The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Business Finance Providers

Milton Keynes, United Kingdom

A

1-10 Employees

2021

Key takeaway

The company, Business Finance Providers, specializes in commercial finance and business loans, offering tailored broking services to help clients achieve their financial goals. With a strong reputation for client service and product knowledge, they aim to simplify the lending process and become a trusted name in financial broking.

Reference

Core business

Home - Business Finance Providers

Apply for business finance in seconds Apply Now "*" indicates required fields Your Name* First Name Last Name Email* Mobile NumberCompany Name* Office LandlineNature of Enquiry*Choose a service…Asset financeBusiness loansCommercial financeRefinancingOtherOther Privacy Policy* I agree to the privacy policy Welcome to Business Finance Providers We are a friendly professional commercial finance broker with a vast […]

Finance Partners

London, United Kingdom

A

1-10 Employees

2020

Key takeaway

Finance Partners specializes in connecting businesses in the UK with various lenders to offer tailored funding solutions based on their specific needs and creditworthiness.

Reference

Core business

Finance Partners providing funding for UK businesses

Finance Partners focus on providing funding solutions for directors and businesses in the UK. We have well established relationships with a wide range of lenders to provide the best finance package specifically for your business needs.

One Business Solutions

London, United Kingdom

A

1-10 Employees

-

Key takeaway

The company emphasizes its commitment to providing tailored financial support to empower businesses, highlighting flexible payment terms that reduce initial costs and protect cash flow. With access to multiple lending organizations, they can facilitate funding solutions that meet diverse business needs, all at no direct cost to the client.

Reference

Product

Supplier Finance - One Business Solutions

Provider Finance Offer money on your items Empower clients to get what they truly care about Increment your transformation rate Finance from £10k to 2million Supplier Finance Offer money on your items Empower clients to get what they truly care about Increment your transformation rate Finance from £10k to 2million Develop SALES WITH ONE […]

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Pitch 4 Finance

London, United Kingdom

A

1-10 Employees

2018

Key takeaway

Provide Finance is an innovative fintech company that transforms the finance landscape by connecting borrowers, lenders, and intermediaries in real-time. With a focus on tailored and fast finance solutions, they offer expert support and resources, making the financing process more accessible and manageable for clients.

Reference

Core business

Provide Finance | The Future of Funding

Choose From Over 200 Lenders Offering Their Best Property, Commercial Mortgages & Business Finance Rates - All From 1 Platform. Save Time and Money.

Finance Loans

Doncaster, United Kingdom

A

1-10 Employees

2021

Key takeaway

The company specializes in providing quick and flexible funding solutions, particularly in Development Finance, Bridging Finance, and Investment Finance, ensuring that each loan is customized to meet the specific needs of borrowers. Their proactive approach and team of experts enable them to deliver competitive financing options.

Reference

Core business

Home - Finance Loans

Modern Finance Solutions

United Kingdom

A

1-10 Employees

2015

Key takeaway

The company offers a wide range of finance solutions, including specialized financing for sectors such as engineering, aviation, construction, and renewable technology.

Reference

Service

Services – Modern Finance Solutions

Technical Connection Limited

London, United Kingdom

A

11-50 Employees

-

Key takeaway

The company highlights its extensive experience in the financial planning process, which enables it to provide valuable support to financial planners and institutions.

Reference

Service

Product Providers

CC Funding Solutions

South Derbyshire, United Kingdom

A

1-10 Employees

-

Key takeaway

The company is an independent asset financing business that offers a variety of funding solutions, including Personal Contract Purchase, Hire Purchase, and invoice finance, making it well-equipped to provide competitive financing options across different asset classes. With access to a large panel of lenders, they can secure the best rates and solutions tailored to customer needs.

Reference

Service

Business Finance - CC Funding Solutions

Short term to 6 years dependant on the lender. From a few thousand to several million pounds. Secured and unsecured available.

Creative Funding Solutions

Crawley, United Kingdom

A

11-50 Employees

2008

Key takeaway

The company, Creative Funding Solutions Ltd, provides a range of flexible funding options such as asset leasing, commercial mortgages, and loans, designed to help businesses secure assets and generate cash flow.

Reference

Service

Vendor Finance | Creative Funding Solutions

Creative Funding Solutions Ltd is a brokerage regulated by the FCA and its services are advertised through this website to introduce you to a wide panel of lenders who may or may not offer you a loan and who may pay us a commission for doing so. [fullwidth backgroundcolor="" backgroundimage=""

First Merchant Finance Plc

London, United Kingdom

A

1-10 Employees

1995

Key takeaway

First Merchant Finance Plc specializes in providing non-regulated business loans to established UK registered Limited Companies, focusing on the hospitality, leisure, and entertainment sectors. With over 25 years of experience, the company is well-equipped to support commercial financing needs.

Reference

Core business

First Merchant Finance | First Merchant Finance

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

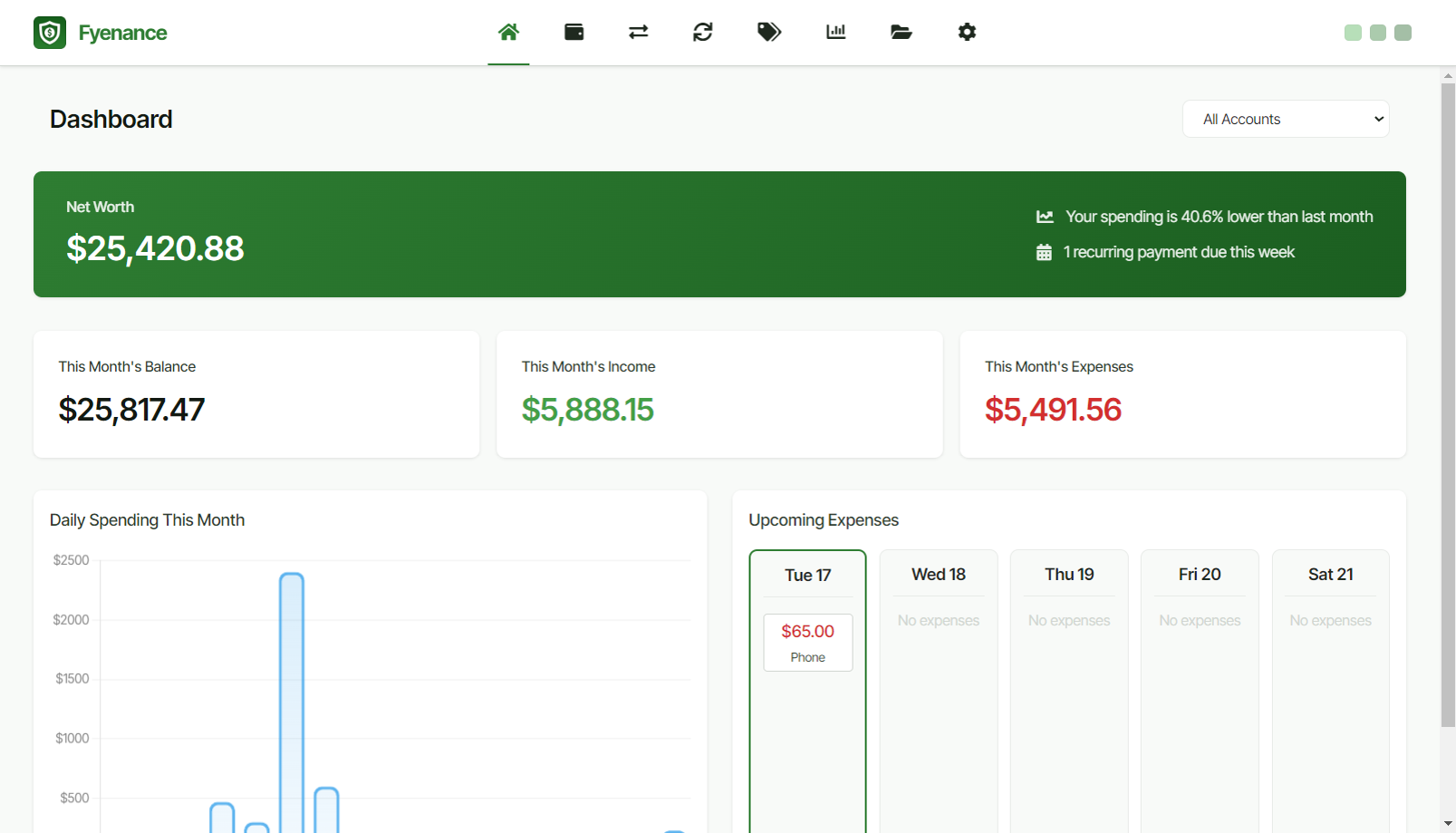

Fyenance

Go to product

Service

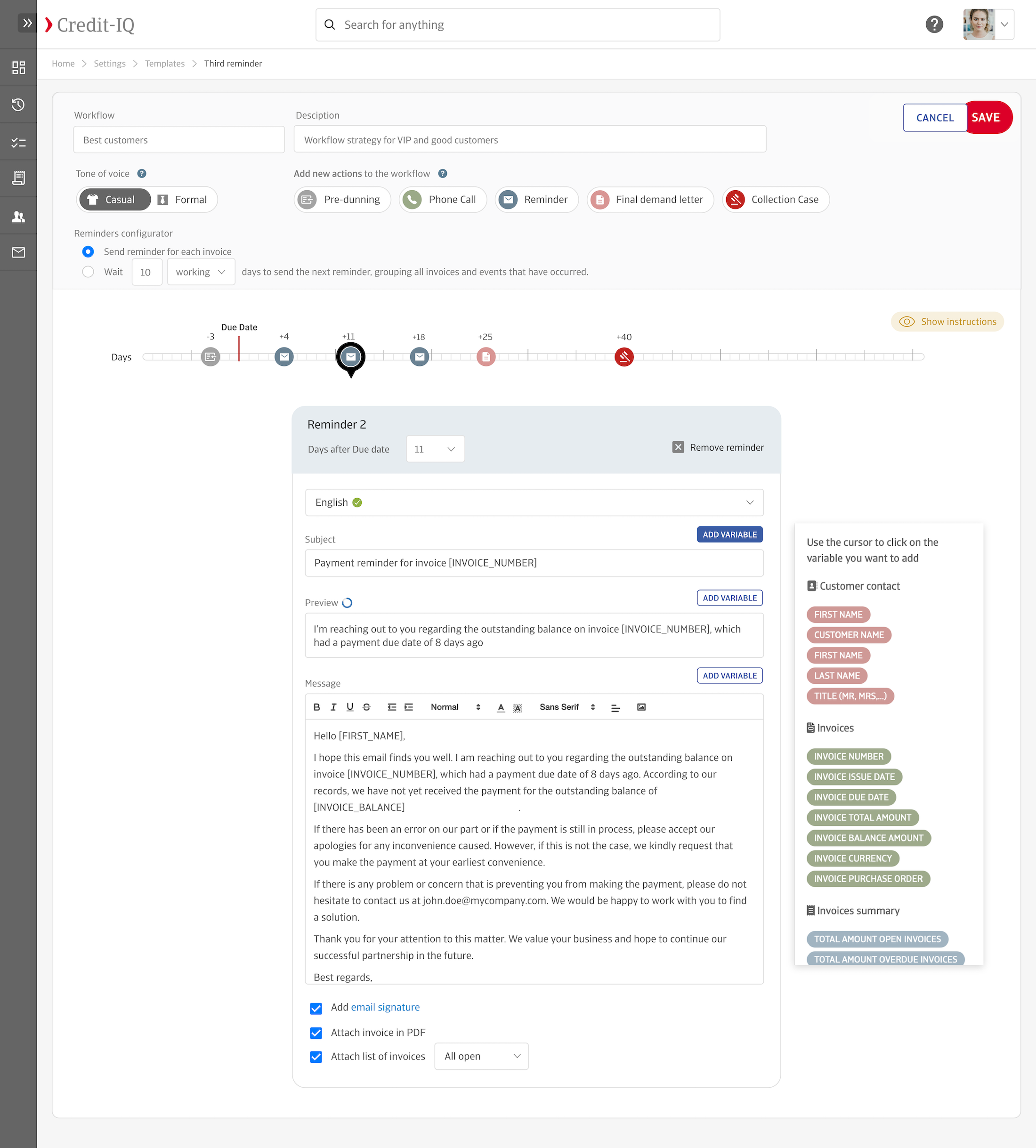

Credit-IQ

Go to product

Service

Gold Buyers

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Accounts Receivable Automation Platform

Accounting, Finance, SaaS, E-commerce, Legal Services, Retail

Credit-IQ is a comprehensive solution designed to automate and enhance accounts receivable (AR) processes for businesses across multiple industries. Our platform tackles common challenges by reducing manual work, accelerating payment collection, and improving cash flow. Credit-IQ seamlessly integrates with popular bookkeeping software to automate invoice reminders, manage unpaid invoices, and provide valuable cash flow insights. By leveraging automated workflows and customizable email templates, our platform helps businesses strengthen customer relationships and experience faster, more consistent payments. Credit-IQ addresses specific needs in sectors such as E-commerce, Legal Services, and Retail, offering multi-language support and personalized AR processes suited to diverse business operations. With Credit-IQ, enterprises scale AR operations effectively, while small and medium businesses reduce payment delays and streamline financial management.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the Finance industry in the United Kingdom, several key considerations come into play. Regulatory compliance is paramount, as the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) impose stringent rules that govern financial practices and protect consumers. Understanding these regulations is essential for navigating the industry effectively. The competitive landscape is robust, with numerous established firms and innovative fintech startups vying for market share. This presents both challenges and opportunities, particularly in areas like digital banking and investment technologies, where disruption is common. Environmental concerns are increasingly relevant, as financial institutions are under pressure to adopt sustainable practices and consider the impact of their investments on climate change. Additionally, the UK's position in the global market remains significant, influenced by factors such as Brexit, which has reshaped trade relationships and regulatory frameworks. Economic fluctuations and geopolitical developments can also affect investment strategies and risk assessments. Lastly, potential entrants should be aware of the evolving consumer preferences towards personalized financial services and the growing importance of cybersecurity in protecting sensitive financial data. These aspects collectively shape the Finance industry's landscape in the UK, making thorough research essential for anyone considering involvement in this sector.

Some interesting numbers and facts about your company results for Finance

| Country with most fitting companies | United Kingdom |

| Amount of fitting manufacturers | 2035 |

| Amount of suitable service providers | 4326 |

| Average amount of employees | 1-10 |

| Oldest suiting company | 1995 |

| Youngest suiting company | 2021 |

Some interesting questions that has been asked about the results you have just received for Finance

What are related technologies to Finance?

Based on our calculations related technologies to Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Who are Start-Ups in the field of Finance?

Start-Ups who are working in Finance are Business Finance Providers, Finance Loans

Which industries are mostly working on Finance?

The most represented industries which are working in Finance are Finance and Insurance, Other, Real Estate, IT, Software and Services, Consulting

How does ensun find these Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.