The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

CLS FINANCE LIMITED

Tameside, United Kingdom

A

1-10 Employees

2004

Key takeaway

CLS Finance Ltd is authorized and regulated by the Financial Conduct Authority, highlighting its credibility in the consumer finance sector.

Reference

Core business

CLS Finance Ltd

FINCERE CAPITAL MANAGEMENT LIMITED

London, United Kingdom

A

1-10 Employees

-

Key takeaway

Fincare Capital is dedicated to enhancing the lives of clients by providing financial investment services and wealth advisory aimed at helping them meet their long-term financial goals. Their structured advisory approach ensures that clients receive tailored portfolio solutions, making it a relevant resource for those interested in consumer finance.

Reference

Core business

Fincare Capital Investment Services LLP - Home

Ezfinanz Official

Hyderabad, India

D

251-500 Employees

-

Key takeaway

Ezfinanz is a retail-focused NBFC that offers a range of consumer finance solutions, including 0% loans for personal use and various segments like healthcare, education, and consumer durables. Their approach helps businesses enhance sales by providing convenient financing options for customers.

Reference

Core business

ezfinanz

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

The Compliance Guys Ltd

Wolverhampton, United Kingdom

A

11-50 Employees

2020

Key takeaway

The company specializes in assisting businesses with FCA compliance for consumer finance, emphasizing their expertise in integrating finance into business operations to attract more customers and increase profits. They offer personalized support throughout the complex FCA authorization process, making it easier for businesses to navigate consumer credit lending.

Reference

Service

Finance Lenders - The Compliance Guys

The FCA Authorisation to hold client money for consumer credit lending is very complex, but we make FCA consumer credit lending as simple as picking up the phone to one of our team of experienced compliance experts

Capital Financial Solutions LLC.

Olympia, United States

B

11-50 Employees

2008

Key takeaway

Capital Financial specializes in consumer finance, offering innovative financing solutions tailored to meet the needs of both prime and non-prime credit customers. Their "second look financing" program is particularly beneficial for healthcare providers, enhancing access to quality credit financing for patients seeking services like LASIK, dental care, and cosmetic procedures.

Reference

Core business

Patient Financing | Payment Processing | Everyone's Approved | Dental Financing

We partner with some of the nation’s leading healthcare organizations and provide exceptional in-office and online financing programs to non-prime consumers through our “second look financing” solution.

Consumer Credit Solutions

Chorley, United Kingdom

A

11-50 Employees

1999

Key takeaway

The company is a market leader in consumer finance, specializing in home improvement credit solutions. They offer competitive interest rates and a range of financing options, including interest-free credit and buy now pay later, ensuring that businesses can effectively meet their customers' needs while adhering to regulatory standards.

Reference

Core business

Home Improvement Finance | Consumer Credit Solutions

Consumer Credit Solutions is the UK’s leading independent provider of home improvement finance | Highly competitive rates | 08451206666

United Consumer Finance

Maussane-les-Alpilles, France

A

11-50 Employees

1989

Key takeaway

United Consumer Finance specializes in subprime automobile financing, focusing on assisting individuals with past credit issues by offering fast and low-cost loan approvals. Their commitment to high service levels and effective communication makes them a valuable partner for dealers in the consumer finance sector.

Reference

Core business

United Consumer Finance, Inc. – United Together With You

Call us to join our dealership network. We provide auto financing through our network of independent automobile dealers.

MVFinance

Sofia, Bulgaria

B

1001-5000 Employees

2013

Key takeaway

MVFinance is a key player in the consumer finance sector, specializing in the creation and management of companies that provide consumer loans. Their focus on upgrading and automating financial services enhances accessibility and efficiency in the fast-growing market.

Reference

Core business

MVFinance is an international financial group founded in Bulgaria

We're improving consumer’s experience on the fast consumer loans market, by making our financial operations more efficient and easily accessible.

Changefinancegroup

Lichfield, United Kingdom

A

1-10 Employees

-

Key takeaway

Change Finance Ltd specializes in providing innovative and tailored finance solutions, making it a relevant player in the consumer finance sector. Their commitment to competitive terms and professional service highlights their focus on meeting clients' financial needs.

Reference

Core business

Change Finance Ltd

Home Credit Group

Amsterdam, Netherlands

A

10001+ Employees

1997

Key takeaway

Home Credit is an international consumer finance provider that specializes in responsible lending, particularly to individuals with little or no credit history. Their innovative financial products and services, which include banking and dynamic loan options, are designed to evolve with customer needs and enhance accessibility.

Reference

Core business

Home Credit Consumer Finance Company Ltd. (China) | Homecredit

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

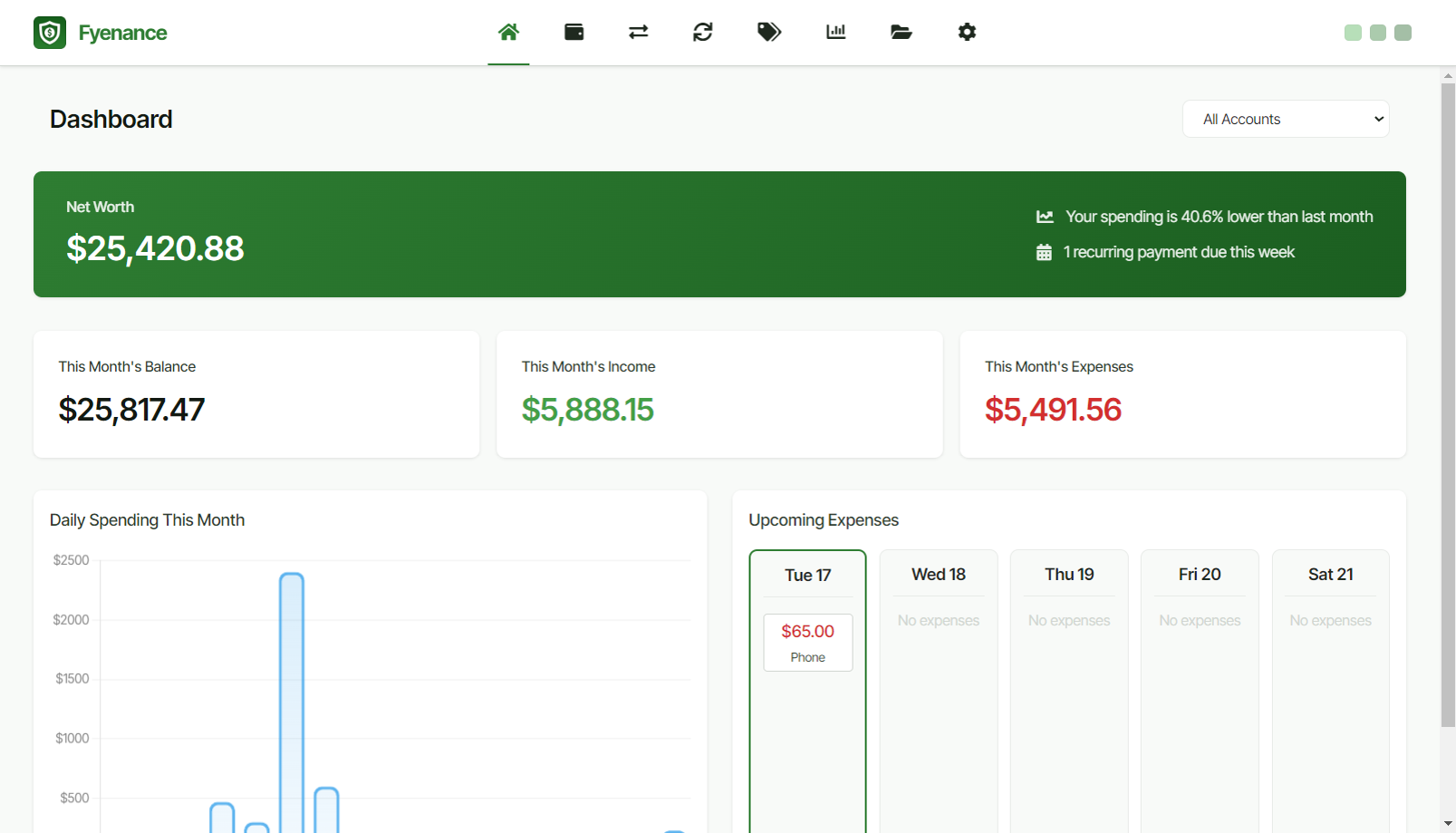

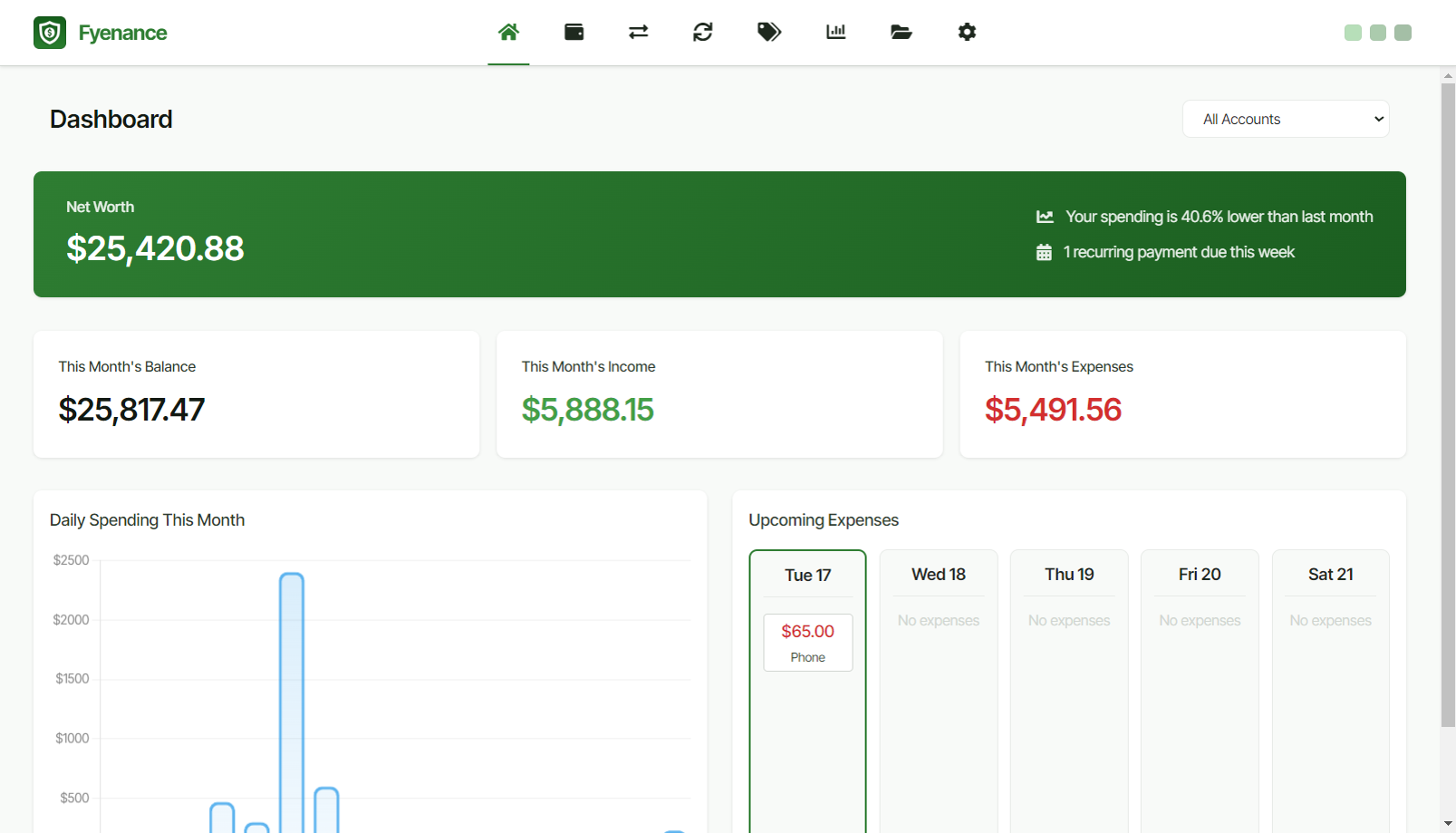

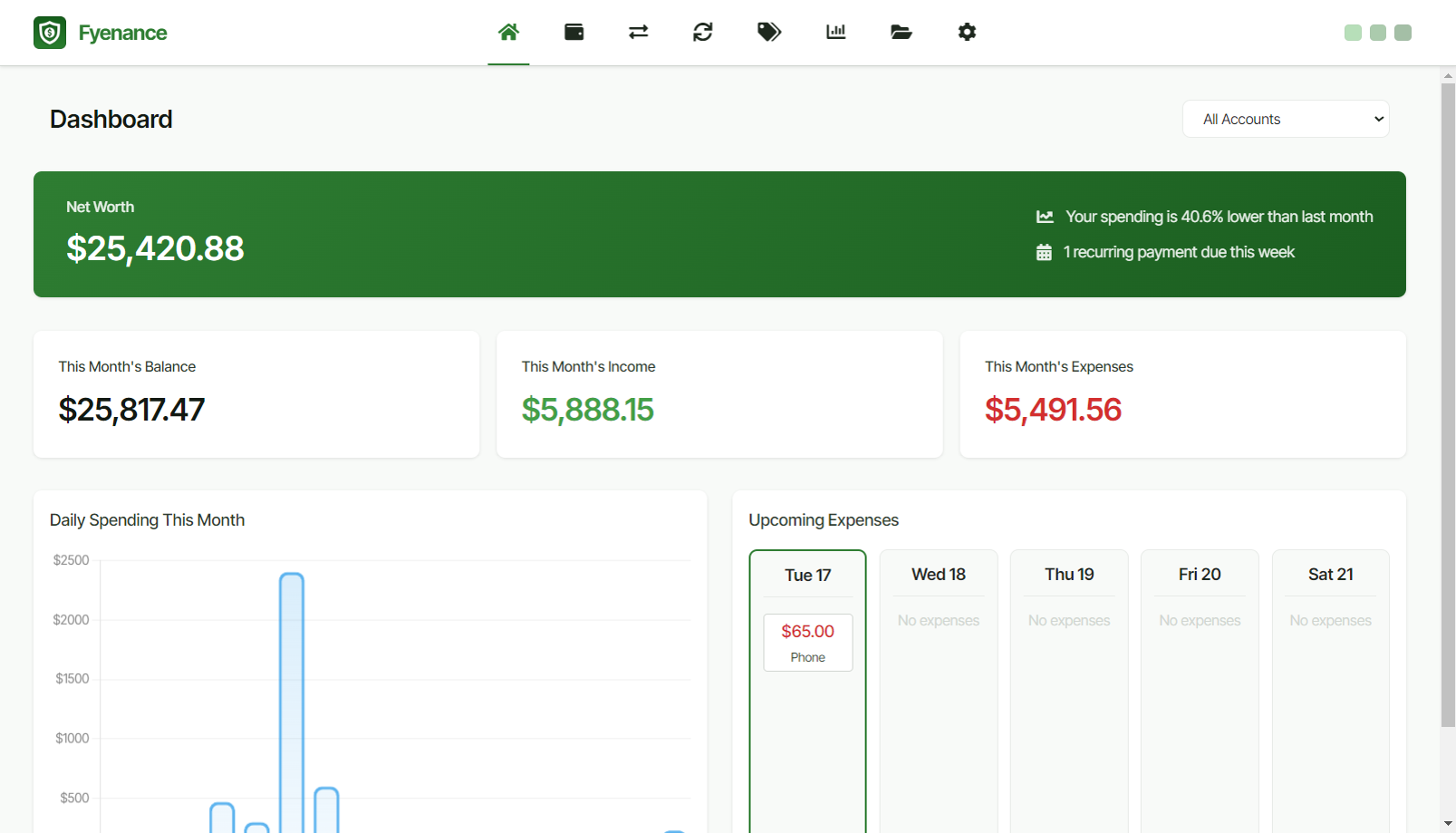

Fyenance

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Consumer finance refers to financial services that provide individuals with access to funds for personal use. This includes loans, credit cards, and various types of financial products designed to help consumers manage their expenses, make purchases, or consolidate debt. These services are typically offered by banks, credit unions, and specialized financial institutions. They play a crucial role in enabling consumers to finance large purchases, such as homes and vehicles, or to cover everyday expenses. The terms and conditions of consumer finance products, including interest rates and repayment schedules, vary widely, allowing individuals to choose options that best fit their financial situations.

Consumer finance plays a significant role in personal budgeting by providing individuals with access to various financial products, such as loans, credit cards, and savings accounts. These products enable consumers to manage their expenses more effectively, allowing for greater flexibility in budgeting. With the right consumer finance tools, individuals can plan for large purchases, manage unexpected expenses, and save for future goals. Furthermore, the availability of credit can impact spending habits, as it may encourage consumers to spend beyond their means. This can lead to debt accumulation if not managed properly. Therefore, understanding the terms and costs associated with consumer finance products is essential for effective budgeting. By incorporating these financial elements into their budgeting strategies, consumers can make informed decisions that align with their long-term financial health.

1. Personal Loans

Consumer finance providers often offer personal loans, which can be used for various purposes such as debt consolidation, home improvements, or unexpected expenses. These loans typically have fixed interest rates and repayment terms.

2. Credit Cards

Many consumer finance companies provide credit cards that allow individuals to make purchases on credit. These cards may offer rewards programs, cash back options, and various promotional interest rates.

3. Auto Loans

Financing for purchasing vehicles is another common service. Consumer finance providers offer auto loans with different terms and interest rates, enabling customers to acquire new or used cars.

4. Mortgages

Some providers specialize in mortgage loans, helping consumers finance the purchase of homes. They may offer various mortgage products, including fixed-rate and adjustable-rate options.

5. Student Loans

Financing for education is also a key service, with consumer finance providers offering student loans that can help cover tuition, fees, and other educational expenses.

6. Financial Advisory Services

In addition to lending, some consumer finance firms provide financial advisory services. These services help individuals manage their finances, plan for future expenses, and make informed financial decisions.

Consumer finance providers offer various tools and services designed to assist individuals in managing their debt effectively. They often provide personal loans with lower interest rates, allowing consumers to consolidate higher-interest debts into a single, more manageable payment. This can reduce monthly payments and alleviate financial stress. Additionally, these providers often offer budgeting and financial planning resources. By helping individuals track their expenses and set financial goals, they empower consumers to develop healthier spending habits and prioritize debt repayment. With the right guidance and resources, managing debt becomes a more structured and achievable process.

Engaging with consumer finance providers entails several risks that borrowers should be aware of. One significant risk is the potential for high interest rates, which can lead to a cycle of debt if not managed properly. Borrowers may find themselves paying much more than the initial amount borrowed, especially if they miss payments or default. Another risk involves the possibility of hidden fees that can increase the overall cost of borrowing. Some providers may not fully disclose all terms, leading to unexpected charges. Additionally, consumer finance can affect credit scores; taking on too much debt or missing payments can negatively impact an individual’s credit rating. Understanding these risks is crucial for making informed financial decisions.

Some interesting numbers and facts about your company results for Consumer Finance

| Country with most fitting companies | United Kingdom |

| Amount of fitting manufacturers | 7265 |

| Amount of suitable service providers | 10000 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 1989 |

| Youngest suiting company | 2020 |

20%

40%

60%

80%

Some interesting questions that has been asked about the results you have just received for Consumer Finance

What are related technologies to Consumer Finance?

Based on our calculations related technologies to Consumer Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Which industries are mostly working on Consumer Finance?

The most represented industries which are working in Consumer Finance are Finance and Insurance, Other, IT, Software and Services, Consulting, Real Estate

How does ensun find these Consumer Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.