The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

TCG Finance Ltd (Trade Finance & Equity Fund)

Mexico

D

51-100 Employees

1997

Key takeaway

TCG Finance is a financial services company that has been supporting middle-market companies with diverse financing solutions in Mexico and Latin America since 1997. They specialize in structuring international financing and providing investment banking services, helping clients access private capital, bank debt, and supplier credit schemes.

Reference

Core business

TCG Finance LTD | Trade Finance & Equity Fund

Factoro

Monterrey, Mexico

D

1-10 Employees

2018

Key takeaway

Factoro is a fintech company that enhances liquidity for businesses by offering digital factoring solutions, allowing for quicker payment processes. By connecting buyers, suppliers, and financial entities, Factoro helps optimize cash flow and manage working capital effectively.

Reference

Core business

Factoraje a proveedores - Factoro

Liberamos el capital de trabajo atrapado en largos plazos de pago. Ayudamos a tu empresa a optimizar su flujo de efectivo.

ARTEA FINANCIERA

Puebla City, Mexico

D

11-50 Employees

-

Key takeaway

The company offers factoring services for businesses and individuals that provide products and services with payment terms of 30, 60, or 90 days, helping them manage cash flow and grow their operations.

Reference

Product

Productos | Artea Financiera

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Finamo

Culiacán Rosales, Mexico

D

1-10 Employees

-

Key takeaway

Fínamo is a Mexican FinTech with over 10 years of experience in the financial sector, providing specialized credit solutions that enhance liquidity for businesses. As part of a larger corporate group with 30 years in the market, Fínamo supports companies across key sectors, demonstrating its expertise in driving growth for SMEs.

Reference

Core business

Fínamo | Home

La FinTech mexicana que impulsa el crecimiento de las Pymes con soluciones crediticias que les otorgan liquidez de forma fácil y ágil.

Finvero

Mexico

D

11-50 Employees

2021

Key takeaway

The company offers financial solutions designed to help you find the best scoring model for your needs, enabling you to explore new opportunities and enhance your financial management. With a focus on secure and efficient transactions, it encourages investing in high-return profiles and provides innovative credit options through a vast network of merchants.

Reference

Core business

finvero Vende a crédito sin tarjeta y aumenta tus ventas

Hay que ayudar a nuestros usuarios con sus finanzas personales… la nueva venta empieza por dar servicio

Regenera

Mexico

D

1-10 Employees

2016

Key takeaway

The company specializes in providing competitive financing solutions for technology providers and their clients, particularly in the context of sustainable infrastructure. With a focus on supporting companies in their decarbonization efforts, they empower organizations to finance their on-site infrastructure needs, addressing the financial aspects of the transition to sustainable practices.

Reference

Core business

Regenera

Latin America's first tech-enabled financing platform for sustainable infrastructure technologies.

Fundary

Mexico

D

11-50 Employees

2016

Key takeaway

The company has received unanimous approval from key financial authorities in Mexico to operate as the first crowdfunding institution in the country, highlighting its commitment to providing tailored financing and investment solutions. They offer credits of up to 10 million pesos.

Reference

Core business

Inicio - Fundary

FINANCIAMIENTO E INVERSIÓN A TU MEDIDA Hemos recibido la aprobación de la CNBV, la SHCP y BANXICO de forma unánime, sin salvedades y publicada en el Diario Oficial de la Federación para operar como la primera Institución de Financiamiento Colectivo en México. SOLICITA UN CRÉDITO ¡Solicita hasta 10 millones de pesos! Pre aprobación en 5

Fairplay

Mexico

D

11-50 Employees

2019

Key takeaway

Fairplay is a financial ally for growing businesses, offering flexible and fast funding specifically for e-commerce. Their platform supports online business growth, providing the capital needed to take your venture to the next level.

Reference

Core business

Fairplay | Financiamiento para Ecommerce

Obtén el capital que necesitas para hacer crecer tu negocio en línea. Financiamiento para Ecommerce flexible y rápido. Solicita tu crédito hoy.

FORT Capital Resources

Mexico

D

1-10 Employees

-

Key takeaway

The company specializes in providing commercial financing solutions with a focus on transparency and specific expertise in various equipment types, including Core IT, medical, and biotechnology. Their integrated platform streamlines the financing process, making it efficient for clients to achieve their financial objectives.

Reference

Core business

FORT CAPITAL RESOURCES

We bring together finance, sales, operations, and accounting on one platform to make financing your customer transactions seamless, transparent, and fast. FORT’s platform integrates financing options into the buying flow, impacting all of your business functions, from the board/executive level to ac

Equity Link

Chihuahua City, Mexico

D

11-50 Employees

2015

Key takeaway

The company offers financial services designed to improve cash flow and provide easy access to financing, allowing businesses to focus on growth rather than collection. They emphasize flexible payment scheduling and working capital solutions, which can help unlock cash tied up in supply chains.

Reference

Core business

Home - EquityLink

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

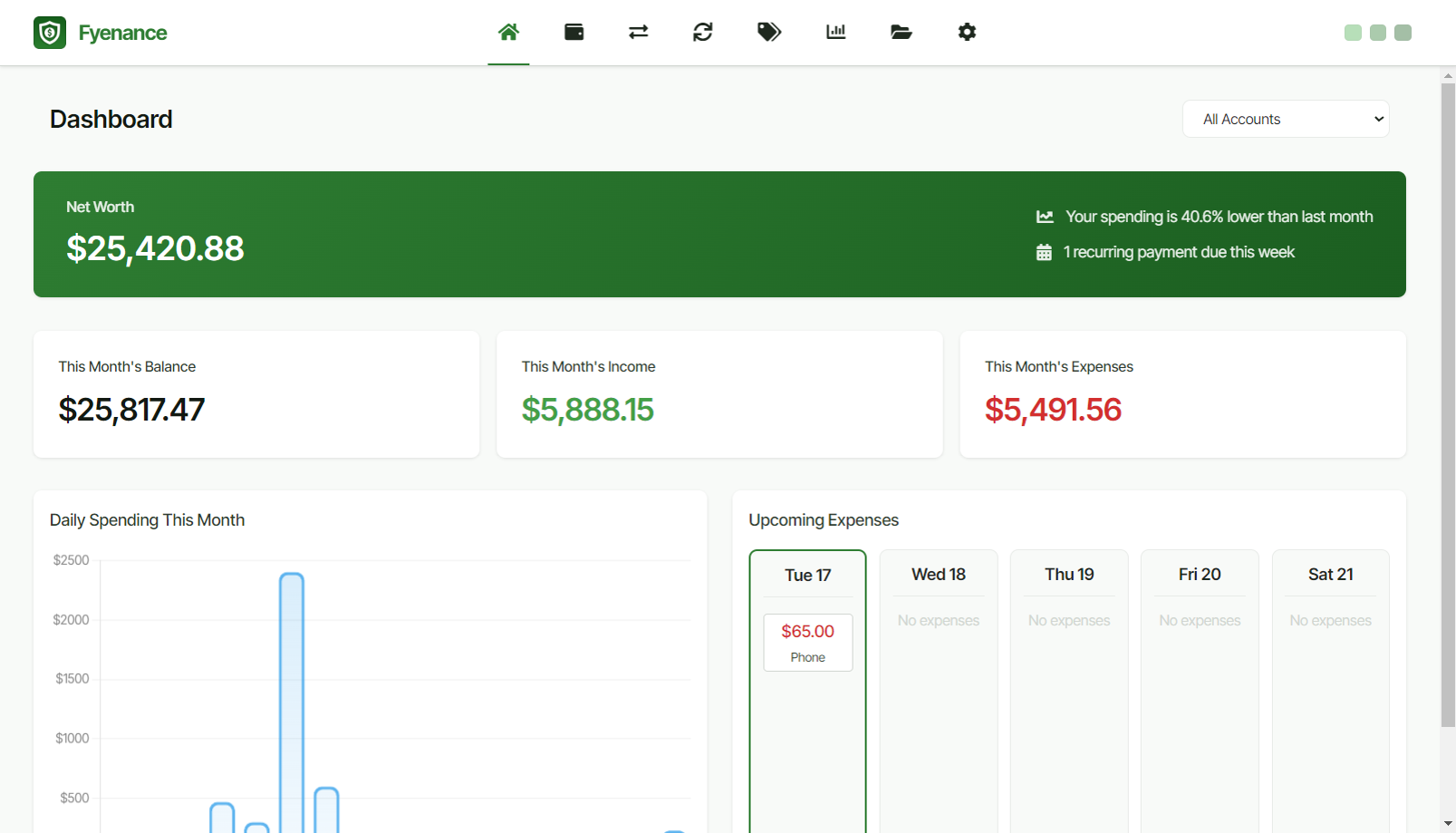

Fyenance

Go to product

Service

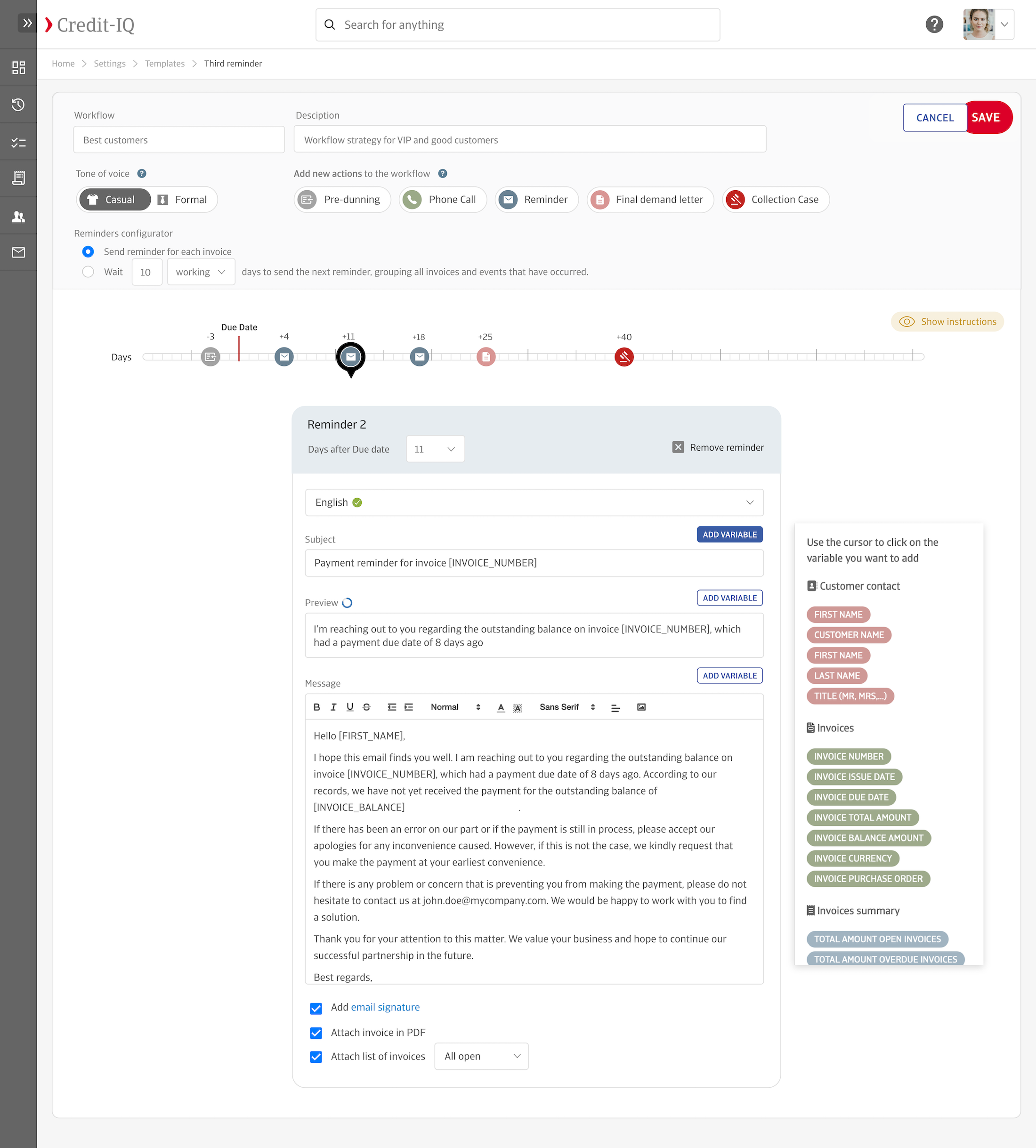

Credit-IQ

Go to product

Service

Gold Buyers

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Accounts Receivable Automation Platform

Accounting, Finance, SaaS, E-commerce, Legal Services, Retail

Credit-IQ is a comprehensive solution designed to automate and enhance accounts receivable (AR) processes for businesses across multiple industries. Our platform tackles common challenges by reducing manual work, accelerating payment collection, and improving cash flow. Credit-IQ seamlessly integrates with popular bookkeeping software to automate invoice reminders, manage unpaid invoices, and provide valuable cash flow insights. By leveraging automated workflows and customizable email templates, our platform helps businesses strengthen customer relationships and experience faster, more consistent payments. Credit-IQ addresses specific needs in sectors such as E-commerce, Legal Services, and Retail, offering multi-language support and personalized AR processes suited to diverse business operations. With Credit-IQ, enterprises scale AR operations effectively, while small and medium businesses reduce payment delays and streamline financial management.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

The finance industry in Mexico presents a dynamic landscape shaped by various factors that potential investors and professionals should consider. Regulatory frameworks are crucial, as the Comisión Nacional Bancaria y de Valores (CNBV) oversees financial institutions, ensuring compliance with laws that promote transparency and stability. Understanding these regulations is essential for navigating the sector effectively. Challenges such as economic volatility and political uncertainty can impact financial markets, demanding a thorough analysis of macroeconomic indicators. However, opportunities abound, particularly in fintech, where innovative solutions are transforming traditional banking and investment practices. The growing middle class and increasing digital adoption create a fertile ground for new financial products and services. Environmental concerns are also becoming significant, as sustainable finance gains traction. Companies are increasingly held accountable for their environmental impact, which influences investment decisions. The competitive landscape is marked by both established institutions and emerging startups, fostering a vibrant ecosystem that encourages innovation. On a global scale, Mexico's finance sector plays an essential role in attracting foreign investment, thanks to its strategic position and trade agreements like the USMCA. Thus, understanding these key considerations can provide valuable insights for anyone exploring career or investment opportunities within Mexico's finance industry.

Some interesting numbers and facts about your company results for Finance

| Country with most fitting companies | Mexico |

| Amount of fitting manufacturers | 4 |

| Amount of suitable service providers | 2 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 1997 |

| Youngest suiting company | 2021 |

Some interesting questions that has been asked about the results you have just received for Finance

What are related technologies to Finance?

Based on our calculations related technologies to Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Who are Start-Ups in the field of Finance?

Start-Ups who are working in Finance are Finvero

Which industries are mostly working on Finance?

The most represented industries which are working in Finance are Finance and Insurance, Other, IT, Software and Services, Marketing Services, Oil, Energy and Gas

How does ensun find these Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.