The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Faktorama SA

Warsaw, Poland

B

1-10 Employees

2013

Key takeaway

The company offers various financing options, including purchase order financing, invoice financing, and inventory financing, with periods ranging from 30 to 150 days, enabling businesses to access working capital quickly and easily.

Reference

Service

Our Services – Faktorama

SmartFunding.sg

Gdańsk, Poland

B

1-10 Employees

2016

Key takeaway

SmartFunding, a licensed regional financing platform backed by ASX-listed Fatfish Group Ltd and Sweden-listed Abelco Investment Group AB, offers investment opportunities with returns of up to 24%. The platform supports SMEs with flexible financing solutions, making it an attractive option for investors looking to grow their portfolio.

Reference

Core business

SmartFunding - The Smart SME Financing Platform

We are a Licensed Regional Financing Platform · Grow Your Investment With Returns Of Up To 24% · Scale Your Business With Flexible Financing Solutions.

Creamfinance

Warsaw, Poland

B

101-250 Employees

2012

Key takeaway

Creamfinance LLC is a consumer finance services provider that specializes in offering unsecured online loans, ranging from €100 to €10,000, with a focus on convenience and speed. Utilizing advanced algorithms and machine-learning capabilities, Creamfinance aims to streamline the personal loan process, making money readily available to consumers worldwide.

Reference

Core business

Creamfinance - Smart Data. Smart Loans.

Creamfinance makes money available by providing one-click loans to consumers globally. Visit our site to learn more about jobs or investment opportunities.

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

FINANTEQ S A

Lublin, Poland

B

51-100 Employees

2014

Key takeaway

FINANTEQ is a prominent player in the mobile finance sector, offering comprehensive solutions and components for mobile banking. Their expertise and innovative products, such as SuperWallet and Mobile Token, position them as a key partner for banks and fintechs looking to enhance their mobile offerings.

Reference

Core business

FINANTEQ - We help banks and fintechs winning in mobile

FINANTEQ is a software and IT consulting company focused on mobile banking. We provide complete mobile solutions as well as ready to integrate add-ons

FinPack

Szczecin, Poland

B

101-250 Employees

2012

Key takeaway

FinPack is directly integrated with banking systems, allowing clients to access loan funds within 24 hours of their meeting. With over 3,500 experts utilizing FinPack for comparing loans, assessing creditworthiness, and generating applications, it serves as a key resource for financial professionals in Poland.

Reference

Core business

FinPack.pl - pakiet usług dla ekspertów finansowych

Fintiera

Wrocław, Poland

B

11-50 Employees

2019

Key takeaway

Fintiera specializes in IT solutions that enhance payment management processes and banking accounting, particularly focusing on treasury operations. Their expertise in SAP ERP systems and commitment to efficient business process management position them as key players in the finance sector.

Reference

Core business

Fintiera - IT Solutions streamlining payment management processes

Fintiera is a company offering IT solutions streamlining payment management processes and banking accounting as well as supporting liquidity reporting and communication with the tax administration and financial institutions.

Fizen.com

Poland

B

1-10 Employees

2021

Key takeaway

Fizen offers a comprehensive financial solution that integrates traditional and digital finance, emphasizing security and efficiency through technologies like PSD2 and open banking. Their services include seamless payment solutions, advanced bulk payments, and tools for effective financial planning, making Fizen a valuable resource for businesses looking to enhance their financial operations.

Reference

Product

Fizen Solutions - meet smart open banking technology.

Money4You

Warsaw, Poland

B

1-10 Employees

-

Key takeaway

Money4You is a company that offers extensive financial intermediation services, assisting clients in selecting the best mortgage, cash loan, and life insurance. Their experienced experts leverage their knowledge and contacts to help businesses secure funding for operations and investment projects.

Reference

Core business

Money 4 You | Eksperci finansowi

PROPERtip

Warsaw, Poland

B

1-10 Employees

-

Key takeaway

ProperTip emphasizes its expertise in providing mortgage services, ensuring clients receive the best financing conditions and support throughout the property buying process. Their team of specialists is dedicated to guiding clients through the complexities of securing a mortgage, making it a cost-effective and expat-friendly option for those looking to invest in real estate.

Reference

Service

Our services | PROPERtip

Our services Consultancy of your mortgage loan options Comprehensive analysis of the mortgage loan market Guarantee of the best financing condiitons Assistance with every single step of the property purchase process Main communication hub for all the parties involved Support in creating contracts and choosing the optimal notary service Individual set up of the property […]

Femion Technology

Wrocław, Poland

B

51-100 Employees

2011

Key takeaway

Femion Technology is a pioneer in Open Banking in Poland, aiming to enhance personalized financial services using data traditionally reserved for banks. They are expanding deferred payment services to all entrepreneurs as an alternative to trade credit or factoring.

Reference

Core business

Femion Technology

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

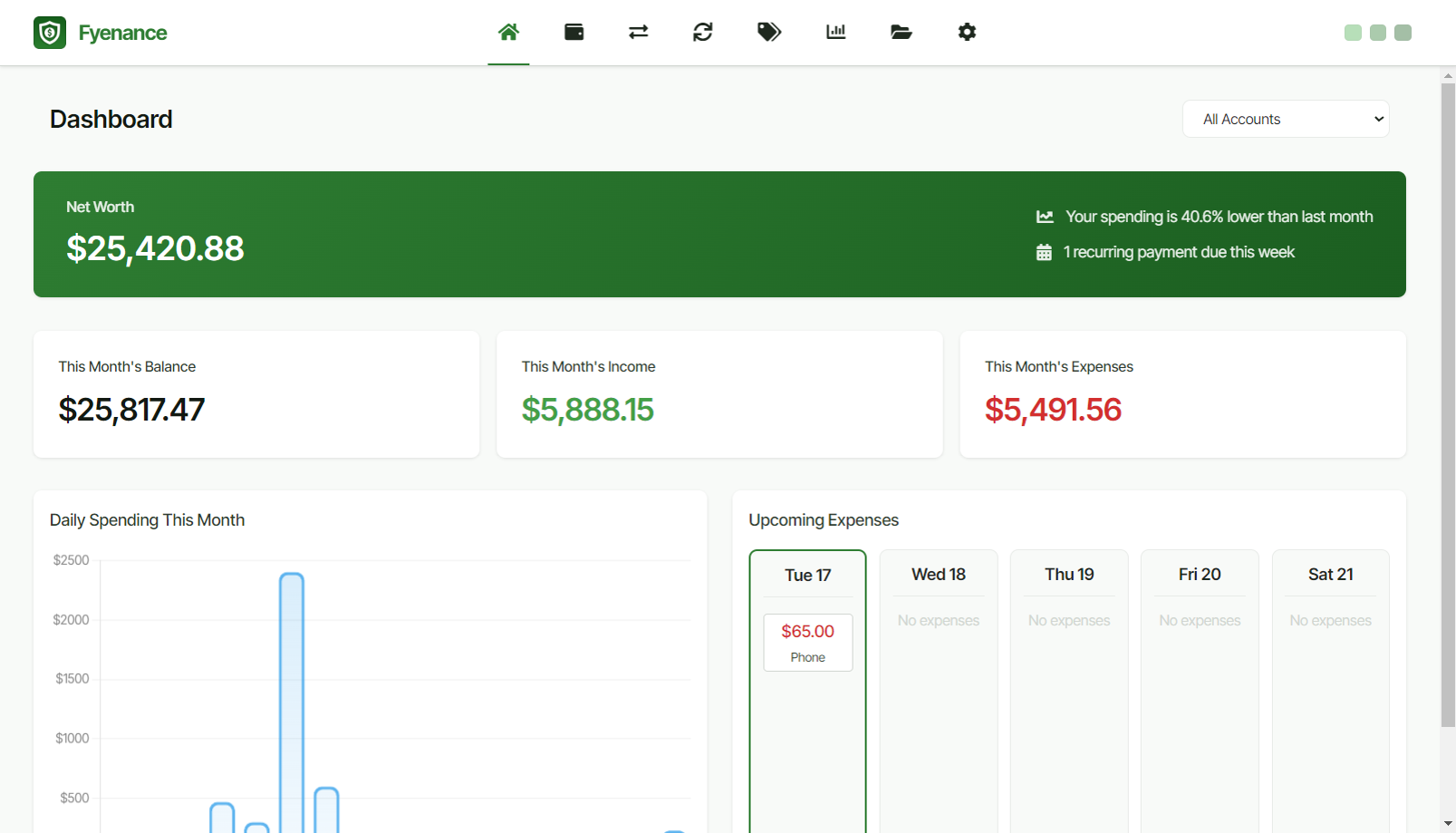

Fyenance

Go to product

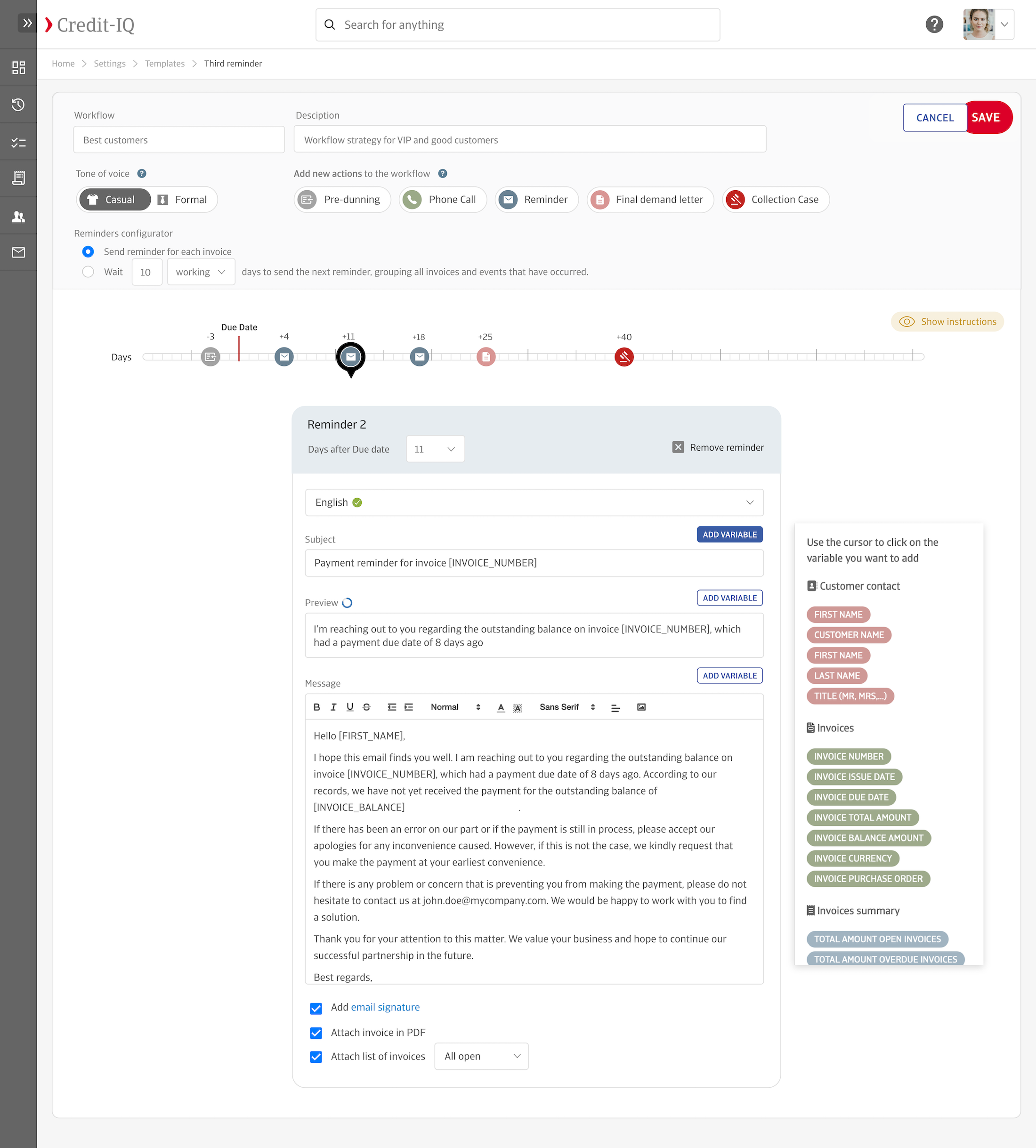

Service

Credit-IQ

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Accounts Receivable Automation Platform

Accounting, Finance, SaaS, E-commerce, Legal Services, Retail

Credit-IQ is a comprehensive solution designed to automate and enhance accounts receivable (AR) processes for businesses across multiple industries. Our platform tackles common challenges by reducing manual work, accelerating payment collection, and improving cash flow. Credit-IQ seamlessly integrates with popular bookkeeping software to automate invoice reminders, manage unpaid invoices, and provide valuable cash flow insights. By leveraging automated workflows and customizable email templates, our platform helps businesses strengthen customer relationships and experience faster, more consistent payments. Credit-IQ addresses specific needs in sectors such as E-commerce, Legal Services, and Retail, offering multi-language support and personalized AR processes suited to diverse business operations. With Credit-IQ, enterprises scale AR operations effectively, while small and medium businesses reduce payment delays and streamline financial management.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the finance industry in Poland, several key considerations come into play. The regulatory framework is robust, with the Polish Financial Supervision Authority (KNF) overseeing compliance and consumer protection, which is crucial for maintaining market integrity. Understanding the local banking system is important, especially the role of major banks and the impact of European Union regulations, as Poland is an EU member state. The competitive landscape features both local and international players, providing various opportunities for collaboration and innovation. Emerging fintech companies are reshaping traditional finance, offering new services and improving efficiency, which presents both challenges and opportunities for established institutions. Additionally, environmental concerns are gaining traction, with a growing emphasis on sustainable finance and investments that align with environmental, social, and governance (ESG) criteria. The global market relevance of Poland's finance sector is increasing, particularly as it serves as a gateway for businesses looking to enter Central and Eastern Europe. Investors should also be aware of potential economic challenges, such as inflation and currency fluctuations, which can impact returns. Overall, a thorough understanding of these factors can significantly enhance the decision-making process for anyone interested in the finance industry in Poland.

Some interesting numbers and facts about your company results for Finance

| Country with most fitting companies | Poland |

| Amount of fitting manufacturers | 11 |

| Amount of suitable service providers | 13 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 2011 |

| Youngest suiting company | 2021 |

Some interesting questions that has been asked about the results you have just received for Finance

What are related technologies to Finance?

Based on our calculations related technologies to Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Who are Start-Ups in the field of Finance?

Start-Ups who are working in Finance are Fizen.com

Which industries are mostly working on Finance?

The most represented industries which are working in Finance are Finance and Insurance, IT, Software and Services, Business Services, Consulting, Other

How does ensun find these Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.