The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Funder.ai Technologies

Abu Dhabi, United Arab Emirates

C

1-10 Employees

2020

Key takeaway

eFunder offers digital financing solutions that can significantly enhance working capital for small and medium-sized businesses by providing instant cash against receivables. Their transparent and technology-driven platform ensures a seamless experience, making eFunder a trusted partner for addressing financing needs.

Reference

Core business

eFunder - Helping Small and Medium Businesses unlock growth

eFunder is a leading digital financing platform that provides instant cash and consistent cash flow against receivables to small and medium-sized businesses.

Money Protects™ of MAB Innovations ROFR Co.

Dubai, United Arab Emirates

C

11-50 Employees

2020

Key takeaway

The company, MONEY PROTECTS, specializes in providing sustainable financial freedom solutions for individuals and corporations, focusing on wealth creation and management. Their team of financial experts offers guidance on fundraising strategies and innovative approaches to debt and equity management.

Reference

Service

Services Archive - Money Protects

QuickFinserv

Deira, United Arab Emirates

C

11-50 Employees

2021

Key takeaway

Quick Finserv is a reliable company in the UAE that addresses various financial challenges by offering tailored solutions to help clients manage debt. Their knowledgeable team specializes in personal loans, business loans, and credit cards, providing practical strategies for financial stability.

Reference

Core business

Home - Quick Finserv Loans and Overdues Rescheduling Services

Loans and Overdues Rescheduling Services

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

Al Ain Finance

Abu Dhabi, United Arab Emirates

C

11-50 Employees

2017

Key takeaway

Al Ain Finance specializes in providing alternative financing solutions to Small and Medium Enterprises (SMEs) in the UAE, focusing on transparent and practical options that enhance liquidity and support working capital needs.

Reference

Product

Vehicle Financing | Alain Finance

Al Ain Finance P.J.S.C is a Private Joint Stock Company, owned by prominent Emirati shareholders, licensed and regulated by the U.A.E. Central Bank.

Fin-Wiser Advisory

Dubai, United Arab Emirates

C

1-10 Employees

2016

Key takeaway

The company offers a range of innovative tools and dedicated services aimed at enhancing financial growth and operational excellence for clients, particularly through their Fin-Wiser services.

Reference

Service

Services - Fin-Wiser

JP Fintrack

Deira, United Arab Emirates

C

11-50 Employees

2021

Key takeaway

JP Fintrack is a trusted company in the UAE that simplifies the loan application process, offering personalized loan comparisons and a wide range of financial products. With over a decade of experience, they provide competitive loan plans, including auto loans with quick approvals and flexible repayment options, making it easier for individuals to manage their financial obligations.

Reference

Core business

JP Fintrack | All loans in one place

CoProvider

Dubai, United Arab Emirates

C

1-10 Employees

2018

Key takeaway

CoProvider is an innovative online B2B marketplace that streamlines the procurement process for professional services, enabling organizations to easily source and compare offers from various vendors. This platform has significantly reduced business development time and costs, making it a transformative tool for procurement professionals.

Reference

Core business

CoProvider | one marketplace. many services.

CoProvider is an online B2B marketplace and RFQ platform for professional services.

Bronze Wing Trading L.L.C.

Dubai, United Arab Emirates

C

1-10 Employees

1998

Key takeaway

Bronze Wing Trading specializes in Trade Finance Products, offering essential services such as Letters of Credit, SBLCs, and Bank Guarantees, which are crucial for securing payments and facilitating timely transactions. Their expertise in the evolving global trade market has positively impacted over 25,000 clients, ensuring their financial needs are met effectively.

Reference

Core business

Trade Finance | Financial Instruments Providers | Letter of Credit | SBLC

We, Bronze Wing Trading provide Trade Finance Services – Letter of Credit, MT700, SBLC, MT760 & Bank Guarantee. Get Free Quote!

Agility Bridging

Dubai, United Arab Emirates

C

11-50 Employees

-

Key takeaway

The company specializes in providing bespoke bridging loans for non-owner occupied commercial and residential properties in England, with loan amounts ranging from £100,000 to £20,000,000 and the flexibility to assess each case individually. With over 35 years of experience, they emphasize a personalized service and the ability to make in-house financial decisions, ensuring tailored solutions for their clients' needs.

Reference

Core business

About - Private Fast Bridging Finance Lenders | Bridge Loans Facility London | Ability Bridging

Lenovo Financial Services META LLC

Dubai, United Arab Emirates

C

1-10 Employees

-

Key takeaway

LFS META (Lenovo Financial Solutions) provides cost-effective payment solutions that enhance the efficiency of IT procurement for enterprise customers and government entities. Their focus on flexible payment models aligns with the shift towards an "as a service" economy, enabling organizations to manage technology investments sustainably and effectively.

Reference

Core business

LFSmeta

We offer cost effective payment solutions to enterprise customers and government entities to help them procure IT more efficiently, drive down costs and dispose of technology in a sustainable way.

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

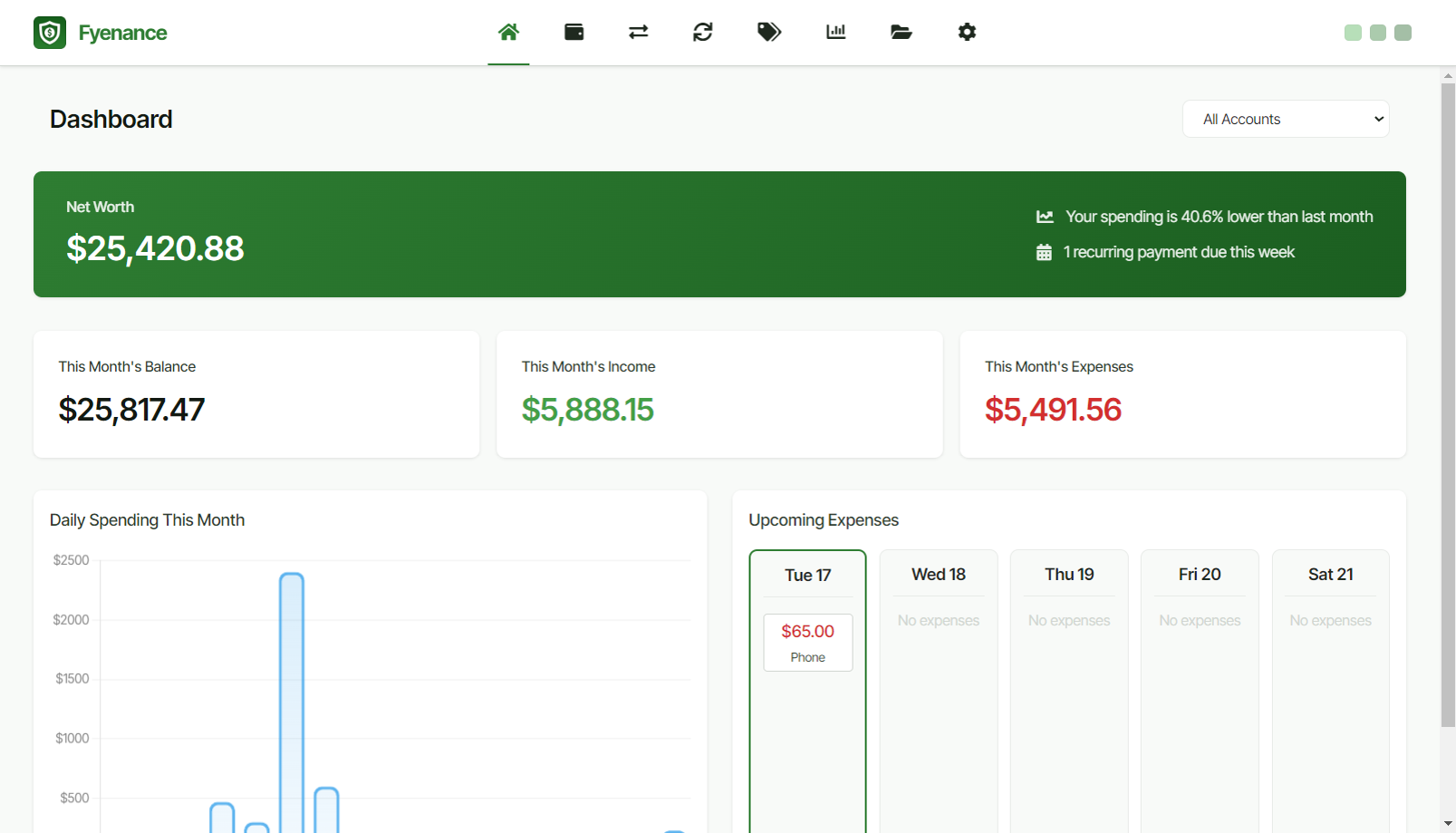

Fyenance

Go to product

Service

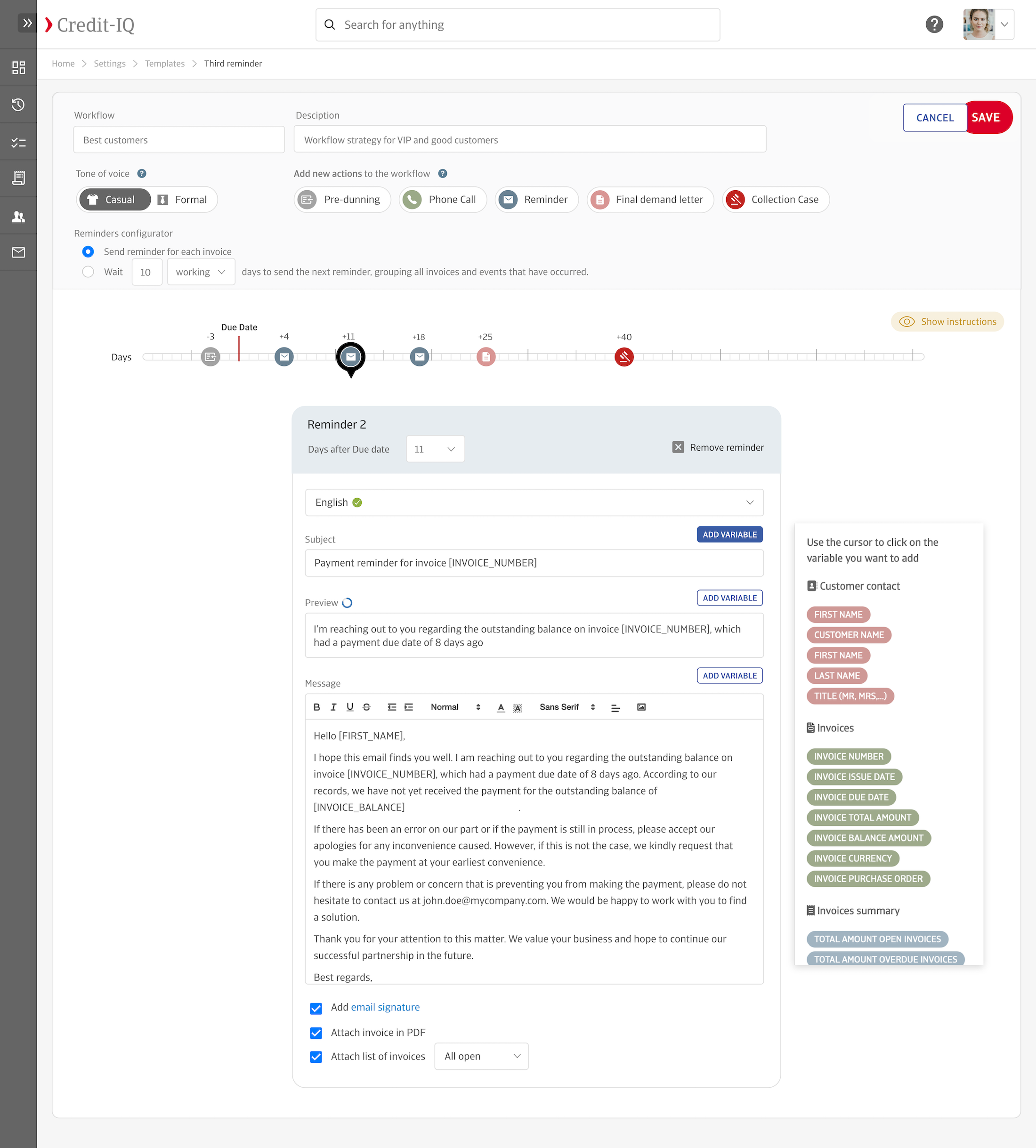

Credit-IQ

Go to product

Service

Gold Buyers

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Accounts Receivable Automation Platform

Accounting, Finance, SaaS, E-commerce, Legal Services, Retail

Credit-IQ is a comprehensive solution designed to automate and enhance accounts receivable (AR) processes for businesses across multiple industries. Our platform tackles common challenges by reducing manual work, accelerating payment collection, and improving cash flow. Credit-IQ seamlessly integrates with popular bookkeeping software to automate invoice reminders, manage unpaid invoices, and provide valuable cash flow insights. By leveraging automated workflows and customizable email templates, our platform helps businesses strengthen customer relationships and experience faster, more consistent payments. Credit-IQ addresses specific needs in sectors such as E-commerce, Legal Services, and Retail, offering multi-language support and personalized AR processes suited to diverse business operations. With Credit-IQ, enterprises scale AR operations effectively, while small and medium businesses reduce payment delays and streamline financial management.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the finance industry in the United Arab Emirates, several key considerations come into play. The UAE has a robust regulatory framework, primarily governed by the Central Bank and the Securities and Commodities Authority, which ensures compliance and stability in the financial sector. Understanding local regulations, such as anti-money laundering laws and consumer protection policies, is essential for navigating the market. The competitive landscape features a mix of local banks, international financial institutions, and fintech companies, creating a dynamic environment ripe with opportunities. The rise of technology in finance, particularly in areas like digital banking and cryptocurrency, presents significant growth potential. However, challenges such as fluctuating oil prices, geopolitical tensions, and economic diversification efforts can impact market stability. Environmental concerns are also gaining traction, with a shift towards sustainable finance and investments that consider environmental, social, and governance (ESG) criteria. Global market relevance is underscored by the UAE's strategic position as a financial hub in the Middle East, attracting foreign investment and talent. In summary, a comprehensive understanding of regulations, market dynamics, and emerging trends is critical for success in the finance industry within the UAE.

Some interesting numbers and facts about your company results for Finance

| Country with most fitting companies | United Arab Emirates |

| Amount of fitting manufacturers | 45 |

| Amount of suitable service providers | 64 |

| Average amount of employees | 11-50 |

| Oldest suiting company | 1998 |

| Youngest suiting company | 2021 |

Some interesting questions that has been asked about the results you have just received for Finance

What are related technologies to Finance?

Based on our calculations related technologies to Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Who are Start-Ups in the field of Finance?

Start-Ups who are working in Finance are QuickFinserv, JP Fintrack

Which industries are mostly working on Finance?

The most represented industries which are working in Finance are Finance and Insurance, Consulting, Other, IT, Software and Services, Real Estate

How does ensun find these Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.