The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers

Close

Filter

Result configuration

Continents

Select continent

Locations

Result types

Company type

Select company type

Industries

Select industry

Company status

Select company status preset

Number of employees

Min.

Max.

Founding year

Trellis Housing Finance Limited

Karachi Division, Pakistan

E

1-10 Employees

2020

Key takeaway

Trellis Housing Finance Limited is a pioneering private lending institution in Pakistan that focuses on providing affordable housing solutions to low-income and informal employment customers. Their commitment to social impact and sustainable development aligns with the broader goals of financial inclusion and community support.

Reference

Core business

Home - Trellis Housing Finance Limited

GharHo Click here to fill the Inquiry Form then you […]

QisstPay

Islamabad, Pakistan

E

51-100 Employees

2020

Key takeaway

The company offers a comprehensive suite of financial solutions designed to streamline disbursements and collections, making it easier for businesses to manage funds. Their platform provides transparent loan options, empowering individuals and MSMEs with quick access to personal and business loans, thereby enhancing financial inclusion.

Reference

Core business

QisstPay - A secured borrowing platform for customer and business

Operating in two countries as a leading lending enabler, creating financial inclusion through loans.

Al-Mawakhat Microfinance - AMCL

Lahore, Pakistan

E

11-50 Employees

2022

Key takeaway

Al-Mawakhat is a Non-Banking Micro Finance Company that offers product-based financial assistance to support the growth of businesses, particularly for those in need. They provide interest-free financing options, making it easier for entrepreneurs to acquire essential tools and resources to enhance their economic development.

Reference

Service

Services

Looking for more accurate results?

Find the right companies for free by entering your custom query!

25M+ companies

250M+ products

Free to use

FFO Support Program-(FFOSP)

Sheikhupura, Pakistan

E

251-500 Employees

2016

Key takeaway

The FFO Support Program (FFOSP) is a rapidly growing Non-Banking Micro Finance Company in Pakistan, offering appraisal-backed individual and group lending to empower micro-entrepreneurs, particularly women. Their key focus areas include financial services, insurance, capacity building, and social sector interventions.

Reference

Service

Service – FFO

Finja

Lahore, Pakistan

E

101-250 Employees

2016

Key takeaway

Finja is a modern financial services platform that addresses the payment, collection, and credit needs of professionals, merchants, and SMEs. With a focus on the underbanked segment, Finja utilizes AI and data-driven methods to offer comprehensive financial solutions, including lending and payment products, all aimed at facilitating seamless financial transactions in Pakistan's evolving economy.

Reference

Core business

Finja

AutoSoft Dynamics

Lahore, Pakistan

E

51-100 Employees

2000

Key takeaway

AutoSoft Dynamics (Pvt) Limited is a leading provider of core banking and financial institution management solutions, offering customizable software and consulting services that enhance process automation for various banking sectors, including Conventional, Islamic, and Microfinance Banking. With over 2,000 man-years of expertise, the company is well-equipped to meet the evolving needs of the financial services industry.

Reference

Product

AutoCREDIT Consumer – AutoSoft Dynamics

Global Bancassurance (GBA) Services Pvt Ltd

Karachi Division, Pakistan

E

11-50 Employees

2009

Key takeaway

Global Bancassurance (GBA) Services Pvt Ltd specializes in the administration of insurance products through bank branches, enhancing financial services and wealth management for banks. With over 50 years of combined experience, GBA effectively manages the entire life bancassurance operations, ensuring a seamless process from policy initiation to servicing, which ultimately benefits both banks and their clientele.

Reference

Product

Enterprise Loan 2016 - Global Bancassurance (GBA) Services Pvt Ltd

Mames integer pretium commodo sed orci magnis euismod a, fusce felis leo habitant ridiculus auctor nisl id, cras nisi porta mus enim dapibus aenean.

B&S Financial Consultants

Lahore, Pakistan

E

1-10 Employees

-

Key takeaway

B&S Financial Consultants specializes in providing comprehensive financial services, including accounting and compliance, which allows entrepreneurs to focus on their core business activities. With a team of experts and over 15 years of experience, the company is dedicated to supporting sustainable growth through integrated financial solutions.

Reference

Service

SERVICES | B&S Financial Consultants

Escorts Investment Bank

Lahore, Pakistan

E

- Employees

1996

Key takeaway

Escorts Investment Bank Limited (EIBL) is a prominent financial institution regulated by the Securities and Exchange Commission of Pakistan and offers a variety of innovative financial solutions, including certificates of deposit and small vehicle finance. With flexible investment terms and a commitment to good corporate governance, EIBL has established itself as a leading investment bank in Pakistan since its inception in 1996.

Reference

Product

Small Vehicle Finance – Escorts Investment Bank

Fauree

Karachi Division, Pakistan

E

11-50 Employees

-

Key takeaway

Fauree is a FinTech supply chain platform that specializes in structured trade finance and working capital optimization for small and medium-sized enterprises (SMEs). Their commitment to addressing the working capital challenges faced by SMEs positions them as a key player in enhancing financial solutions within the supply chain sector.

Reference

Core business

Tech Driven Supply Chain Finance Solutions | Fintech - Fauree

Fauree has brought a working capital solution in supply chain finance. We are one of the leading fintech companies serving in Pakistan, UAE, Saudi Arabia, Oman and Canada.

Technologies which have been searched by others and may be interesting for you:

A selection of suitable products and services provided by verified companies according to your search.

Product

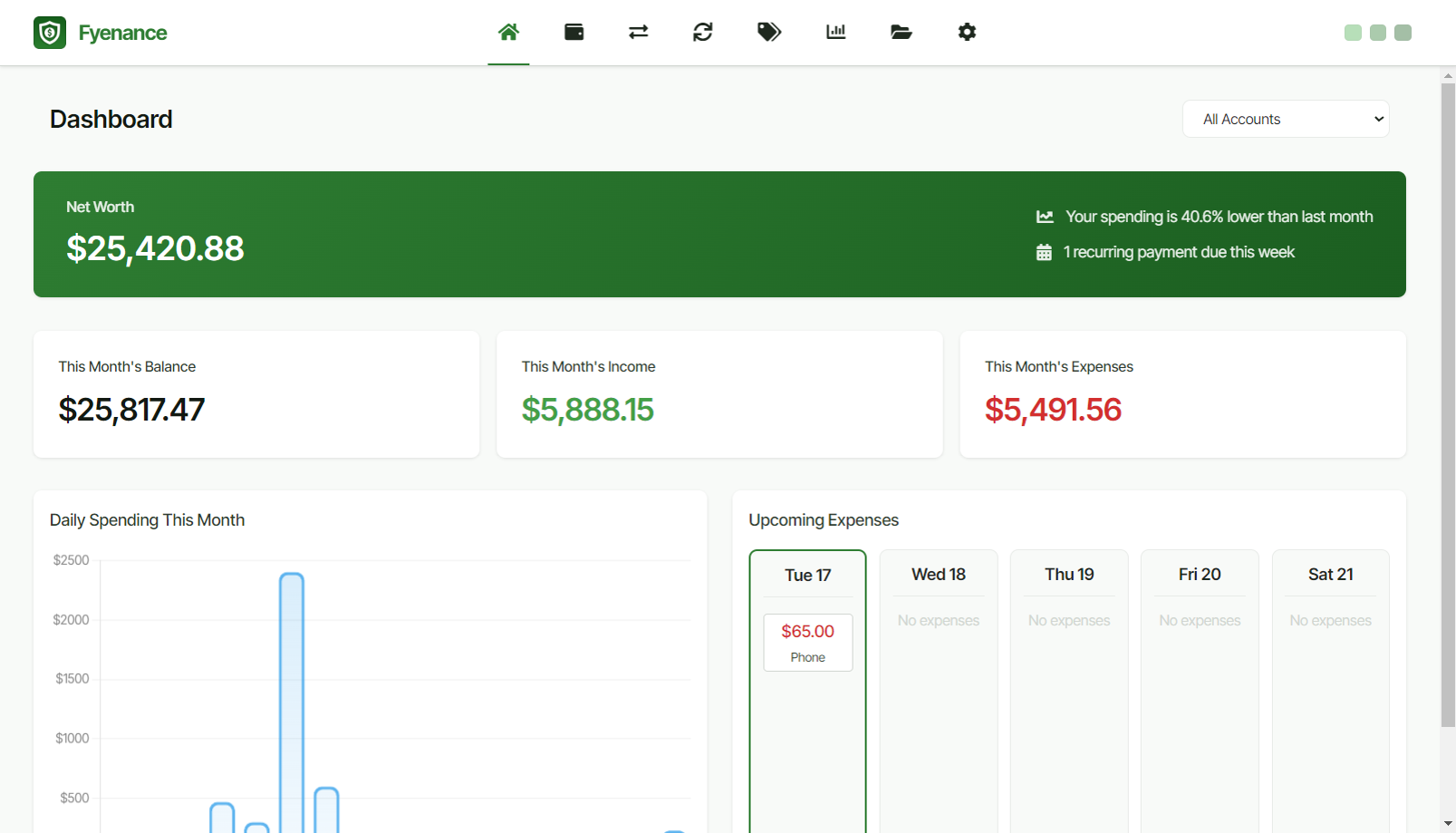

Fyenance

Go to product

Service

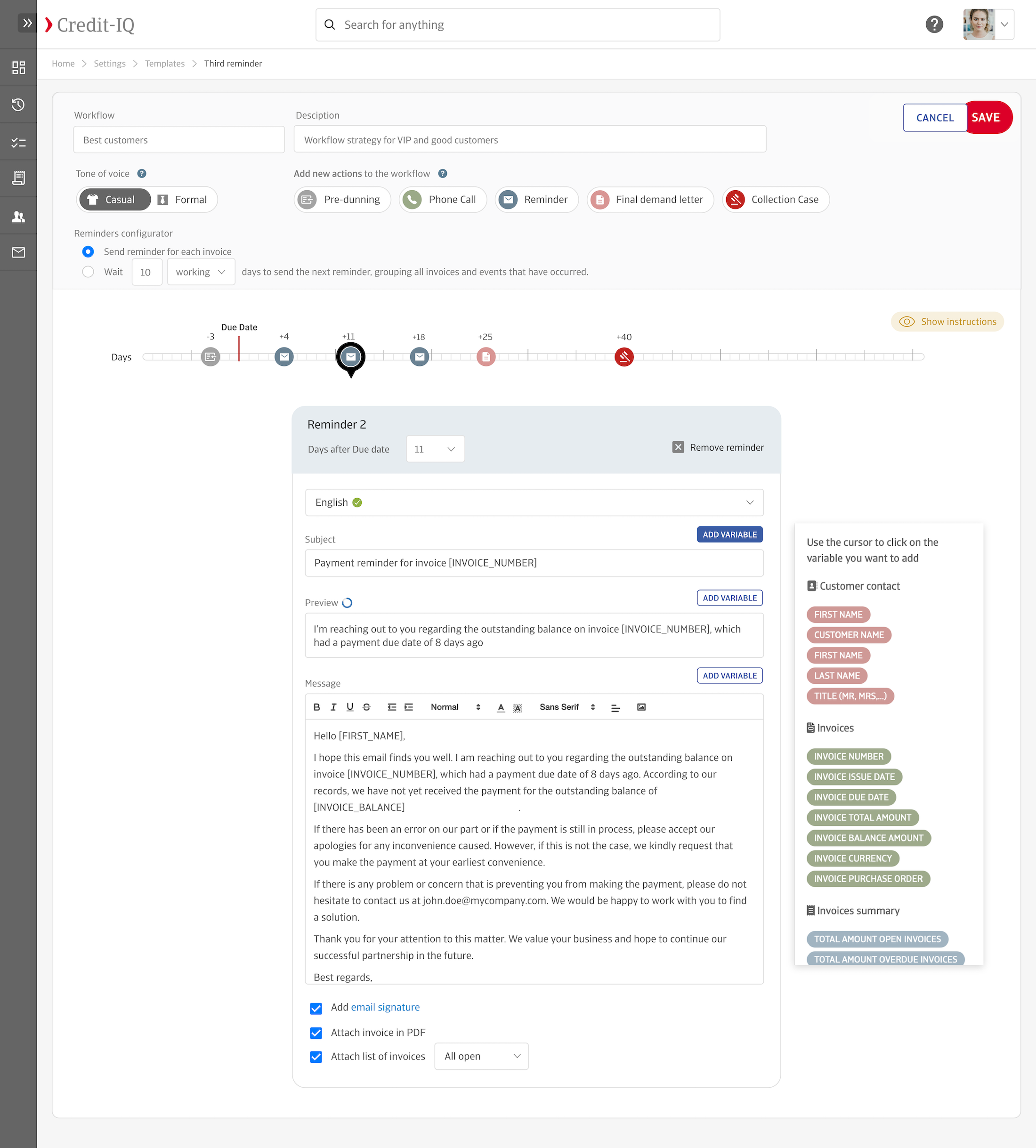

Credit-IQ

Go to product

Service

Gold Buyers

Go to product

A selection of suitable use cases for products or services provided by verified companies according to your search.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

Use case

Accounts Receivable Automation Platform

Accounting, Finance, SaaS, E-commerce, Legal Services, Retail

Credit-IQ is a comprehensive solution designed to automate and enhance accounts receivable (AR) processes for businesses across multiple industries. Our platform tackles common challenges by reducing manual work, accelerating payment collection, and improving cash flow. Credit-IQ seamlessly integrates with popular bookkeeping software to automate invoice reminders, manage unpaid invoices, and provide valuable cash flow insights. By leveraging automated workflows and customizable email templates, our platform helps businesses strengthen customer relationships and experience faster, more consistent payments. Credit-IQ addresses specific needs in sectors such as E-commerce, Legal Services, and Retail, offering multi-language support and personalized AR processes suited to diverse business operations. With Credit-IQ, enterprises scale AR operations effectively, while small and medium businesses reduce payment delays and streamline financial management.

Use case

Personal Finance Management

Personal Finance, Fintech, Productivity Tools, Software, Accounting , Finance Software

Fyenance is a robust desktop application focused on streamlining personal finance management for users who prioritize privacy and control. The app's standout features include its completely offline operation, which ensures no financial data is stored on the cloud, thus alleviating privacy and security concerns. Fyenance provides a comprehensive suite of tools including a smart dashboard for instant financial overviews, management of recurring transactions, and insightful reporting to help analyze user spending and income trends. Each feature of Fyenance is designed to give users better control of their finances by emphasizing manual data entry, promoting a more thoughtful and aware relationship with their finances. The intuitive interface allows for easy navigation and personalization, including options such as dark mode for comfort. Fyenance uniquely positions itself as a one-time purchase application, requiring no subscriptions, thus offering significant cost-saving benefits to users. With its multi-platform support, it is accessible to users across Windows, macOS, and Linux systems.

When exploring the finance industry in Pakistan, several key considerations come into play. First, understanding the regulatory framework is crucial as the State Bank of Pakistan and the Securities and Exchange Commission of Pakistan oversee financial operations, ensuring compliance with laws that govern banking, investments, and capital markets. The industry faces challenges such as political instability and economic fluctuations, which can impact investor confidence and financial performance. However, opportunities exist in fintech, as digital banking and mobile payment solutions gain traction, reflecting a shift towards innovative financial services. Environmental concerns are becoming increasingly relevant, with the need for sustainable finance practices growing among investors and institutions. The competitive landscape includes both traditional banks and emerging fintech startups, creating a dynamic environment where agility and adaptability are essential. Global market relevance cannot be overlooked, as Pakistan's finance sector is increasingly interconnected with international markets, providing avenues for foreign investment and collaboration. Overall, understanding these factors will provide valuable insights for anyone researching companies within Pakistan's finance industry.

Some interesting numbers and facts about your company results for Finance

| Country with most fitting companies | Pakistan |

| Amount of fitting manufacturers | 20 |

| Amount of suitable service providers | 30 |

| Average amount of employees | 51-100 |

| Oldest suiting company | 1996 |

| Youngest suiting company | 2022 |

Some interesting questions that has been asked about the results you have just received for Finance

What are related technologies to Finance?

Based on our calculations related technologies to Finance are Education, Engineering Services, IT & Technology Services, Healthcare Services, Consulting

Who are Start-Ups in the field of Finance?

Start-Ups who are working in Finance are Al-Mawakhat Microfinance - AMCL

Which industries are mostly working on Finance?

The most represented industries which are working in Finance are Finance and Insurance, IT, Software and Services, Other, Consulting, Oil, Energy and Gas

How does ensun find these Finance Companies?

ensun uses an advanced search and ranking system capable of sifting through millions of companies and hundreds of millions of products and services to identify suitable matches. This is achieved by leveraging cutting-edge technologies, including Artificial Intelligence.