The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

ZZFinancing.com

Jerusalem, Israel

B

1-10 Employees

-

Key takeaway

The company specializes in providing international financing and liquidity solutions for high net-worth individuals and business entities, emphasizing a streamlined process that does not require personal guarantees or credit checks. They offer fast, fixed-interest loans, with the ability to pledge publicly-traded securities as collateral, ensuring quick access to funds.

Reference

Core business

ZZFinancing.com - International Financing Solutions. We solve problems. We provide solutions. FAST LOW FIXED-INTEREST LOANS UP TO $1+ BILLION USD. Quick Liquidity / Fast Funding available in 1-3 weeks. Contact us today.

Inside Out Finance

Tel-Aviv, Israel

B

1-10 Employees

2020

Key takeaway

Inside Out Finance is a specialized financial firm that supports high-tech companies with their financial needs from incorporation and helps them establish operations in both Israel and the United States.

Reference

Product

Portfolio – Inside Out Finance

Rhino Eco

Tel-Aviv, Israel

B

1-10 Employees

2021

Key takeaway

The company offers an AI-powered point-of-sale platform that provides tailored solar financing options, allowing clients to receive personalized digital financing offers in under 60 seconds. This streamlined approach eliminates the need for sales reps to navigate multiple lending platforms, making solar financing more accessible and efficient.

Reference

Core business

Rhino Eco - Solar Financing Made Easy

Rhino-eco is providing solar dealers with a simple point-of-sale financing platform offering flexible & tailored financing for homeowners wishing to go solar.

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

iCapital Ltd.

Tel-Aviv, Israel

B

1-10 Employees

2016

Key takeaway

The company offers a range of automated solutions specifically designed for banks, insurance companies, financial brokers, and investment firms. Their iPro platform enhances the efficiency of financial product distribution, facilitating better pricing, promotions, and relationships between financial vendors and brokers.

Reference

Product

iPro – iCapital

iPro is our solution for financial vendors - automating their relationship with the brokers in terms of pricing, promotions and distribution of the financial products. iPro is aimed at investment firms, insurance companies and other financial vendors that create financial products and distribute them through distribution channels. By using iPro financial vendors increase the efficiency of their

WaBo FinTech

Mate Asher Regional Council, Israel

B

1-10 Employees

2015

Key takeaway

WaBo FinTech is a peer-to-peer microloans platform that utilizes advanced financial risk management tools and innovative technologies, including deep learning AI and blockchain, to enhance lending processes. Their unique algorithm assesses borrowers' creditworthiness through behavioral profiling, thereby improving the likelihood of repayment.

Reference

Core business

Home | WaBo FinTech

Balance

Tel-Aviv, Israel

B

11-50 Employees

2020

Key takeaway

Balance offers a comprehensive B2B payments processing solution that includes financing options such as net 30 terms and invoice factoring, designed to streamline business transactions and enhance cash flow. Their tools support digital transformation and provide diverse payment methods, making it easier for wholesalers to manage payments effectively.

Reference

Product

Balance | B2B Payments Processor for Wholesalers

Launch your B2B ecommerce sales this year with a B2B payments processor for wholesalers that offers net 30 terms, invoice factoring, and marketplace take rates.

Open-Finance.ai

Nes Ziona, Israel

B

11-50 Employees

2021

Key takeaway

Open-Finance.ai enables financial institutions to leverage customers' financial data through open banking technology and AI, enhancing decision-making and creating innovative financial solutions. Their partnership with FICO aims to improve the speed and accuracy of credit and insurance decisions, making it a valuable resource for banks and fintechs.

Reference

Core business

Open Finance - Open Banking for everyone

Connect with open banking with ease.

Loan in Click

Tel-Aviv, Israel

B

11-50 Employees

2017

Key takeaway

Loan In Click provides an innovative platform that enables customers to submit loan requests quickly and securely, streamlining the loan application process. With features like a secure file transfer protocol and a comprehensive loan administration panel, the company enhances efficiency in managing digital loans.

Reference

Core business

Home | Loan In Click | Loans Platform

Loan in click offers a flexible & secure loan administration panel to manage the whole process in the digital loans platform. Verification - Offering - Signing

PBO-Prime Business Office

Hod HaSharon, Israel

B

1-10 Employees

2011

Key takeaway

PBO-OBS Global Group offers a comprehensive range of financial services, including access to project funding, corporate loans, equity, and venture capital investment. Their expertise in non-traditional capital solutions supports entrepreneurs and enterprises in achieving their growth ambitions.

Reference

Core business

PBO - Prime Business Office | Project Funding

PBO-Prime Business Office, Advisory firm,M&A,Project Funding,Private Equity,Venture Capital,Bank Instruments,Monetization, Contact +55 21 99210 1129

Keren Finance Trade Solutions

Gedera, Israel

B

1-10 Employees

2008

Key takeaway

Keren Finance specializes in providing structured trade finance solutions for SMEs, emphasizing their ability to meet specific international trade finance needs. They offer uncollateralized Letters of Credit, allowing clients to access funding quickly without tying up their capital, with a commitment to deliver these instruments efficiently within 2-3 working days.

Reference

Core business

Keren Finance - Committed To Helping Our Clients Succeed

Why Choose Keren Finance? Professional And Experienced Company, we had the time to build a strong client base and cumulate priceless experience. Professional And Expirienced Company. Committed To Helping Our Clients Succeed.

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

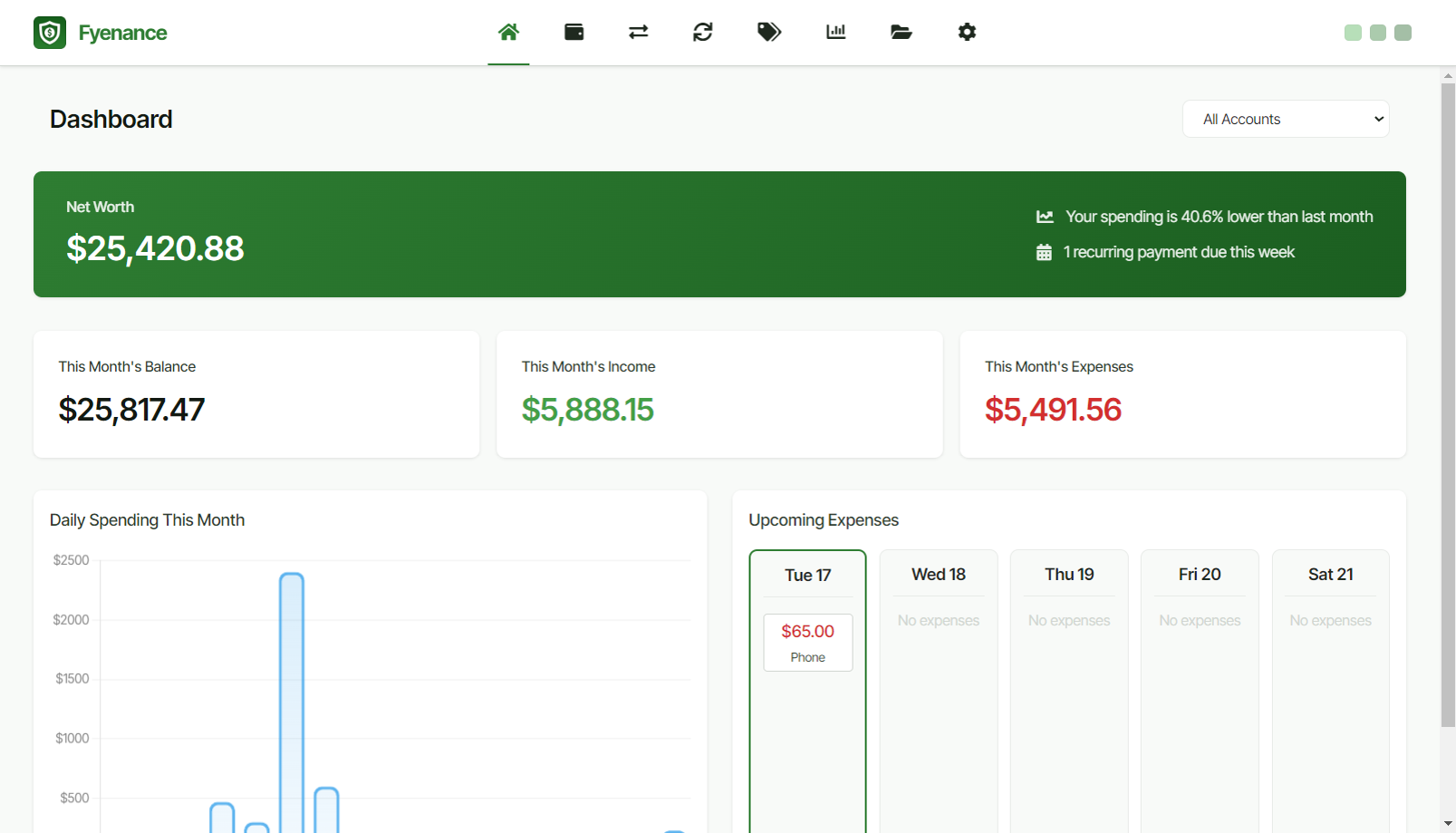

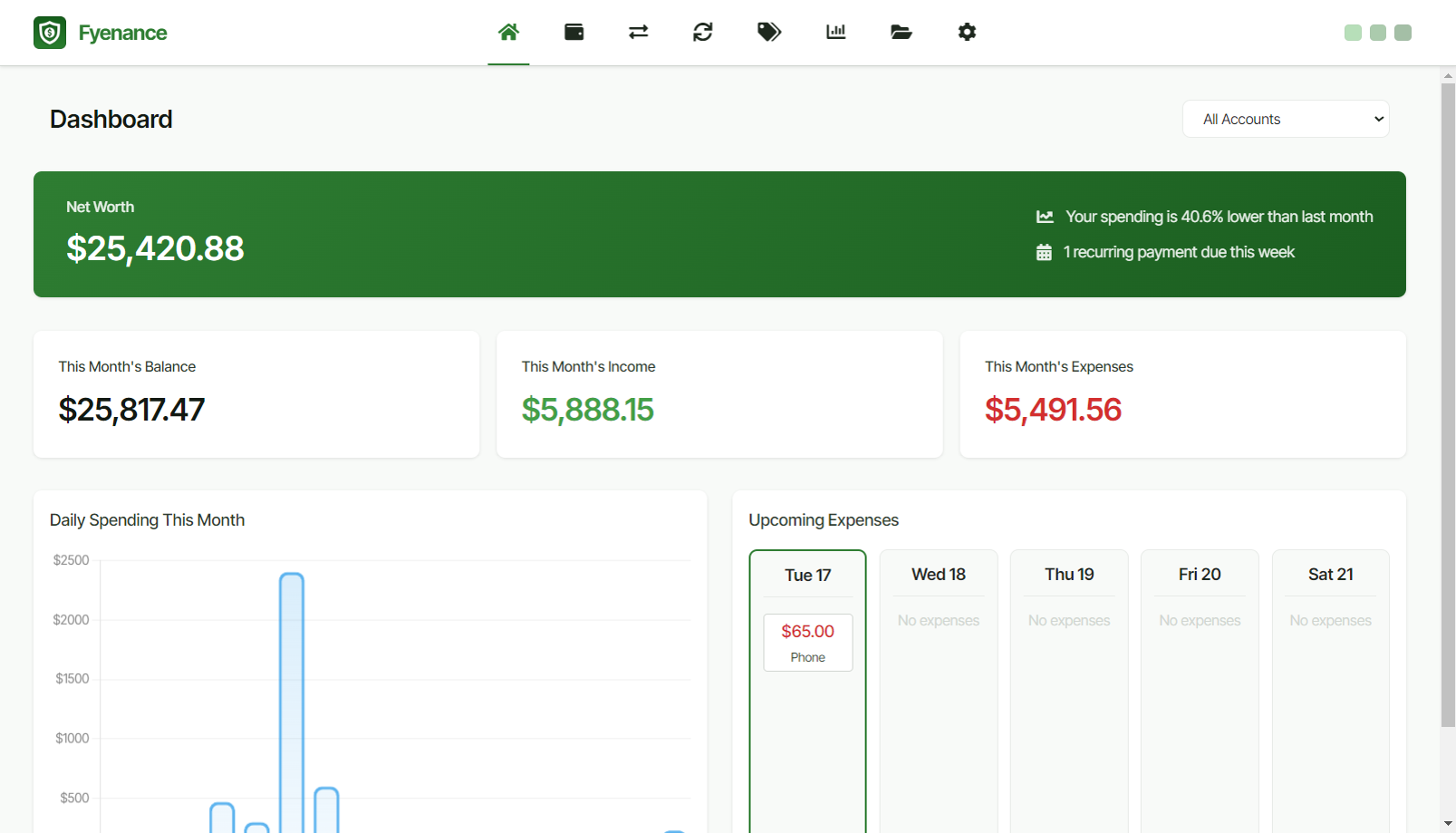

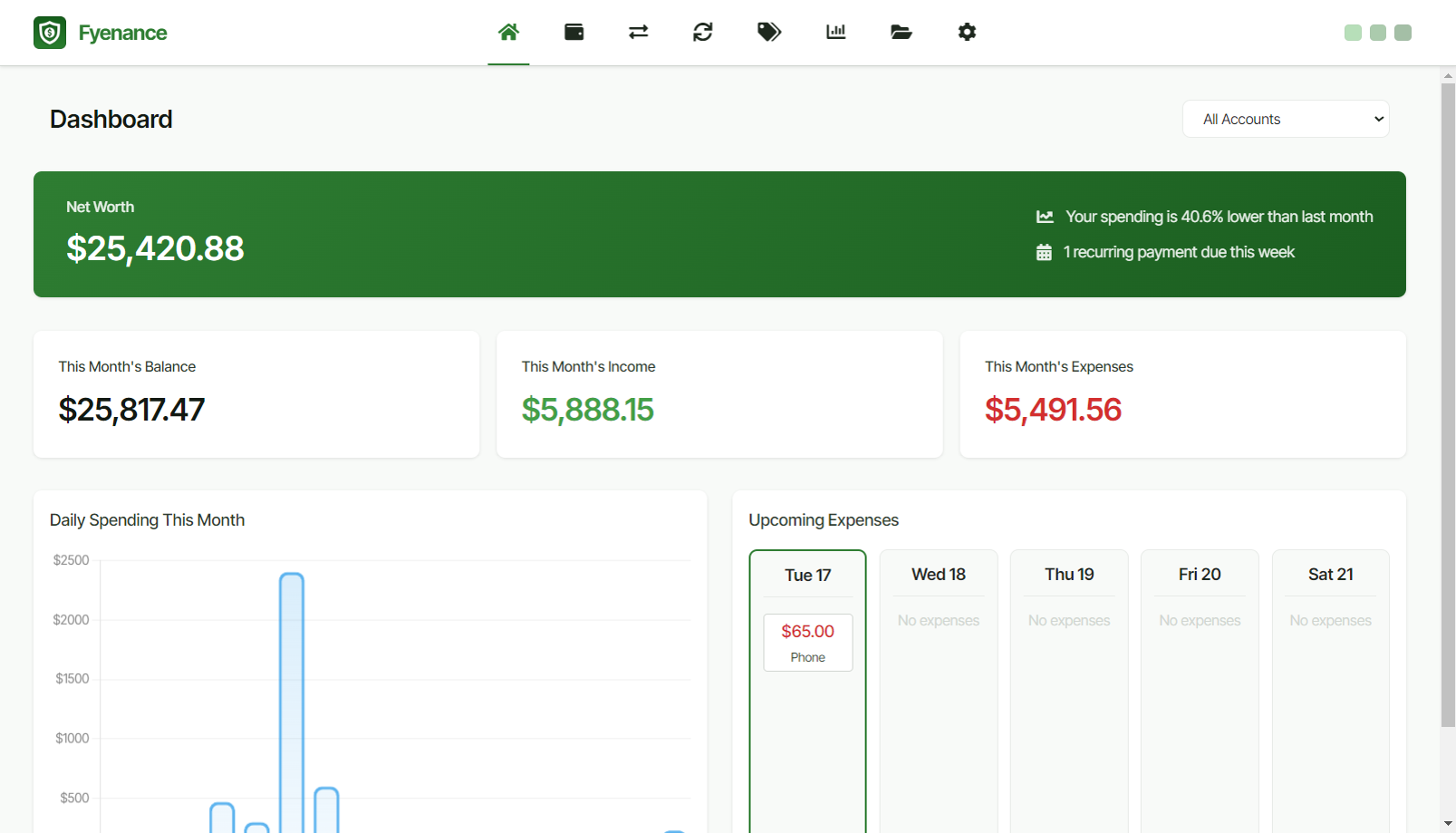

Product

Fyenance

Go to product

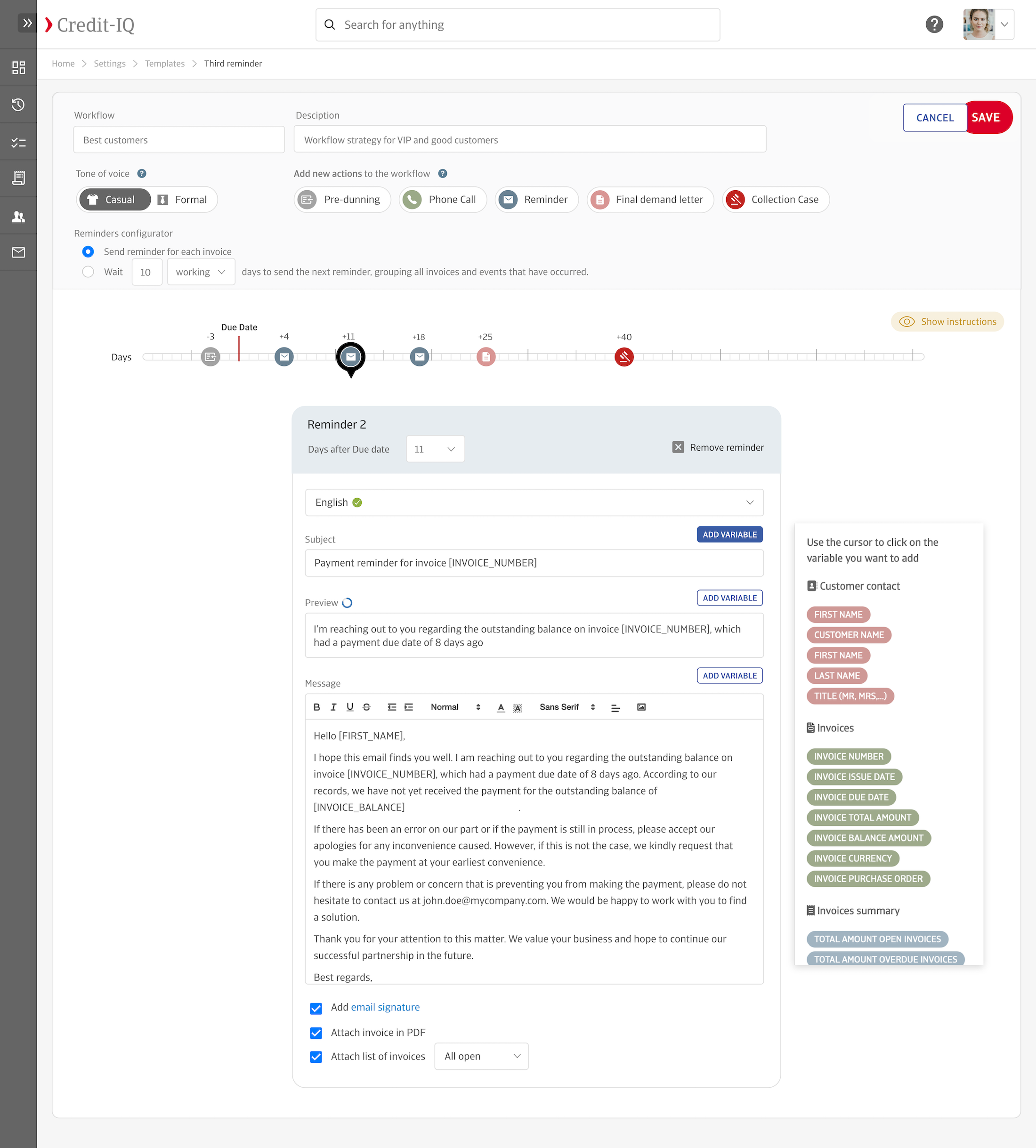

Service

Credit-IQ

Go to product

Service

Gold Buyers

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Accounts Receivable Automation Platform

Accounting, Finance, SaaS, E-commerce, Legal Services, Retail

Credit-IQ is a comprehensive solution designed to automate and enhance accounts receivable (AR) processes for businesses across multiple industries. Our platform tackles common challenges by reducing manual work, accelerating payment collection, and improving cash flow. Credit-IQ seamlessly integrates with popular bookkeeping software to automate invoice reminders, manage unpaid invoices, and provide valuable cash flow insights. By leveraging automated workflows and customizable email templates, our platform helps businesses strengthen customer relationships and experience faster, more consistent payments. Credit-IQ addresses specific needs in sectors such as E-commerce, Legal Services, and Retail, offering multi-language support and personalized AR processes suited to diverse business operations. With Credit-IQ, enterprises scale AR operations effectively, while small and medium businesses reduce payment delays and streamline financial management.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the finance industry in Israel, it is crucial to consider several factors that shape the landscape. The country boasts a robust regulatory framework overseen by the Israel Securities Authority (ISA) and the Bank of Israel, which ensures transparency and stability within the sector. Understanding these regulations is essential for compliance and operational success. Additionally, the finance sector in Israel is characterized by the presence of innovative fintech companies, driven by a strong technology ecosystem and a culture of entrepreneurship. This creates numerous opportunities for collaboration and investment. Challenges include navigating the complexities of local and international regulations, particularly in the context of anti-money laundering and data protection laws. The competitive landscape is dynamic, with both established banks and emerging startups vying for market share, leading to a need for continuous adaptation and innovation. Environmental concerns are also gaining traction, as investors increasingly prioritize sustainable finance practices. Finally, Israel's finance industry is relevant on a global scale, often attracting foreign investors and partnerships due to its reputation for technological advancement and a skilled workforce. Keeping these factors in mind will provide valuable insights for anyone interested in the finance sector in Israel.

Some interesting numbers and facts about your company results for Finance

| Country with most fitting companies | Israel |

| Amount of fitting manufacturers | 12 |

| Amount of suitable service providers | 21 |

| Average amount of employees | 1-10 |

| Oldest suiting company | 2008 |

| Youngest suiting company | 2021 |

Some interesting questions that has been asked about the results you have just received for Finance

What are related technologies to Finance?

Based on our calculations related technologies to Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Who are Start-Ups in the field of Finance?

Start-Ups who are working in Finance are Rhino Eco, Open-Finance.ai

Which industries are mostly working on Finance?

The most represented industries which are working in Finance are Finance and Insurance, IT, Software and Services, Other, Consulting, Gaming

How does ensun find these Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.