The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

finanziat GmbH

Cologne, Germany

A

1-10 Employees

-

Key takeaway

The company specializes in franchise startups and aims to connect you with the right partners to meet your specific needs. They emphasize that overcoming the crucial hurdle of financing is essential for achieving success.

Reference

Service

SERVICE | finanziatmme

Finiata

Berlin, Germany

A

101-250 Employees

2016

Key takeaway

Finiata offers innovative credit solutions tailored for small businesses, enabling them to access working capital quickly. Their platform allows for seamless integration of financial products, helping partners enhance their offerings and support B2B relationships through efficient funding and cash flow management.

Reference

Core business

Finiata - we simplify business lending

Grow your sales by providing financing to your B2B customers

Fiduciam Deutschland

Frankfurt, Germany

A

1-10 Employees

2014

Key takeaway

Fiduciam GmbH specializes in secured lending to SMEs, emphasizing its long-term commitment and ability to manage complex transactions efficiently. The company, backed by institutional investors and having collaborated with the Welsh government to finance a new production facility, highlights its expertise in facilitating substantial funding for viable businesses.

Reference

Core business

Fiduciam – Secured lending to SMEs

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

LGFinance

Emsdetten, Germany

A

1-10 Employees

-

Key takeaway

LGFinance offers a comprehensive credit management module that meets all criteria for approval and utilizes current variable interest rates and market data for effective portfolio assessment and reporting. The company's innovative platform is designed to address the specific financial needs of municipal associations.

Reference

Core business

LGFinance

Jens Lorenz Finanzdienstleistungen

Weisendorf, Germany

A

1-10 Employees

-

Key takeaway

Easyfinanzierung24 is an independent provider of private financing, focusing on creating tailored financial solutions to meet individual customer needs. Their extensive partner network, diverse product offerings, and expert advice on public funds and grant programs set them apart in the competitive landscape.

Reference

Core business

Easyfinanzierung24 - Ihr Anbieter für private Finanzierungen

Leasingagentur Böther

Norderstedt, Germany

A

1-10 Employees

-

Key takeaway

The company has been successfully operating for many years in the area of financing for small and medium-sized businesses, working collaboratively with renowned banks and institutions.

Reference

Service

Finanzierung - Leasingagentur Böther

LeFa FINANZ

Ratingen, Germany

A

1-10 Employees

2019

Key takeaway

LeFa FINANZ specializes in providing tailored financing solutions that enhance companies' access to the capital market. They emphasize the importance of liquidity for business success and offer expert advice and attractive terms, ensuring that their clients' financing needs are prioritized.

Reference

Service

Factoring - LeFa FINANZ

S5 - Die Finanzpartner GmbH

Munich, Germany

A

11-50 Employees

-

Key takeaway

S5 – Die Finanzpartner GmbH is a specialized company in independent financial consulting and the mediation of financial products, with a strong focus on areas such as money and asset investment, insurance, retirement planning, building savings, and real estate financing.

Reference

Service

Leistungen – S5 – Die Finanzpartner GmbH

HRP Factoring & Credit Insurance Broker GmbH

Neustadt an der Donau, Germany

A

1-10 Employees

-

Key takeaway

The company highlights its expertise in the financing sector, emphasizing its access to international financing and reinsurance solutions that cater to the evolving and individualized needs of entrepreneurs.

Reference

Core business

Factoring & Credit Insurance Broker

German Finanzleasing GmbH

Höhenkirchen-Siegertsbrunn, Germany

A

11-50 Employees

2017

Key takeaway

The company specializes in financing options such as leasing, hire purchase, and rentals for commercial customers in the luxury vehicle segment. With 30 years of collaboration with leading automotive manufacturers, they effectively market their vehicle fleet and offer comprehensive financial solutions.

Reference

Core business

FINANCE | German Finanzleasing GmbH

WE FINANCE & LEASE NEW CARS TO COMMERCIAL CUSTOMERS YOU WANT TO BECOME OUR PARTNER ?Bitte aktiviere JavaScript in deinem Browser, um dieses Formular fertigzustellen.Bitte aktiviere JavaScript in deinem Browser, um dieses Formular fertigzustellen.Name *VornameNachnameCompany Name *Email *Country *Please selectAfghanistanAlbaniaAlgeriaAndorraAngolaAntigua…

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

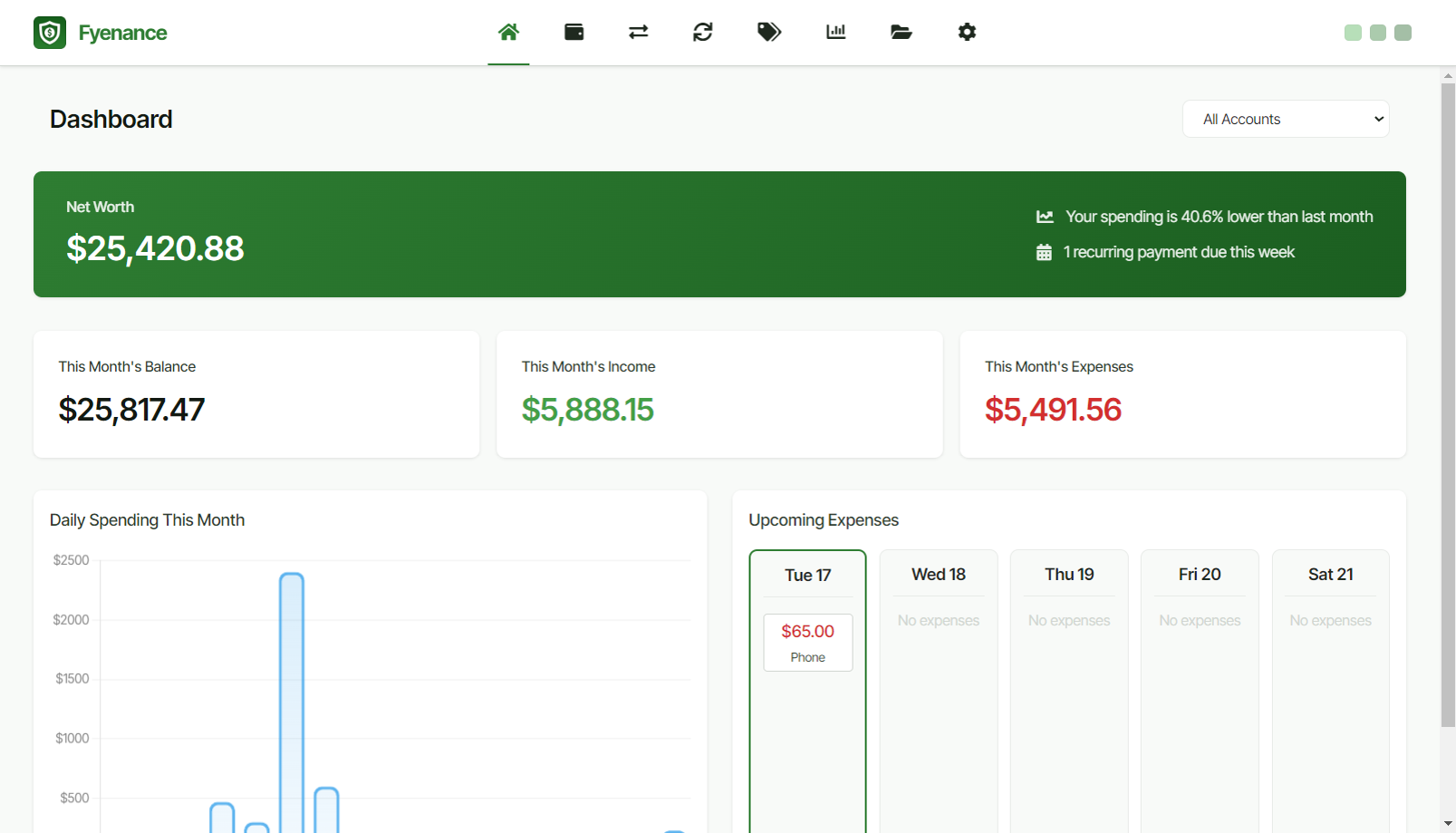

Fyenance

Go to product

Service

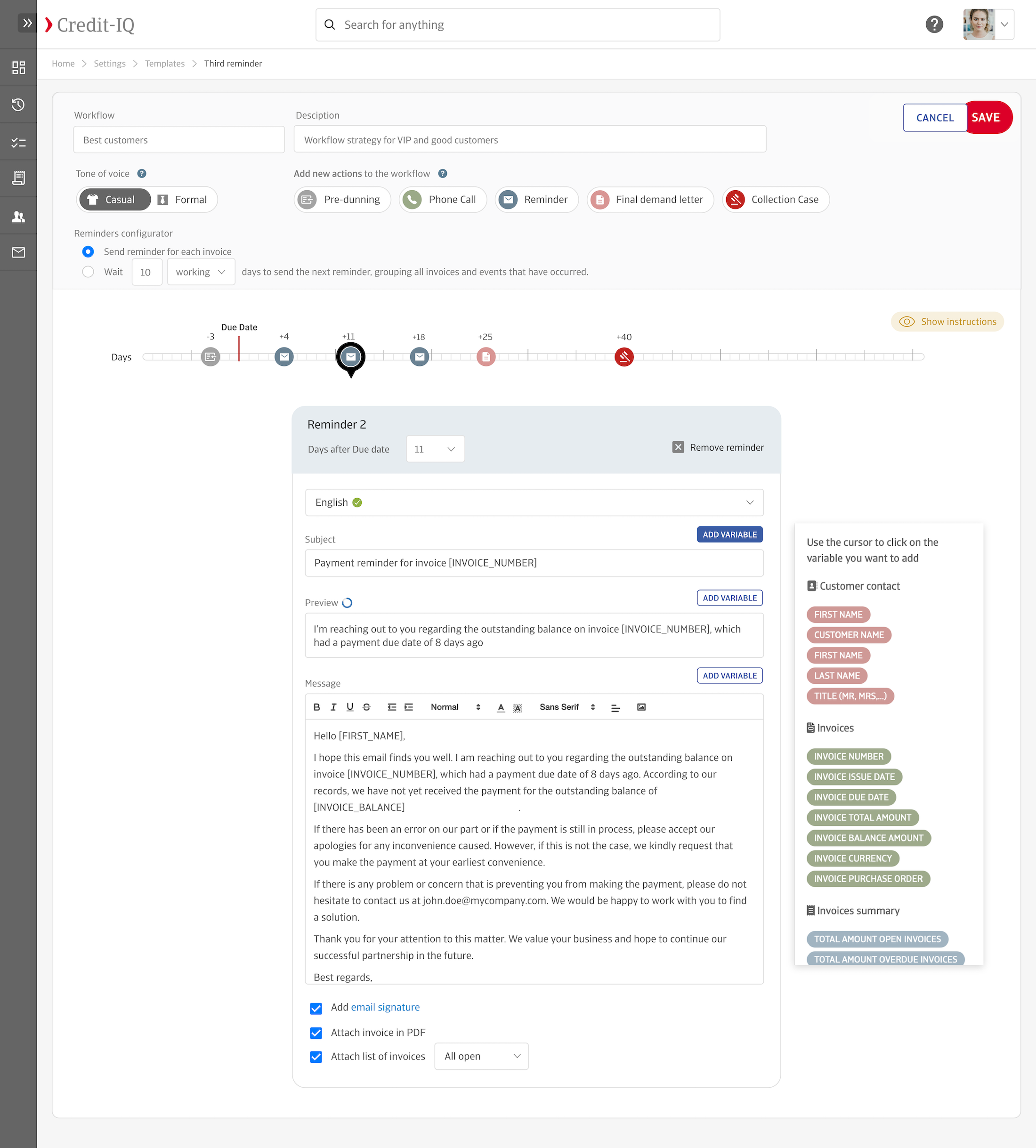

Credit-IQ

Go to product

Service

Gold Buyers

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Accounts Receivable Automation Platform

Accounting, Finance, SaaS, E-commerce, Legal Services, Retail

Credit-IQ is a comprehensive solution designed to automate and enhance accounts receivable (AR) processes for businesses across multiple industries. Our platform tackles common challenges by reducing manual work, accelerating payment collection, and improving cash flow. Credit-IQ seamlessly integrates with popular bookkeeping software to automate invoice reminders, manage unpaid invoices, and provide valuable cash flow insights. By leveraging automated workflows and customizable email templates, our platform helps businesses strengthen customer relationships and experience faster, more consistent payments. Credit-IQ addresses specific needs in sectors such as E-commerce, Legal Services, and Retail, offering multi-language support and personalized AR processes suited to diverse business operations. With Credit-IQ, enterprises scale AR operations effectively, while small and medium businesses reduce payment delays and streamline financial management.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

The finance industry in Germany is characterized by a robust regulatory framework shaped by both national and European Union laws, with institutions like BaFin overseeing compliance and consumer protection. Understanding these regulations is crucial for anyone entering the field, as they dictate operational standards and influence company strategies. The competitive landscape is intense, with established banks, fintech startups, and asset management firms vying for market share, all adapting to digital transformation trends. Additionally, environmental concerns are gaining traction, as financial institutions are increasingly expected to address sustainability in their investment strategies, aligning with global initiatives like the Paris Agreement. Opportunities abound in areas such as sustainable finance, digital banking, and innovative financial technology solutions. Germany's strong economic position within Europe and its status as a financial hub provide access to a diverse range of markets and investment opportunities. However, challenges include navigating market volatility and geopolitical uncertainties, particularly in light of recent global events. Awareness of these dynamics is essential for anyone looking to establish a career or business in Germany's finance sector, as they can significantly impact decision-making and strategic planning. Overall, a thorough understanding of the regulatory environment, competitive dynamics, and emerging trends is vital for success in this multifaceted industry.

Some interesting numbers and facts about your company results for Finance

| Country with most fitting companies | Germany |

| Amount of fitting manufacturers | 182 |

| Amount of suitable service providers | 431 |

| Average amount of employees | 1-10 |

| Oldest suiting company | 2014 |

| Youngest suiting company | 2019 |

Some interesting questions that has been asked about the results you have just received for Finance

What are related technologies to Finance?

Based on our calculations related technologies to Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Finance?

The most represented industries which are working in Finance are Finance and Insurance, Other, IT, Software and Services, Consulting, Real Estate

How does ensun find these Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.