent payments. Credit-IQ addresses specific needs in sectors such as E-commerce, Legal Services, and Retail, offering multi-language support and personalized AR processes suited to diverse business operations. With Credit-IQ, enterprises scale AR operations effectively, while small and medium businesses reduce payment delays and streamline financial management.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the finance industry in the United States, several key considerations emerge that are essential for informed decision-making. Regulatory compliance is paramount, as the U.S. financial sector is governed by a complex network of federal and state regulations, including those imposed by the Securities and Exchange Commission (SEC) and the Federal Reserve. Understanding these regulations can help mitigate legal risks. Additionally, the competitive landscape is intense, with numerous players ranging from traditional banks to fintech startups, each vying for market share. Challenges such as economic fluctuations, changing interest rates, and technological disruptions can significantly impact financial institutions. On the other hand, opportunities abound, particularly in areas like digital banking, investment management, and sustainable finance, which are gaining traction among consumers. Environmental concerns are also increasingly relevant, with a growing emphasis on socially responsible investing and environmental, social, and governance (ESG) criteria. Finally, the global market relevance of the U.S. finance industry cannot be overstated, as it plays a critical role in international finance and trade. Being aware of global economic trends and geopolitical factors is crucial for anyone interested in this field. Overall, a thorough understanding of these elements can provide valuable insights for navigating the finance industry in the United States.

Some interesting numbers and facts about your company results for Finance

| Country with most fitting companies | United States |

| Amount of fitting manufacturers | 1291 |

| Amount of suitable service providers | 1479 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 1971 |

| Youngest suiting company | 2020 |

Some interesting questions that has been asked about the results you have just received for Finance

What are related technologies to Finance?

Based on our calculations related technologies to Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Finance?

The most represented industries which are working in Finance are Finance and Insurance, Other, IT, Software and Services, Real Estate, Consulting

How does ensun find these Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.