The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Credit Engine

Tokyo, Japan

A

11-50 Employees

2016

Key takeaway

Credit Engine's lending platform enhances the quality of lending services, offering customizable features that support individual product installment purchases and credit services. Their digital solutions, such as CE Loan and CE Servicing, promote the modernization of financial institutions' lending operations.

Reference

Core business

Company Profile | Credit Engine, Inc.

オンライン融資管理システム「CE Loan」、オンライン債権回収システム「CE Servicing」など、金融機関の融資業務のデジタル化を推進するサービスを提供しています。

Oak Business Consultant

Kasukabe, Japan

A

11-50 Employees

2009

Key takeaway

The company, Oak Financial and Management Consultant, specializes in financial services, offering expertise in financial performance assessment, planning, budgeting, and risk management. Their commitment to providing reliable financial consulting aims to empower clients with the insights needed for informed decision-making and long-term success.

Reference

Product

Online Marketplace Financial Model - Oak Business Consultant

Oak Business Consultant is providing you Online Marketplace Financial Model to help your Business Decision Making and efficient operations.

MUFG Investor Services

Tokyo, Japan

A

10001+ Employees

1864

Key takeaway

MUFG Investor Services, a division of Mitsubishi UFJ Financial Group, Inc, specializes in servicing the global alternative investment management industry. They offer comprehensive fund financing solutions, which include competitive pricing and efficient capital use for FX hedging, addressing the financial needs of asset managers.

Reference

Service

Fund Financing - MUFG Investor Services

The benefits of working together with MUFG Investor Services on your fund financing needs include competitive pricing, integrated collateral monitoring, efficient use of capital for FX hedging, and a captive balance sheet.

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

LENDY Japan

Tokyo, Japan

A

1-10 Employees

2016

Key takeaway

LENDY is an online lending service that provides small business loans, allowing users to easily access funds without the cumbersome application process. By integrating with their existing online services, LENDY's algorithm automates the approval process, making it a convenient option for entrepreneurs.

Reference

Core business

LENDY - LENDY(レンディ)| オンラインで完結するスモールビジネスローン

LENDYはオンラインで完結する事業者向けの融資サービスです。いつでも借りられるお金を用意することができます。面倒な融資申し込み手続きはもう必要ありません。 LENDYの登録に必要なのは、あなたの利用しているオンラインサービスを連携するだけ。 LENDYのアルゴリズムが自動で判断します。

CoreForth

Tokyo, Japan

A

- Employees

2010

Key takeaway

The company provides valuable information for individuals looking to borrow money quickly.

Reference

Core business

お金借りるコアフォース!すぐに借りたい人にお得な情報を発信

Tokyo FinTech

Tokyo, Japan

A

1-10 Employees

2017

Key takeaway

The company offers a weekly newsletter, "Japan FinTech Observer," that provides insights into FinTech, blockchain, and crypto in Tokyo, fostering a community for networking and innovation in the financial sector.

Reference

Service

Services | Tokyo FinTech

Double Feather Partners

Tokyo, Japan

A

1-10 Employees

-

Key takeaway

The company is an international venture capital firm based in Japan that focuses on addressing social issues in Africa through investments and support for the startup ecosystem, including financial advisory services. They are involved in initiatives like Acceleration Programs and have insights from industry experts, which could enhance their investment strategies in the African market.

Reference

Service

Service | Double Feather Partners | Solving social problems through business.

Double Feather Partners is committed to solving social problems in developing countries, especially in Africa, through financial, strategic, and M&A advisory services, and to contributing to a world in which all people can enjoy the benefits of services that form the foundation of society. We will contribute to the realization of a world in which all people can enjoy the benefits of fundamental social services.

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

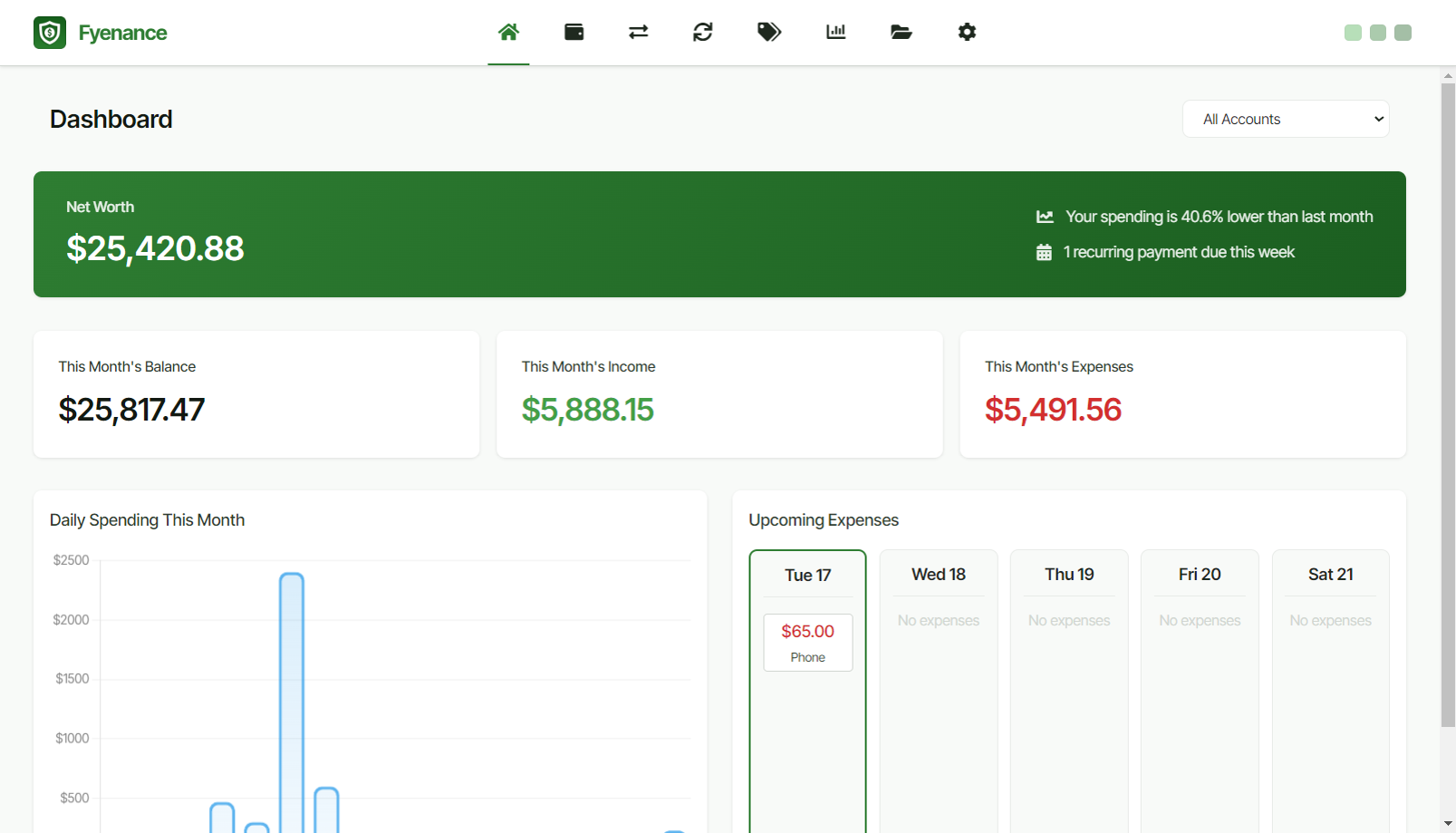

Fyenance

Go to product

Service

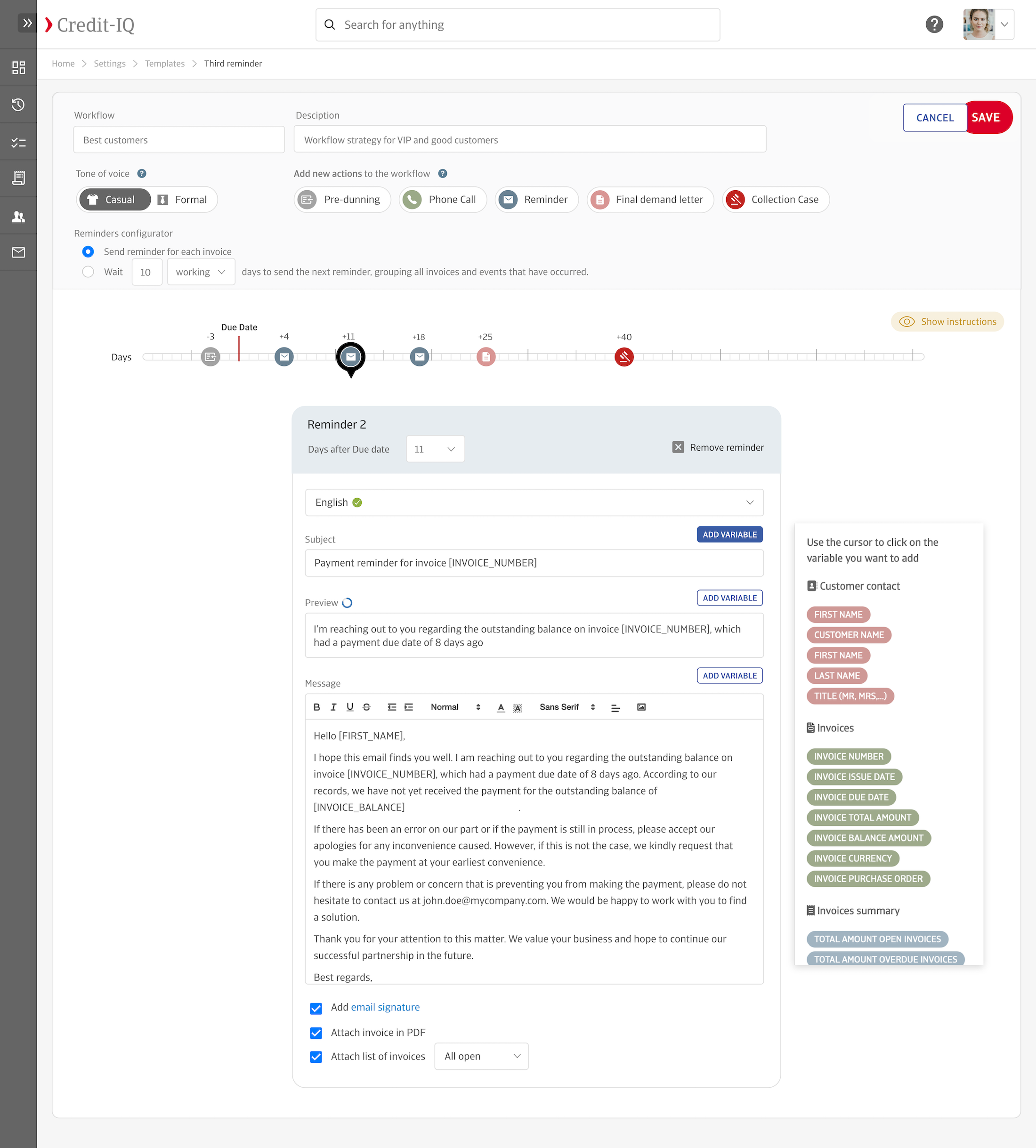

Credit-IQ

Go to product

Service

Gold Buyers

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Accounts Receivable Automation Platform

Accounting, Finance, SaaS, E-commerce, Legal Services, Retail

Credit-IQ is a comprehensive solution designed to automate and enhance accounts receivable (AR) processes for businesses across multiple industries. Our platform tackles common challenges by reducing manual work, accelerating payment collection, and improving cash flow. Credit-IQ seamlessly integrates with popular bookkeeping software to automate invoice reminders, manage unpaid invoices, and provide valuable cash flow insights. By leveraging automated workflows and customizable email templates, our platform helps businesses strengthen customer relationships and experience faster, more consistent payments. Credit-IQ addresses specific needs in sectors such as E-commerce, Legal Services, and Retail, offering multi-language support and personalized AR processes suited to diverse business operations. With Credit-IQ, enterprises scale AR operations effectively, while small and medium businesses reduce payment delays and streamline financial management.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the finance industry in Japan, it is crucial to consider several key factors. The regulatory environment is stringent, governed by the Financial Services Agency (FSA), which enforces compliance with laws that aim to maintain market integrity and protect investors. Understanding these regulations is vital for navigating the industry effectively. Additionally, the Japanese finance sector faces challenges such as an aging population, which impacts consumer behavior and savings rates, and low-interest rates that squeeze profit margins. Opportunities exist in the growing fintech landscape, where innovations like blockchain and digital currencies are gaining traction. Moreover, Japan's strong global economic ties make it a significant player in international finance, providing avenues for foreign investments and partnerships. Environmental concerns are increasingly shaping corporate strategies, as sustainability becomes a focus for both investors and regulators. Companies are adopting Environmental, Social, and Governance (ESG) criteria to appeal to a broader range of stakeholders. The competitive landscape is marked by a mix of traditional banks, securities firms, and emerging fintech startups, each vying for market share. As the industry evolves, staying informed about technological advancements and shifting consumer preferences will be essential for anyone interested in pursuing a career or investment opportunities in Japan's finance sector.

Some interesting numbers and facts about your company results for Finance

| Country with most fitting companies | Japan |

| Amount of suitable service providers | 3 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 1864 |

| Youngest suiting company | 2017 |

Some interesting questions that has been asked about the results you have just received for Finance

What are related technologies to Finance?

Based on our calculations related technologies to Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Finance?

The most represented industries which are working in Finance are Finance and Insurance, Consulting, Other

How does ensun find these Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.